Continuously rising carbon dioxide (CO2) emission is a leading cause of climate change which is considered to be one of the most pressing issues the world is facing today. Being one of the biggest contributors to CO2 emission, steel industry has garnered wide-spread criticism over the years. Several alternatives to conventional steelmaking process have been developed in an effort to reduce CO2 emission, however, the question is whether the producers of this shining grey alloy are ready to face the challenges in implementation of cleaner technologies.

Steel industry strives to move towards a low-carbon future

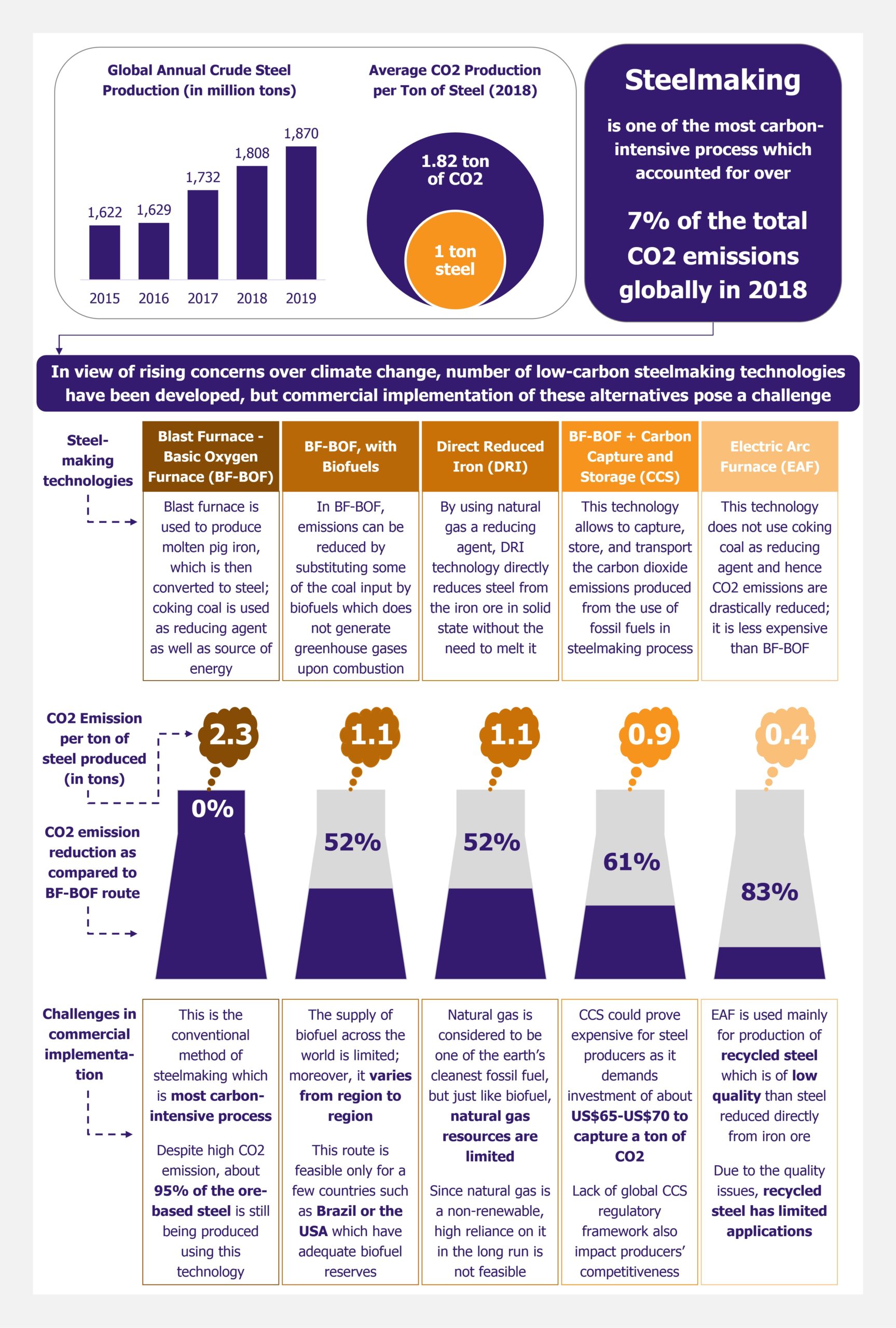

Global crude steel production increased from 1,808.6 million tons in 2018 to 1,869.9 million tons in 2019, registering 3.4% year-on-year growth. World Steel Association indicated that, on average for 2018, for every ton of steel produced, 1.82 tons of CO2 were emitted. In the same year, steelmaking accounted for 7% of the total CO2 emissions globally.

UN Paris agreement on climate change, inked in 2015, outlines a global framework to ensure global temperatures do not rise above 2 degrees Celsius compared to pre-industrial levels. To align with the goals set out in the Paris agreement, the steel industry will be required to reduce its CO2 emissions by 65% by 2050, as compared to 2014 emission levels.

Leading steel producers along with other stakeholders in the value chain, including automotive giants, banking and financial institutions, raw materials suppliers, and environmental organizations, came together in 2016 to establish ResponsibleSteel, an initiative to develop global standards and certification program aimed at reducing carbon emission in the steelmaking process and improve sustainability. Besides ArcelorMittal, the biggest steel producer in the world and one of the founding members of the ResponsibleSteel initiative, other steel producers such as Aperam, BlueScope Steel, Outokumpu, VAMA, and Voestalpine have also joined the initiative.

Alternative technologies to reduce CO2 emission at every stage of steelmaking process

Steel is produced either from iron ore or scrap. Conventionally, ore-based steel is produced in blast furnace-basic oxygen furnace (BF-BOF) which is undoubtedly the most carbon-intensive steelmaking process. This is because BF-BOF route uses coking coal as reducing agent as well as source of energy. World Steel Association indicated that, in 2018, coal accounted for about 90% of a BF-BOF’s energy input, while 7% energy input came from electricity, and remaining from natural gas and other sources. Overall, for every ton of steel produced through BF-BOF route, about 2.3 tons of CO2 is emitted.

To reduce CO2 emission in BF-BOF route, it has been proposed to substitute coking coal with biofuel. Biofuel is also carbon-based but it does not contribute to greenhouse gases upon combustion. Hence, its impact on the environment is comparatively lower. By using biofuels in BF-BOF, the CO2 emissions can be almost halved.

Moreover, combining BOF route with Carbon Capture and Storage (CCS) technology can also help to reduce CO2 emission

by almost 60%. CCS technology allows to capture the CO2 emissions produced from the use of fossil fuels in steelmaking process, thus preventing the CO2 from entering the atmosphere. CCS technologies are quite advanced and can be retrofitted with the existing infrastructure used for BF-BOF production processes.

Direct reduced iron (DRI) is another steelmaking technology in which the metal is reduced directly from the ore in solid state without the need to melt it. DRI route generally uses natural gas as reducing agent, which reduces the carbon emission by about 50% as compared to BF-BOF route. About 5% of the global steel production is done through DRI route.

Electric Arc Furnace (EAF) is a dominant technology used to produce recycled steel from scrap. EAF are smaller and less expensive than BF-BOF. Moreover, in case of EAF route, coking coal is not consumed as a reducing agent, and thus the CO2 emission is much lower. Further, as per World Steel Association estimates, in 2018, for EAF route, electricity was the main source of energy accounting for 50% of the total energy input, followed by natural gas which accounted for 38% of energy input. In the same year, coal represented only for 11% of the total energy input for EAF route. EAF emits only about 0.4 ton of CO2 per ton of steel produced. The CO2 emission can be further reduced in the EAF route by using zero-carbon sources for electricity.

There are a few other technologies which are still in the research phase, but have the potential to provide a breakthrough in future. For instance, research is ongoing on use of hydrogen in place of coking coal, as reaction of hydrogen with the iron ore generates water vapor as a by-product instead of CO2. Several leading steel companies including SSAB, ArcelorMittal, and Thyssenkrupp Steel are exploring and conducting feasibility studies to test this new concept. Another technology being explored involves reduction of iron ore through direct electrolysis at temperatures of about 1,600 degrees Celsius. This technology is already being widely used in aluminum production, but it is still in early phase of research for steel production.

Challenges in implementation

Eco-friendly steelmaking process is technically achievable but there are several challenges in implementation at commercial scale. Thus, steel industry lacks the incentive to adopt environment-friendly low-carbon technologies in the current business environment.

Even though a number of alternatives to BF-BOF route have been developed for ore-based steel production, about 95% of the ore-based steel is still being produced through BF-BOF route. The industry has been making constant efforts to make changes and improvement in BF-BOF process with a view to reduce carbon emissions. For instance, the replacing of coking coal with biofuel in BF-BOF route is a mature technology, but feasibility to implement this on large-scale depends on availability of biofuel, which varies from region to region. Thus, countries such as Brazil that have large biofuel resources have commercial-scale biofuel-based BF-BOF steel production, but it is not feasible for countries that do not have sufficient biofuel resources.

Similarly, DRI technology uses mainly natural gas as input and as the natural gas availability varies significantly from region to region, the feasibility of implementing DRI technology depends on the location.

CCS seems to be a promising alternative but it demands a large investment in construction of infrastructure for storage and transportation of CO2. A study released by Global Carbon Capture and Storage Initiative (GCCSI) in 2017 indicated that costs for capturing CO2 from steel furnaces could be estimated around US$65-US$70 per ton of CO2. For steel producers operating on competitive margins, this is a significant cost; thus, they seek strong incentives or policy reforms from their governments to support their investment in CCS. At present, only a handful of countries including, the USA, UK, Canada, Australia, and Denmark have CCS-specific policies and these policies vary significantly from country to country. Since steel is a globally traded commodity, the difference in government policies and framework may impact the competitiveness of the steel producers. Thus, lack of global regulatory framework for CCS is a major barrier in wide-scale implementation of the technology.

Scrap-based steel produced using EAF technology accounts for over one-fourth of the total global steel production and it is less carbon-intensive than ore-based steel. Hence, in order to keep the CO2 emissions in check, it is essential to increase the contribution of scrap-based steel in fulfilling the overall steel demand. But the quality of recycled steel is low compared to primary steel produced directly from iron ore, which makes it unsuitable for some specific applications such as construction. Moreover, steel scrap generally has high copper content which becomes problematic during the recycling process because it causes cracks. Application of such type of recycled steel is extremely limited. In order to give a boost to production of recycled steel over ore-based steel, it is important to overcome these downcycling problems.

EOS Perspective

While there are several challenges in implementation of alternative technologies in steelmaking process to reduce CO2 emission, steel producers are under pressure to act in wake of rising carbon prices. 86% of the industry’s production comes under the purview of existing or planned carbon pricing markets.

A study published in July 2019 by CDP, a non-profit environmental advocacy group, pointed out that the world’s 20 largest publicly-listed steel companies, which together account for over 30% of the global steel production, could suffer an average loss of 14% if the carbon price rise to US$100 by 2040. The report also indicated that about 60% of the companies have set some target for carbon emission reduction, of which, target of only two companies align with the Paris agreement goals. The 20 companies under study are expected to cumulatively reduce the CO2 emissions by less than 50% by 2050, which is much less than the target of 65% reduction in CO2 emission required to meet the Paris agreement goals. This clearly shows that the steel producers are underprepared to align with the global climate change goals. The need of the hour is to embrace radical technology changes, but high cost, limited resources, and lack of unified and global policy framework are the main barriers disincentivizing the steel industry to move towards low carbon future.

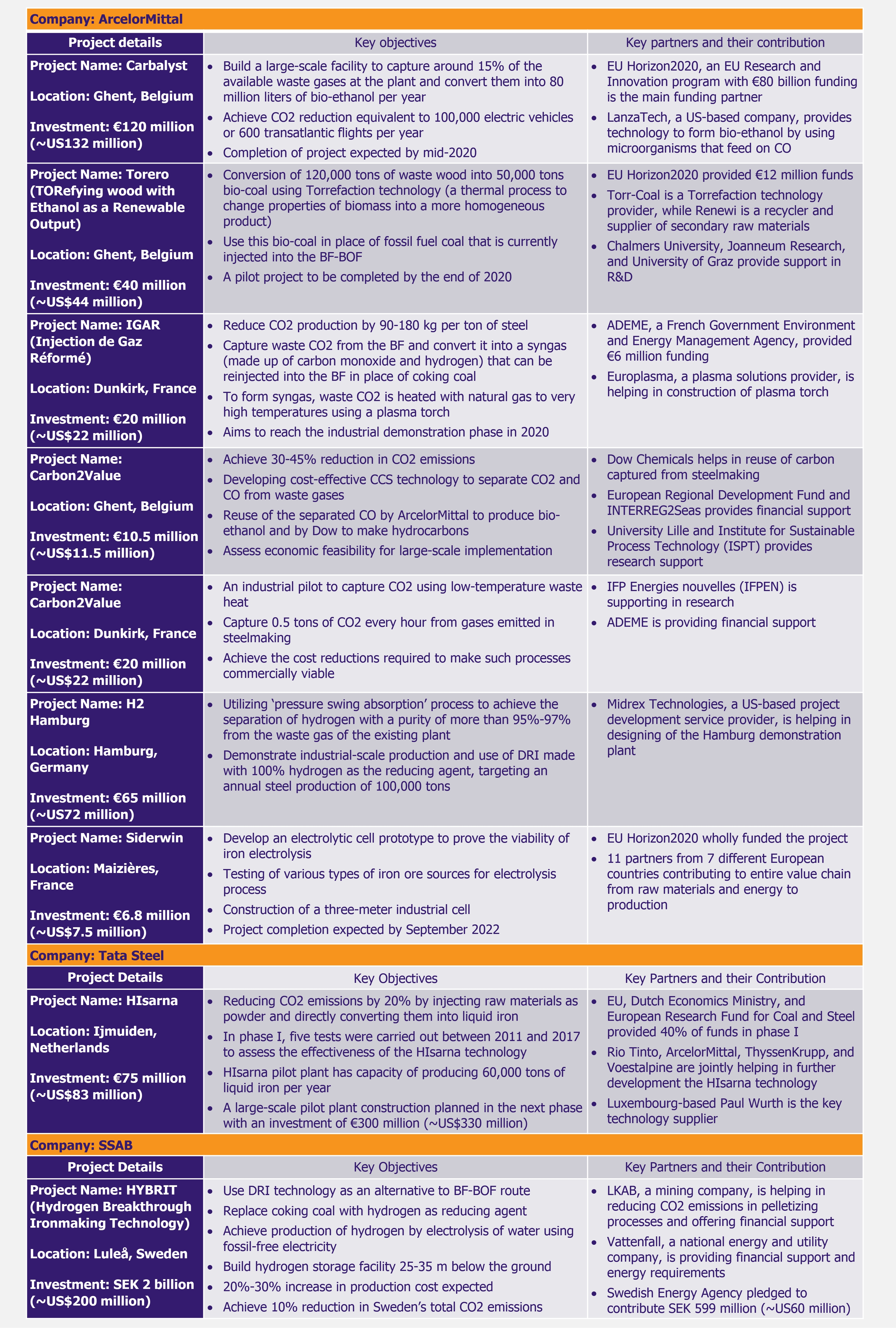

However, with the support of the governments, technology innovators, and other stakeholders, some steel giants are working on several green initiatives to reduce the CO2 emissions. Most pilot projects are concentrated in Europe, as companies in this region are receiving immense support from the European Commission in view of its goal to make EU carbon neutral by 2050. The table highlights key projects undertaken by the leading steel companies to move towards low-carbon future.

Currency Conversion as on 26 March:

€1 = US$1.10

SEK1 = US$0.10