As purchasing power growth is slowing down in mature markets such as the USA and Europe, international brands and luxury retailers are seeking expansion opportunities in dynamic and rapidly developing Asian countries. Thailand is fast becoming a destination of choice for several luxury brands owing to robust demand, developed urban infrastructure, and low cost of establishing a business. Increasing number of tourists indulging in massive luxury spending as well as mushrooming high-end shopping centers are slowly coalescing to establish Thailand as a premier luxury shopping hub in South East Asia.

Luxury goods sales in Thailand are likely to reach US$ 2.2 billion by 2019 owing to improved economic conditions, retail expansion, and plethora of international brands entering the country. This growth has also spurred as Thailand offers several other benefits to luxury brands and retailers such as low rent and investment cost, and strong government support. Retail infrastructure is also witnessing a rapid growth, with expansion of several shopping malls and outlets.

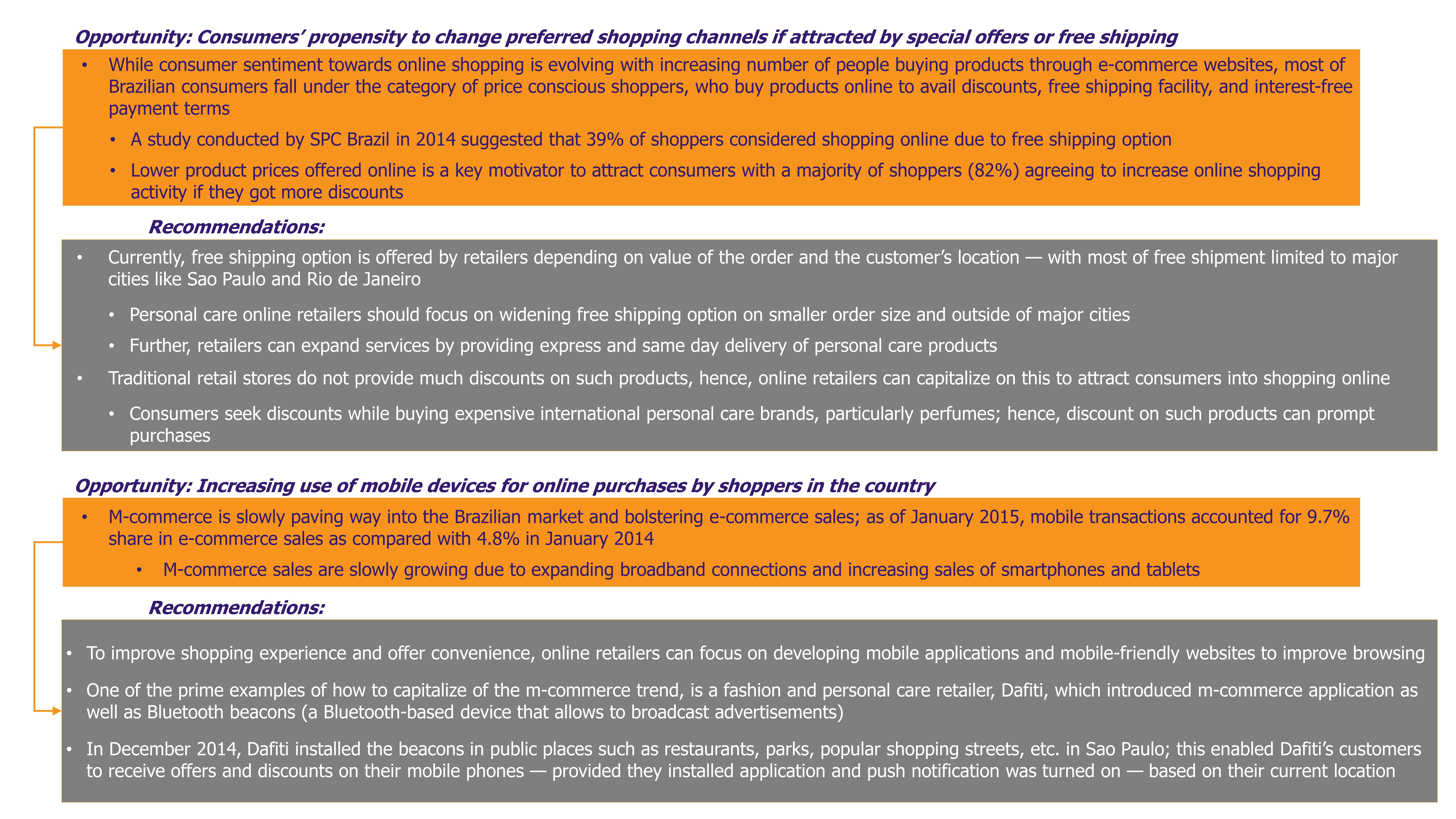

Despite the bright growth prospects and encouraging retail development, there are several factors that are inhibiting this growth. For instance, the high luxury goods tax is a major hindrance to retail sales. Other factors such as counterfeit products, fragmented market, and political instability in the country are also adversely affecting sales.

EOS Perspective

Thailand faces a strong competition from other commercial centers such as Hong Kong, China, and Singapore, yet it is slowly emerging as a premier market for luxury products due to its unique ability to offer goods at more competitive prices owing to relatively lower overheads. Additionally, China and Hong Kong are the two most penetrated markets by high street brands in Asia, and are approaching saturation. Several luxury brands are halting further expansion in the two countries amid sluggish sales. Consequently, this has opened doors for Thailand which is slowly becoming a target market for retailers to expand operations.

Nevertheless, luxury retailers in Thailand face a major setback due to the 30% luxury goods tax, which discourages even affluent shoppers. Limited domestic purchasing capabilities further hinder sales, however relatively low housing costs leave a considerable disposable income in hand, which marginally helps to spur luxury spending.

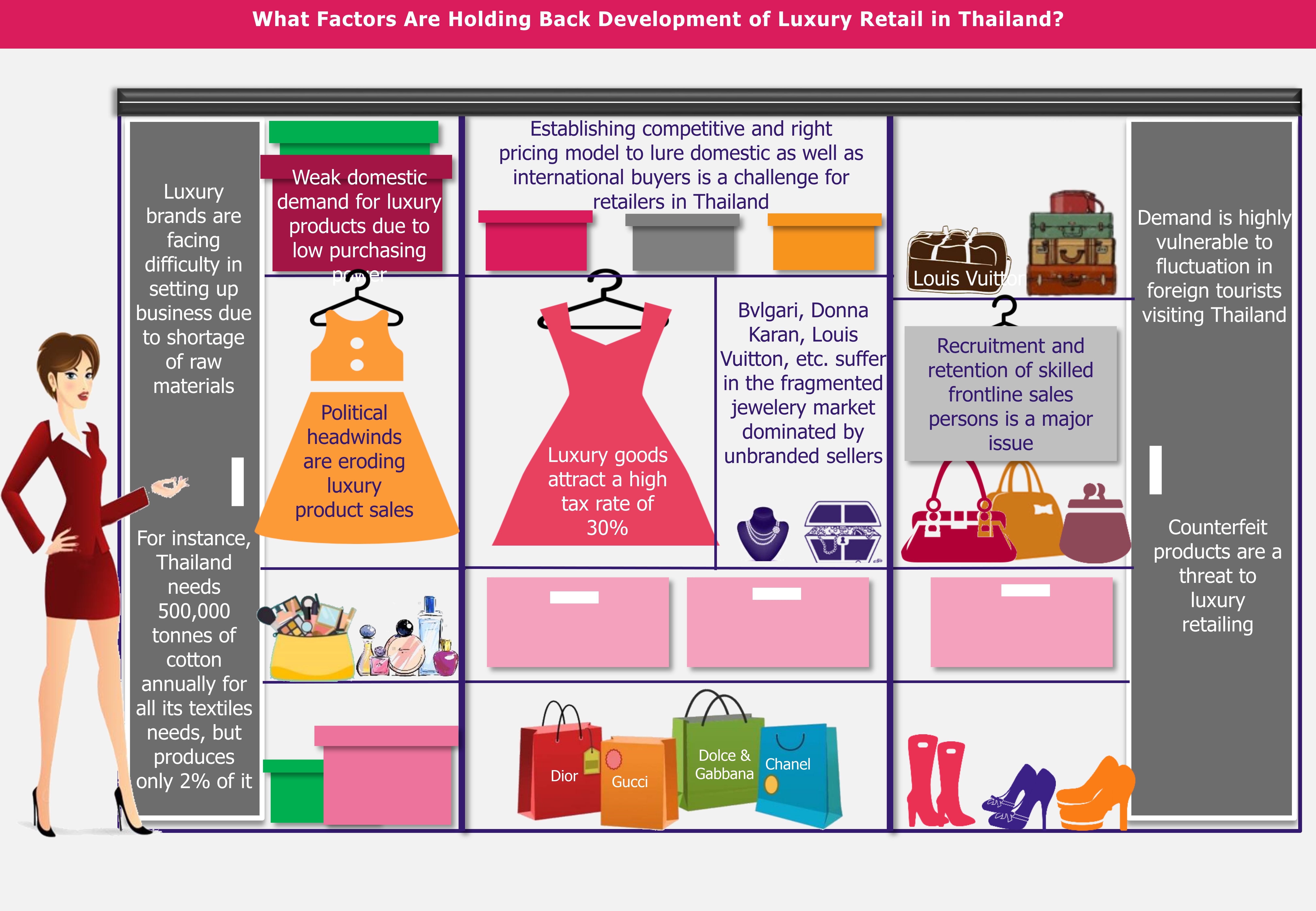

Based on our analysis, certain strategies can be adopted to succeed in the Thai market – widening distribution channel by opting for online retailing, choosing the right target audience, designing an effective marketing strategy, and tapping the M-commerce boom in Thailand.

While Thailand still remains behind many of its peer countries in terms of luxury retail development, it is likely to become one of the leading Asian markets in medium to long term, increasingly hosting several prominent international luxury brands and registering tremendous retail sales growth.