Zambia, like many other African countries, has struggled with the image of being underdeveloped, poor, and unsafe, a perception which has kept foreign travelers at bay. While these aspects do remain true to some extent, the Zambian government has initiated efforts to rebrand Zambia’s image as an attractive tourist destination. To this effect, the government is working on improving the country’s infrastructure as well as increasing marketing efforts to position Zambia as a premiere tourist destination to the world. With the right investments and policies, Zambia has the potential to become a popular tourist place within Africa, giving stiff competition to its neighbors, such as Zimbabwe, and to Africa’s key tourist destinations, such as Kenya. This goal might be achievable, considering that in addition to having a wide range of national parks and game reserves, Zambia is home to Victoria Falls (shared with Zimbabwe), one of the seven natural wonders of the world and a UNESCO Heritage Site.

Previously neglected tourism industry to receive a new push

While Victoria Falls remains Zambia’s most unique attraction, Zambia seems to have more on its tourist offer. The country boasts of around 23 million hectares of land being dedicated to diverse wildlife, in the form of 20 national parks and 34 game management areas (GMAs).

In addition, it is rich in other natural resources and tourist attractions such as waterfalls, lakes, woodlands, several museums, and rich and diverse culture, which gives tourists a taste of the land through many traditional ceremonies and festivals.

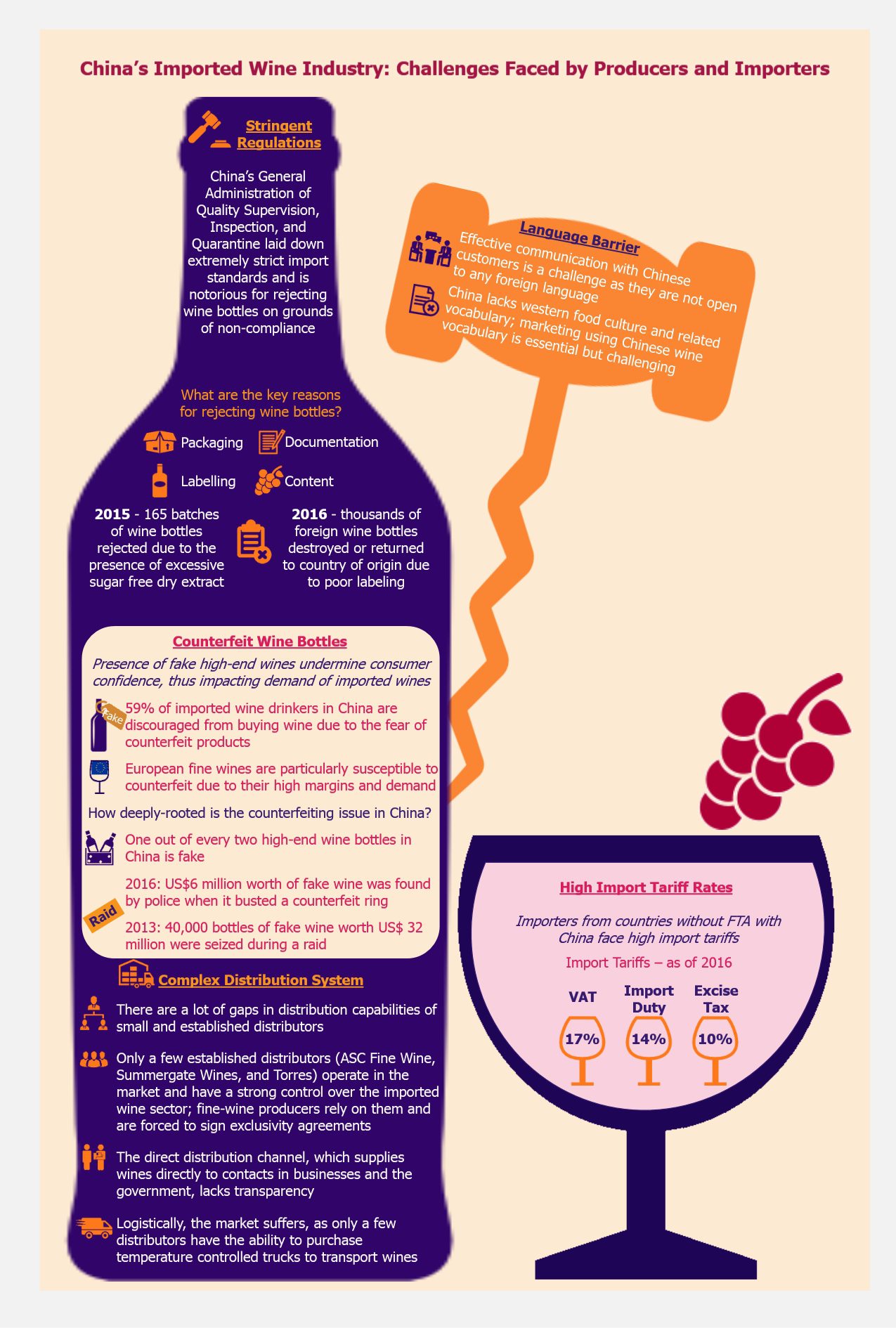

Despite all of this, tourism has never flourished in the country, although this might change now, as the government launched a National Tourism Policy 2015, aiming at positioning Zambia among the top five African tourist destinations of choice by 2030. The initiative is hoped to bring increased revenues from tourism needed by Zambia to improve its economic diversification, as the country has largely been dependent on revenues from copper mining and agriculture, a model only moderately sustainable at best.

The government has undertaken multi-pronged approach to put Zambia’s tourism on the map

Regions prioritization

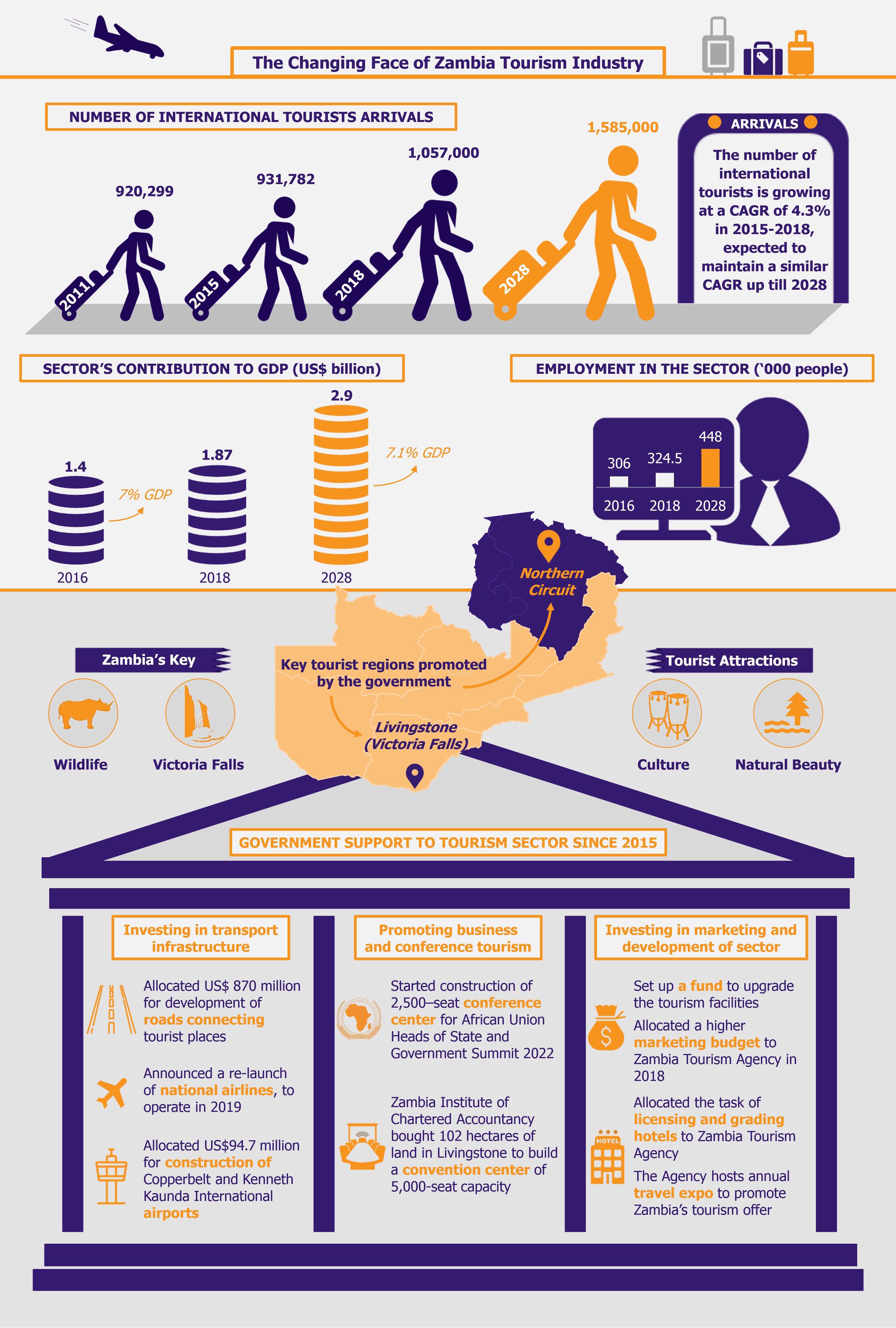

In order to achieve this, the government is prioritizing two major regions, namely Livingstone (which provides access to Victoria Falls) and the Northern Circuit, situated in the Southern and Northern Provinces of Zambia, respectively. It is for this purpose that the government has opened up investments in the Northern Circuit region that encompasses the David Livingstone memorial in Chitambo, Kasanka National Park, beaches at Banguelu, Kasaba Bay, Lumangwe, and Kabweluma Falls, among other key tourism sites.

Appointment of investments facilitator

Industrial Development Corporation (IDC), a state-owned investment company undertaking the government’s commercial investments has assumed the job of facilitating long-term financing of several projects that will help boost tourism, in addition to acting as a co-investor alongside private investors in the sector.

Establishing of tourism development fund

The government has taken several other measures under the Tourism and Hospitality Act 2015 to provide the needed push to its tourism sector. It has established a tourism development fund, a special fund for the sole purpose of developing and funding the various spheres of the sector. To support this fund, in March 2017, the government introduced Tourism Levy, a tourist tax charged at 1.5% of a tourist’s (both domestic and international) total bill in respect to accommodation and tourist events. As per Zambia’s Ministry of Tourism and Arts (MoTA), the tourism fund collection through this tax equaled US$338,885 (K3.4 million) as of 31 August 2017.

An increased tourism marketing budget to the Zambia Tourism Agency (ZTA) for 2018 has been allocated to promote Zambia as a prime tourist destination. In April 2018, the ZTA hosted the Zambia Travel Expo (ZATEX), a tourism fair, which is one of the most important marketing platforms for Zambia’s tourism products. The fair hosted close to 60 international buyers (including both trade and media) from Southern and East Africa, the UK, Germany, the USA, China, France, India, and several other countries.

Hotels grading and licensing

In addition, the ZTA, which acts as the tourism industry regulator in Zambia, has taken up the task of licensing and grading hotels and other accommodation facilities in order to promote efficient service delivery and maintain a certain minimum standard in the tourism sector.

Under its 2018 National Budget, the government is also working on reducing bureaucracy and the cost of doing business in the tourism sector. To achieve this, the government, along with the Business Regulatory Review Agency, is expected to establish a Single Licensing System, which will act as a one-stop shop for obtaining a tourism license.

Quest to re-launch national airlines

Apart from investments and efforts to enhance efficiency and quality of ground infrastructure (such as accommodation facilities), the government has also announced the launch of national airlines, which were expected to commence operations in 2018 (later pushed to unspecified date in early 2019, hurdled by Zambia’s difficult fiscal position). The airline, a strategic partnership between the Zambian government and Ethiopian Airlines, was to have an estimated first year budget of about US$30 million.

Infrastructure investments

In similar lines to the Tourism and Hospitality Act 2015, Zambia’s 7th National Development Plan (NDP) (2017-2021) also outlines several key strategies and measures to boost tourism sector growth. Under the NDP, the MoTA (along with other sectors and ministries) aims at developing and upgrading several roads, bridges, and air-strips that interlink and ease access to the main wildlife reserves and other tourist destinations across the Northern and Southern Circuits. The NDP allocated US$870 million (K8.7 billion) towards road infrastructure development that is pertinent to growth in the tourism sector, such as the Link Zambia 8000, the C400, and the L400 projects.

In addition to this, the NDP allocated about US$94.7 million (K950.5 million) towards the construction of the Kenneth Kaunda and Copperbelt International airports. These airports, once established, are expected to position Zambia as a regional transport hub and in turn uplift tourism.

Furthermore, the government intends to develop requisite infrastructure with the aim to facilitate an increased length of stay, rehabilitate heritage sites, and strengthen wildlife protection.

Ensuring viability of wildlife tourism

The authorities have also realized the importance of rehabilitation and restocking of the country’s wildlife parks, where wildlife population has declined to levels that make it non-viable for safaris and photographic tourism. To achieve this, the government is looking into establishing strict anti-poaching rules and is exploring various public-private partnership models to aid conservation and develop national parks.

Development of non-traditional modes of tourism

To boost further awareness about Zambia’s tourism, the government aims to develop and promote ethno-tourism through events such as the Pamodzi Carnival, which showcase Zambia’s rich art and culture. Developing non-traditional modes of tourism, such as green tourism (covering eco- and agro-tourism), sports tourism, etc., is also on the agenda.

Boosting domestic private and business tourism

The government is also undertaking efforts to boost domestic tourism, by engaging and marketing to the Zambian middle class population. This will help open another revenue avenue for tourism, as local populations are likely to be easier to encourage and fuel the sector growth while Zambia’s international brand is still being developed.

Similarly, the government is also encouraging business tourism by turning several large cities, such as Livingstone and Lusaka, into premiere conference destinations. There is a huge untapped potential in the conference category that will help attract a host of domestic as well as bit of international business-based tourism to the region. In April 2017, the Zambia Institute of Chartered Accountancy (ZICA) bought 102 hectares of land in Livingstone to set up a 5,000-seat convention center, 10 presidential VIP villas, and an international-standard golf course at a cost of US$350 million. This will be the first international convention center of this scale in Zambia.

Zambia is also the host country of the African Union Heads of State and Government Summit 2022. The Ministry of Housing and Infrastructure Development is undertaking the construction of a 2,500-capacity international conference center in Lusaka, which will be the venue for the summit. The government has garnered support from the Chinese government to help construct the center.

The initiatives start to show modest results

In-bound international tourism on the rise

All these efforts have yielded visible results in the last couple of years and are expected to boost tourism in the future as well. This can be seen in the number of international tourists entering Zambia. While the number of international tourists visiting Zambia remained largely stagnant between 2011 and 2015 (registering a CAGR of only about 0.3%), the government’s initiatives brought an increased influx of tourists, estimated to have reached 1,057,000 by the end of 2018, in comparison with 931,782 in 2015 (registering a CAGR of about 4.3% during the period). International tourist figures are further expected to reach 1,585,000 by 2028, maintaining a CAGR of about 4.1%.

A nudge to the industry job creation

A similar trend is also visible in job creation in the tourism sector (both direct and indirect). In 2016, about 306,000 people worked in the tourism sector (including indirect jobs supported by the industry). Employment in the sector increased by about 2.5% in 2017 and was expected to further rise by 3.4% in 2018 to reach 324,500 jobs. The number of jobs created by the tourism sector is expected to increase to 448,000 by 2028, registering a CAGR of 3.3% during 2018-2028.

Early signs of increased contribution to the GDP

The total contribution of the travel and tourism sector (encompassing both direct and indirect contribution) to Zambia’s GDP was about US$1.79 billion in 2017, rising from US$1.4 billion in 2016. The sector’s contribution to the GDP is further estimated to rise to reach about US$1.87 in 2018 and is expected to reach US$2.9 billion by 2028 (accounting for 7.1% of total GDP).

Sprouting opportunities for investors

The government’s efforts and increasing tourist numbers also result in significant opportunity for investors to enter this sector. A large number of global hotel brands, such as Carlson Rezidor Hotel Group (Radisson), Marriott, Accor Hotels, South Africa’s Southern Sun, Protea Hotels and Sun International, as well as Taj Hotels, have already established presence in the country.

However, further scope for growth in the accommodation sector remains, especially in the 3-5 star category hotels that have 50-500 beds. As per African Hotel Report 2015, Zambia ranked as the 2nd best destination for Hotel Developers in Africa in 2015. During the same year, Zambia had a supply of 122 branded bedrooms per million population. This was well below the average in the Southern African region of about 350 branded bedrooms per million population.

Further scope exists in the development of conference facilities, tourist transport services, global cuisine restaurants, communication facilities, and other supporting infrastructure.

Investment opportunities are also present in the development of gaming venues, considering that gambling is legal in Zambia. This could help build a unique tourism offer that would combine city life and wildlife activities.

Investors are likely to find several reasons to consider investment in the country. Zambia offers easy access to a pool of English-speaking work force at competitive costs. The country has one of the lowest power tariff rates in Africa. Even after a 75% increase in power rates in 2017 (now ranging between US$0.05 and US$0.07), they are still much lower than rates in other countries in the region (where they range between US$0.06 and US$0.11 per kWh). Zambia is also well endowed with abundant water resources, which is essential to the tourism industry (as per World Bank, Zambia’s internal freshwater resource per capita was estimated at about 5,134m3, much higher than in its neighboring countries – Kenya (450m3), Zimbabwe (796m3), Botswana (1,107m3), Namibia (2,598m3), and Mozambique (3,686m3)).

Tourist safety and complex legislation hamper growth of the industry

While Zambia seems to have all the right ingredients to become a popular travel destination, there are several challenges that exist.

The key challenge is tourist safety. Zambia’s reputation has for long been affected by cases of tourists being targeted in financial scams or other types of crimes such as theft, murder, rape, etc. Continuous and consistent efforts to minimize such risks are essential to change the situation, which, apart from greater police involvement and law enforcement, should also include marketing campaigns voicing the benefits of tourism in the country to the local population.

Another challenge that the government must deal with is the level of bureaucracy and excessive number of laws governing various aspects of the tourism operations. Currently, some 10 pieces of legislation that affect tourism business are in force, most of which need to be simplified and harmonized, and in doing this, the government should use input from the local industry players.

The excessiveness in regulations is also paired with magnitude of charges and levies added on many activities, resulting in higher retail pricing. These include 16% VAT, 10% service charge on accommodation, food and beverage, and conferencing, 1.5% tourism levy, and 0.5% skills levy in addition to other levies, such as business levy, fire, health permit, food handling, etc. This leads to Zambian hotels being more expensive than hotels in neighboring countries. A prime example of this is found in Victoria Falls – Zambian tourism offer in Victoria Falls remains largely uncompetitive with regards to price in comparison to the offer on the Zimbabwe side of this major attraction.

EOS Perspective

With the ongoing government support along with growing interest in African wildlife holidays, Zambia has all the ingredients to emerge as a popular tourist destination in the future. China could be one of the key target markets for Zambia, as a large number of financially-capable Chinese tourists have shown keen interest in travelling deep into Africa. Zambia should also bet on business travel and conferences (both domestic and international) to form another lucrative revenue streams.

While efforts to boost tourism are being made in the right direction, with somewhat visible results, revamping such a long-neglected industry will take more than that. Ensuring the safety of the travelers is an objective that should remain on top of the government’s priorities list.

Further, it appears that some forms of tourism have been marginalized in the government’s focus areas, but should probably receive more attention in the long-term plans. Despite the fact that Zambia has about 35% of South African Development Community’s (SADC) water resources, little emphasis has been put on marine tourism development in the form of boat cruises (on lakes), fishing, etc. Similarly, considering the country’s rich wildlife and natural reserves, education tourism seems like an obvious segment to offer a great potential.

It appears that the required will and leadership from the government are in place to change the industry. However, Zambia’s current fiscal struggles (as it is coping with rapidly increasing debt and implementing austerity measures) might limit the resources needed to realize the plans and ambitions. This might lead to lost opportunities (much needed in this agriculture and copper mining reliant economy), as Zambia has the potential of becoming a popular travel destination, giving stiff competition to its neighboring popular travel destinations, Zimbabwe and Kenya.