Swiss watches have long been synonymous with innovation, elegance, and class. These pieces have been considered the standard of sophistication and finesse, making their producers the undisputed leaders of the luxury watch market. But as the saying goes “what rises must fall”, the rock solid foundation of this popularity is going thorough turbulent times. The industry has seen a hard time in the past two years, as Swiss-made watches exports have recently declined. We are taking a look into what has led to low exports of these watches and whether the industry is ready to take any steps to see a revival in the near future.

Swiss watchmakers dominate the luxury watch segment with close to 50% of the global market share controlled by three Swiss watch manufacturers (Swatch Group, Richemont, and Rolex). As of 2016, these luxury watches were exported across all continents – Asia (53%), Europe (31%), Americas (14%), Africa (1%), and Oceania (1%). Hong Kong, USA, and China are the top three export markets.

The Swiss watch industry has been facing difficulties since 2015, when the year ending exports by value of Swiss watches stood at US$ 21.5 billion (CHF 21.5 billion), a 3.1% decline from 2014. The situation worsened in 2016, when the exports were further 9.7% lower than in 2015, falling to the lowest level since 2011. This was mainly due to a sharp decline in sales across Asia, especially Hong Kong and China, which are among the industry’s top export markets. Hong Kong is the most crucial market for Swiss watches – its share decreased from 14.4% in 2015 to 11.9% in 2016. During the span of five years between 2012 and 2016, exports to Hong Kong reduced by 46.5%. The third largest export market, China, was also affected and observed a decline of 18.7% in value exports over the five year period. The situation has not been so dramatic in the USA. Exports share held by the USA also went down between 2012 and 2016, showing a marginal decrease of 0.45%. The Swiss watch industry, over the period of five years, also saw a fall in sales volume globally, declining by almost 13% from 29.1 million units in 2012 to 25.3 million units in 2016.

The year 2017 also did not start on a positive note for the Swiss watch industry. The first quarter of the year recorded a drop of 3.1% in unit exports to 5.6 million from 5.9 million in 2016. Similar trend was observed in the change of exports value. The industry generated US$ 4.5 billion (CHF 4.5 billion) from exports during January to March in 2017, a figure showing a 3% decrease in export value from US$ 4.6 billion (CHF 4.6 billion) in 2016 and a 11.6% lower from US$ 5.1 billion (CHF 5.1 billion) in 2015 in the first quarter. Exports to Hong Kong and USA also took a plunge during the first three months of 2017 – the value of exports for Hong Kong was lower by 0.1% and 31.6% when compared to 2016 and 2015, respectively, in the USA exports were lower by 4.2% and 18.9% in contrast to 2016 and 2015, respectively. However, China gained 16.6% (over 2016) and 7.9% (over 2015) in exports value. But this small achievement does not paint a rosy picture for the luxury watch industry for 2017. With exports taking a dive globally, the downward trend is expected to continue over the coming months.

The dip in exports to Hong Kong and China is a cause of worry. Economic slowdown in Hong Kong is one of the reasons responsible for slumping sales of luxury watches here. Hong Kong also attracts a large number of Chinese travelers each year solely for shopping purposes. The country is heavily dependent on China in terms of trade and tourism, and any drastic change in China’s economic situation affecting the buying patterns of Chinese consumers can be seen across Hong Kong as well. The launch of anti-corruption campaign in China by President Xi Jinping in November 2012 has also affected the sales of luxury watches. The campaign keeps a strict check on government officials and employees of state-owned enterprises who indulge in extravagant show-off of property, luxury belongings, or other similar expensive assets. Under the new amendments made to the campaign in 2014, both the payer and payee of a bribe are to be penalized. This has made consumers wary of buying Swiss luxury watches, among other lavish goods, as a gifting item to high rank government officials. The Swiss watch market has been hit by this policy and the impact on luxury watches sales has been negative. Another reason that has led to the decrease in luxury watches exports is the strengthening of the Swiss Franc. After the Swiss National Bank removed the cap on the exchange rate to prevent the Swiss Franc from over appreciating in 2015, importing products from Switzerland in these Asian countries became more expensive which has disturbed exports.

Swiss luxury watchmakers also face tough competition from smartwatch manufacturers. In 2016, 21.1 million smartwatches were shipped as against 25.3 million Swiss watches. The volume gap between the two types of watches is expected to further reduce in the coming years. With most of the smartwatches priced in the range of US$ 400 to US$ 1,000, the high-end luxury watch market does not feel too much competitive pressure from the smartwatch industry. It is the low-cost and mid-tier segments of the luxury watches that are facing the largest threat. Luxury watchmakers are introducing their own line of smart watches to deal with this threat posed by smartwatch manufacturers.

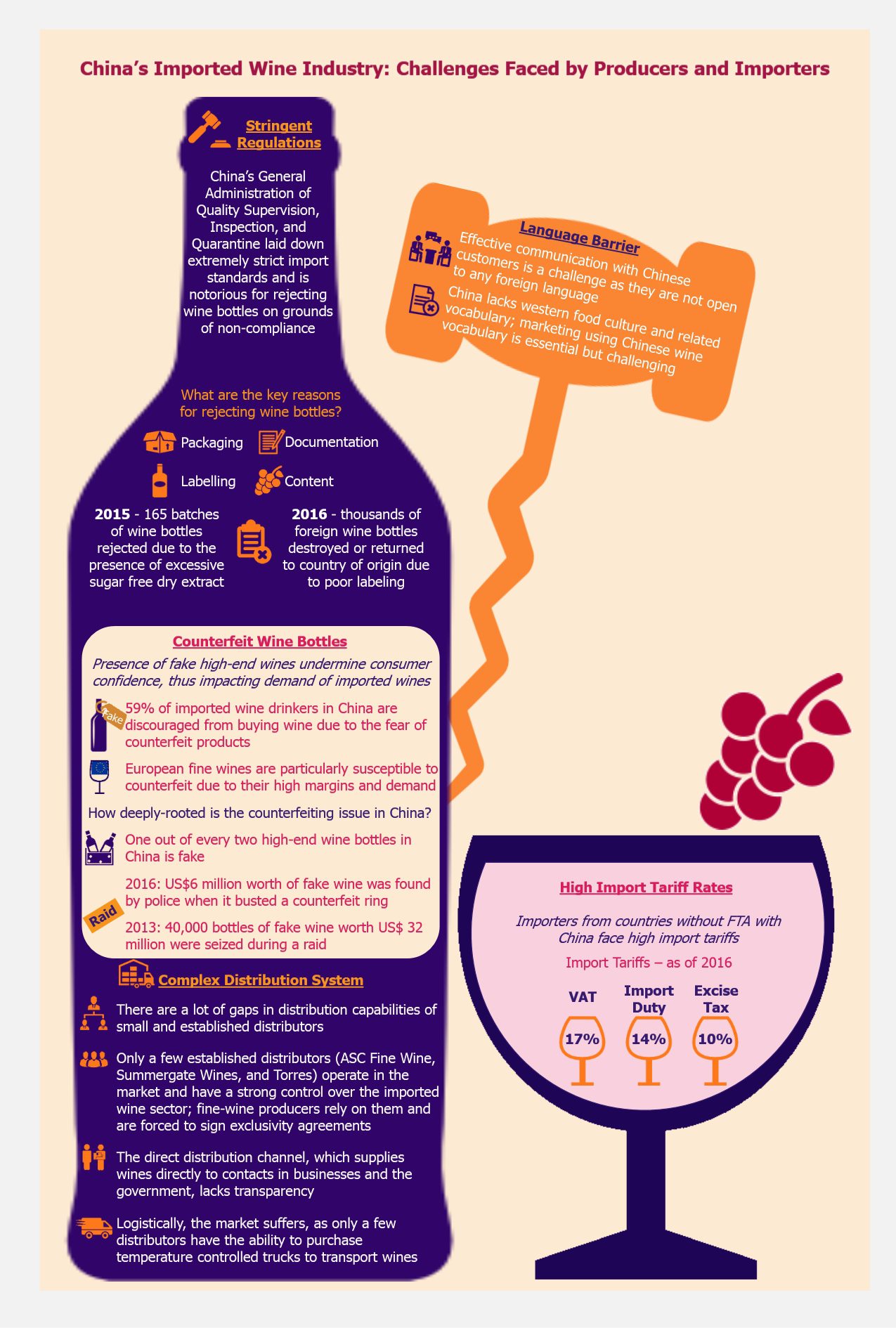

Luxury watch market is also not free of counterfeit products. The urge to own a luxury piece without burning a hole in the pocket is a dream of many, pushing some consumers to settle down for fake items at affordable prices. With better mechanical parts and improvement in aesthetics over the years, the fake copies have improved in quality. Every year, 40 million fake pieces are produced (against 30 million original Swiss watches), as per figures published by Federation of Swiss Watch Industry. With more fakes than genuine products available in the market, the Swiss industry needs to find ways to curb the illegal sales of counterfeit products and prevent erosion of own sales.

EOS Perspective

In the current challenging environment, Swiss watchmakers are forced to rethink their business strategies. With plunging exports, the manufacturers are focusing on introducing new products enabled with newer technologies and gradually stepping into the smartwatch market to attract buyers. For instance, Swatch Group, in 2015, launched ‘pay-by-the-wrist’ watch named Swatch Bellamy. With built-in NFC technology, the watch allows the user to pay for their purchases. Another example is Mont Blanc, part of the luxury Swiss manufacturer Richemont Group, which introduced Montblanc Summit that runs on Google’s Android Wear 2 platform. The watch is equipped with features such as heart-rate monitor but still looks like a classic mechanical watch. The watch aims at offering consumers a unique experience of wearing a smartwatch which does not resemble a typical smartwatch, a factor important for many style-oriented users.

In the midst of these risks hovering above the luxury watch industry, we believe innovation, adoption of new technology, and expanding into new markets should be the top priorities for watch manufacturers in the coming years. There is some concern about how long will it take for the luxury watch industry to revive from the current turbulent situation, but this definitely does not indicate the death knell for the Swiss watch makers anytime soon.