Achieving efficient generation and distribution of electricity in Nigeria has over the years remained a sore point and a major threat to growth of the economy. Poor electricity supply has serious consequences for the businesses in the country, with several existing companies struggling to maintain profitability and new players shying away from entering the market. The government has undertaken several measures, including transferring majority of the power infrastructure from government to private hands, however, it has not managed to improve the situation. Ambitious policies and agreements with multinational energy companies might just be the key to solve Nigeria’s energy problems.

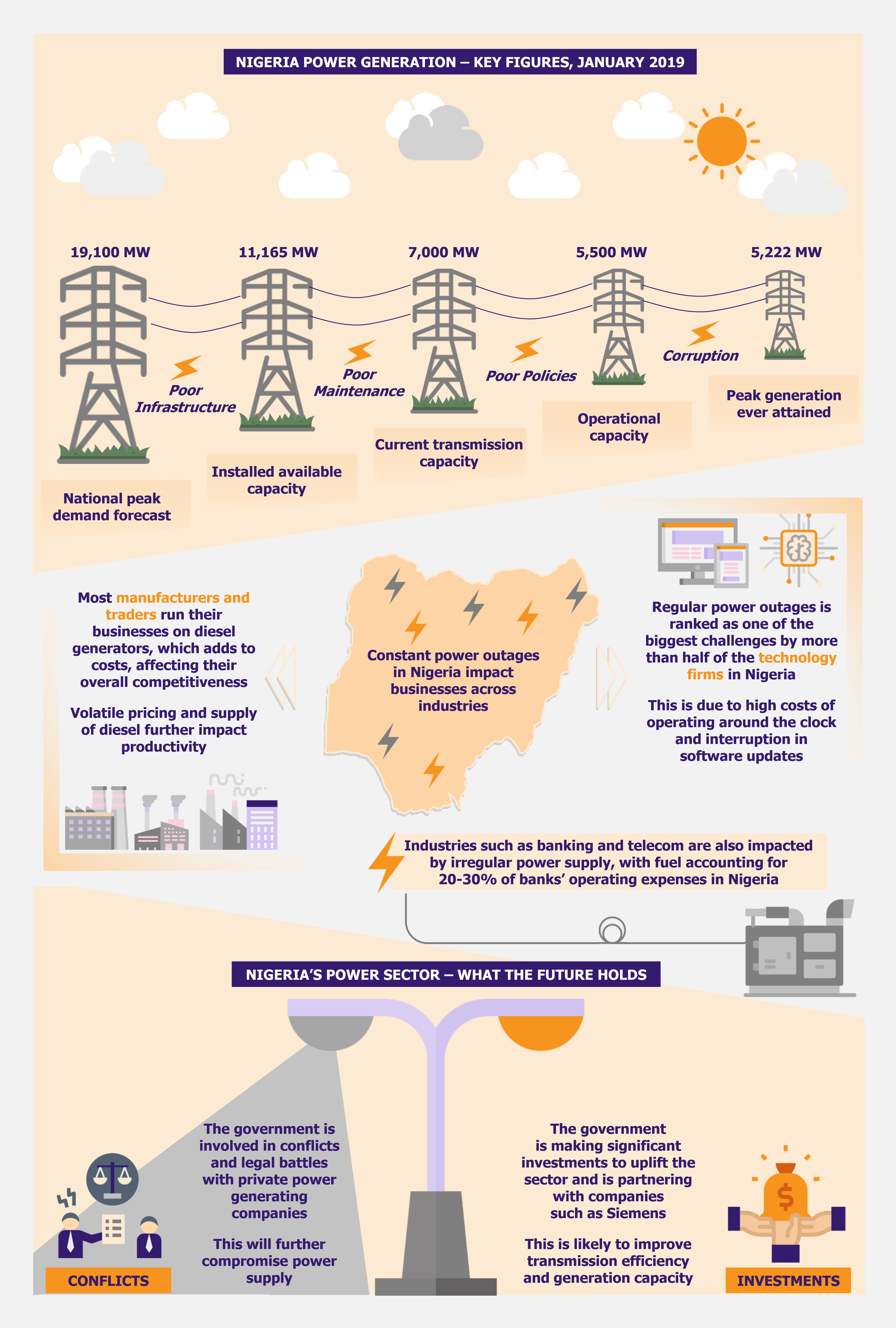

Nigeria is considered most abundant in natural reserves and is the largest economy in Sub-Saharan Africa. The country has the potential to generate about 11,000-12,000 MW of electric power from existing plants. Despite this, Nigeria is only able to generate about 4,000 MW on most days, which is less than one-third of what is required to provide for its more than 190 million citizens.

According to a 2014 World Bank survey, about 27% of Nigerian businesses identified electricity as the main hurdle in doing business. Also, IMF estimated per capita electricity production in Nigeria to be less than 25% of that of the Sub-Saharan Africa average. The gap between the electricity generation capacity and demand in the country is a result of poorly maintained electricity generation facilities and very little investment in new power plants as well as an outdated transmission and distribution infrastructure.

Government action or lack thereof

Nigeria’s power sector has suffered from mismanagement and corruption for many years. Since Nigeria’s independence from the British rule in 1960, the government set up a heavily subsidized grid, which was subject to high level of corruption and was never able to generate enough profits to finance new power plants or upgrade the transmission and distribution network to meet the needs of the growing population. In addition to its inability to upgrade, the electricity sector suffers from a huge range of issues, ranging from leakages in power transmission and distribution, to lack of maintenance, to theft and vandalism.

In an effort to combat the country’s energy poverty, the government liberalized the power sector in the early 2001 in hope to attract foreign investments. However, the plan didn’t work as expected. Instead, privatization increased corruption as the political members tried to appoint political allies and family members to head the new distribution companies.

According to a 2018 publication by the Istituto Affari Internazionali, an Italian non-profit think tank, Nigeria has been steadily generating 4,000 MW/h since 2005, with no increase in output over the past decade. This is costing the Nigerian economy a great deal as businesses and industries suffer due to regular power outages. Moreover, as per a 2018 estimate by A2EI (a Berlin-based collaborative R&D platform in the solar off-grid industry), Nigerians spend NGN4.3 billion (US$12 million) annually on small gasoline generators, of which NGN2.9 billion (US$ 8 million) is spent on fuel.

Nigeria’s energy poverty affecting businesses across industries and sizes

Manufacturing and trading industry

Poor electricity supply is affecting the manufacturing industry in an immense way. A typical Nigerian factory experiences power outage or voltage fluctuations approximately eight to ten times a week, with each power outage lasting about two hours. This adds to the cost of production through lost material, damaged products, and restarting the factory equipment. This makes the manufacturing business unattractive to investors since the overhead costs are high, return is low, and the business environment is largely uncertain.

To combat the power issue, companies depend on diesel generators for power backup, however, this significantly adds to the cost of the product, which in turn affects the competitiveness of the business since whatever is produced in the country is more expensive when compared with production costs in other regions.

In addition to electricity shortage, prices and availability of fuel for operating the generators also impact businesses. While small business generators are powered by price-capped gasoline, the larger generators that power big businesses, apartment complexes, and big homes can only be run on diesel, which in turn is volatile with regards to pricing and supply.

According to a market intelligence firm based in Lagos, SBM Intelligence, diesel is among the top three cost heads for many Nigerian firms. Moreover, with the price of diesel also being volatile, many businesses operate with a constant risk of increasing overhead cost, which may result in reduction in output, downsizing, or even business closure. This was seen in May 2015 when Nigeria was hit by fuel scarcity, which caused many traders and businesses to shut shop as they could not afford diesel for their generators.

One business sector most impacted by Nigeria’s energy poverty is the perishable food sector. Nigeria’s fuel scarcity in 2015, caused the loss of approximately NGN10 million (US$27,000) worth of food items. Similarly, as per members of the Ajeromi Frozen Foods Market Association in Lagos, a severe bout of power outage in March 2016 resulted in the decay (and thereby loss) of frozen food worth NGN20 million (US$55,000) in just five days.

Apart from this, small businesses are also severely impacted by Nigeria’s power shortage. Most small shops cannot afford complete generator back up and therefore suffer with limited working hours and sub-par working conditions. For the ones that can afford a generator, the cost of it is very high, squeezing out profits from their already limited setup. For instance, a small tailor shop with a daily income of about NGN4,000 (US$11) spends close to NGN3,000 (US$8.2) daily on fueling their generator to keep the business going, highlighting the disproportionately high cost of electricity to run a small business in the country.

According to a market intelligence firm based in Lagos, SBM Intelligence, diesel is among the top three cost heads for many Nigerian firms. Moreover, with the price of diesel also being volatile, many businesses operate with a constant risk of increasing overhead cost, which may result in reduction in output, downsizing, or even business closure.

Technology sector

Nigeria’s tech industry accords for approximately 14% of the Nigeria’s GDP in 2019 and is poised to be the next frontier for growth. However, constant power outages have become a serious problem for the booming sector. Most tech companies operate around the clock to provide a 24*7 service to their customers, however, in Nigeria, most app companies operate for only 8-9 hours a day as they cannot sustain generator costs for the entire 24 hours. This impacts the quality of service provided.

As per Chris Oyeniyi, owner of a smartphone app called KariGo, electricity cost (including generator cost) on a monthly basis is about US$800 for the bare minimum number of operating hours. The same electricity bill would be around US$100 if the public power grid was dependable. This hampers growth for tech start-ups, which have to allocate significant amount of their funds towards power supply instead of using them for expanding, both in terms of scale and staff.

In an attempt to overcome this challenge, several technology start-ups prefer to work in co-working spaces that allow them to pool their electricity bills. This concept is becoming very popular in the country, however, despite this, generator costs remain very high to provide around the clock services.

In addition to the high costs, technology firms also operate with a constant risk of losing all their digital work (that is not backed up) or hampering important software updates in case of a sudden blackout.

According to a survey of 93 Nigerian tech start-ups by the Center for Global Development conducted in 2019, 57% of start-ups found power outages to be one of the biggest challenges for their business. Moreover, one-third of the firms surveyed reported losing more than 20% of their sales due to power outages.

Other sectors

Just like the manufacturing and technology sector, most of the other industries are also impacted by irregular power supply and thereby rely on large generators to run their operations. This puts additional cost pressures on the business.

In 2019, Temi Popoola, the West Africa chief executive of investment bank Renaissance Capital, stated that diesel accounts for approximately 20-30% of banks’ operating expenses in Nigeria, which is significantly higher compared with other developing countries.

The telecom sector is also vulnerable to the power outages faced by the country. In 2015, MTN, a telecom giant, stated that it spends approximately NGN8 billion (US$22 million) annually on diesel to keep its network online. This is a huge cost and accounts for about 60% of its operating costs. Due to such heavy operating costs, the company is forced to focus more on sustaining its day-to-day activities rather than investing in any other area such as expanding its network.

The road ahead

Currently there does not seem to be any light at the end of the tunnel for Nigeria’s power woes. With high level of corruption paralyzing the sector and limited amount of new private investment, the sector is in a state of limbo.

Moreover, there are constant disagreements between the Nigerian Bulk Electricity Trading Company (NBET) and the private power generating companies, which further impact electricity supply. Recently, in September 2019, another issue came into the light, when NBET directed all thermal electricity generation companies (GenCos) to pay an administrative charge. To oppose this, the GenCos have threatened to shut down power production and supply and argued that there is no policy directive to that effect by the Nigerian Electricity Regulatory Commission (NERC). The two sides have not managed to reach any consensus as of now. However, such additional charges will further put financial pressure on already struggling GenCos, who have largely failed to improve their generation levels due to lack of capital for maintenance and operation. This will further negatively impact the already dismal grid supply levels.

Nigeria is dealing with another legal dispute over a hydro power project with a proposed capacity of 3,050 MW. In 2003, the Nigerian government awarded the build-operate-transfer (BOT) contract to a local company, Sunrise Power and Transmission Company Limited (SPTCL) and followed it up with signing a general project execution agreement with the company in November 2012. However, simultaneously, the government also awarded the bid to execute the hydro project to a JV between China Gezhouba Group Corporation of China (CGGCC) and China Geo-Engineering Group Corporation (CGGC) in 2006.

Moreover, in 2017, it signed another engineering, procurement and construction (EPC) contract with Sinohhydro Corporation of China, CGGCC and CGGC to form a joint venture but excluded SPTCL from the agreement. Following this SPTCL filed a legal suit against the federal government and its Chinese partners at the International Chamber of Commerce (ICC) in Paris for breaching the contract. The government risks approximately US$2.3 million in fines in this legal tussle. Moreover, the Chinese government refused to provide the required funding for the project (US$5.8 billion) until the legal dispute is settled. Thus, the project is on hold until any legal solution is reached.

However, that being said, the Nigerian government is ambitiously trying to revive the country’s electricity sector. In 2017, the government developed a National Renewable Energy and Energy Efficiency Plan, under which it aims to achieve 30,000 MW electricity by 2030, with renewable energy accounting for 30% of the overall energy mix (9,000 MW). The government plans to adopt ‘The Sustainable Energy for All Action Agenda’ (SE4ALL), which is a UN initiative to support sustainable energy in Africa, with targets of 90% Nigerians having access to electricity by 2030.

To this effect, in May 2019, Central Bank of Nigeria announced the disbursement of NGN120.2 billion (US$330 million) to different distribution companies, power generating companies, service providers, and gas companies in order to improve their liquidity situation. Furthermore, in 2018, the government secured a loan of US$485 million from the World Bank to upgrade the country’s electricity transmission network and infrastructure and is currently in talks about a US$2.5 billion additional loan to uplift the power sector.

The government has also signed a six year power deal with the German energy giant Siemens, with an aim to generate a minimum of 25,000 MW of electricity by 2025. As a part of this deal, Siemens will work alongside the Transmission Company of Nigeria to achieve 7,000 MW and 11,000 MW of reliable power supply by 2021 and 2023, respectively. Thus in addition to building new generation capacity, the government is also focusing on improving supply from the existing grids, which has been stagnant at around 4,000 MW over more than a decade.

Moreover, the country’s energy sector is receiving significant support from international bodies such as PowerAfrica, which is a wing of the United States Agency for International Development (USAID). Over the past few years, PowerAfrica has been assisting the government in agreements on solar projects that help Nigeria in diversifying its energy mix. In 2015, PowerAfrica supported Nigeria’s first private IPP Project (the Azura Edo Project) to reach financial close in 2015. It also assisted it in securing a US$50 million investment by the Overseas Private Investment Corporation (OPIC). The Azura plant (the first project initiated by Azura power) became operational in 2018 with 461 MW capacity. It is the first phase of the 1,500 MW IPP (Independent Power Project) facility that is being developed in Nigeria. In December 2019, Africa50 (a pan-Africa infrastructure investment platform) expressed its plans to invest in the Azura power plant.

Growing private investments, international support, and supportive government policies as well as investment may just lift up the Nigerian electricity sector, which has been in dire need for reform over several decades.

In 2017, the Nigerian government developed a National Renewable Energy and Energy Efficiency Plan, under which it aims to achieve 30,000 MW electricity by 2030, with renewable energy accounting for 30% of the overall energy mix (9,000 MW).

EOS Perspective

As per the International Centre for Investigative Reporting (ICIR), the Nigerian government has spent approximately NGN1.164 trillion (US$3.2 billion) on the power sector during 2011-2018 without any significant improvement in energy supply. Poor power supply has been crippling the country for many decades now.

Large businesses, especially in the technology sector, could help boost the economy but like any other business, they require electricity to run successfully. Nigeria lacks the basic business environment at the moment. Moreover, ongoing issues with the private generation players further hamper the sectors growth and performance.

Recently, the government has made several moves in the right direction (especially with regards to investment in renewable energy sources), but it is too early to comment if they could solve Nigeria’s decades-long energy problem. Moreover, the real issue is not about investment levels or government policies, but about the implementation of these initiatives. As seen previously at the time of privatization of the sector, the government failed to uplift the sector as it was plagued by corruption, favoritism, and bureaucracy.

Similarly, the government adopted a policy in 2010 called Vision 20:20, wherein it aimed to be featured in the top 20 economies globally by 2020. Within the power sector, Vision 20:20 aimed to increase generation capacity to 20,000 MW by 2015 and 35,000 MW by 2020. However, it failed to make significant investments or incentivize private players to invest in the sector and failed miserably in its goals. If the same is repeated now, the result will not be very different.

The government’s plans can only be implemented if there is substantial transformation of the entire sector, with the private sector participating equally in the upliftment. The government needs to provide significant financial incentives for new power projects and must also restructure the distribution companies to improve liquidity. Lastly it must counter the corruption and bureaucracy seeped into the sector and ensure that generating companies receive complete and timely cost-reflective tariff from the government. While these measures are difficult to achieve, they are the only way the sector can see any respite in the coming years.