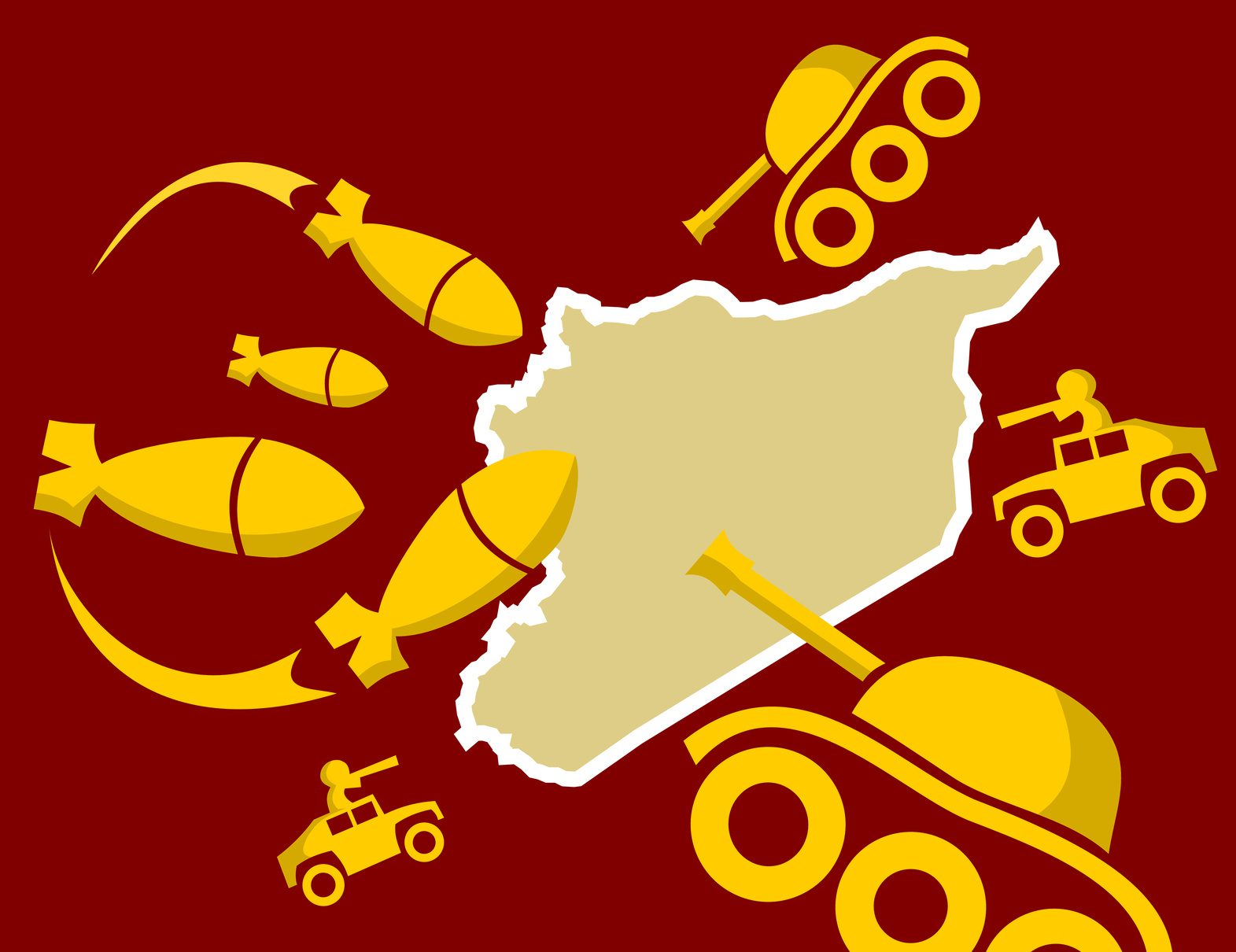

When Mexico’s telecommunication market is under discussion, one name is sure to pop out – that of the world’s richest man, Carlos Slim, who through his companies (America Movil Telcel and America Movil Telmex), controls majority of the market. But now, with the government determined to break open this tightly-held market, it gave a first-ever nod to game-changing reforms that can boost foreign investment and competition. The question, however, remains whether the country is mature enough to take these reforms till the finish line.

In July 2012, when after 12 years the PRI Party (Institutional Revolutionary party) bounced back to power in Mexico under the leadership of Enrique Pena Nieto, there was little hope for any reforms in the country. This assumption was based on the party’s actions during its previous tenures, which were marked by electoral frauds, widespread corruption, economic mismanagement, and its success in blocking attempts at reforms proposed by previous presidents: Vicente Fox (2000-2006) and Felipe Calderón (2006-2012).

However, remaining under a growing pressure of frustrated and agitated general public asking for reforms and solutions the widespread mafia problem, PRI was forced to offer several promises during the electoral campaign. These included addressing the problem of unwarranted concentration and lack of competition in many sectors of the economy, and post election PRI had no choice but go ahead with at least some of its promised reforms. PRI’s-led government entered into an alliance, called the ‘Pact for Mexico’, with its opposition – National Action Party and the Democratic Revolution Party, to push reforms and encourage competition. After the overhaul in the labor laws and the education system, this Pact has been pushing for reforms in the country’s telecommunication and broadcast industry. These reforms look to provide a makeover to this previously quasi-monopolistic and inefficient sector, introducing several fundamental changes:

-

Firstly, opening the market to new international players by allowing 100% foreign ownership in the telecom sector (a rise from the existing 49% FDI limit)

-

Secondly, forming two new independent regulatory commissions to regularize the industry

-

Federal Telecommunications Institute, with profile similar to the U.S. Federal Communications Commission, to have the authority to check and punish non-competitive practices to the extent of withdrawing company licenses

-

Federal Competition Commission, created to fight monopolistic practices by ordering companies that control more than 50% of the market to sell off assets to reduce market dominance

-

The reforms also encompass the creation of a specialized court to oversee all competition, telecom, and media rulings

-

The previously existing Mexican law allowed companies to file private injunctions in order to block the regulator’s rulings aimed at improving competition in the market (while appeals were in progress); this loophole in law, which was misused by companies to indefinitely freeze inconvenient regulatory decisions, has been removed under the new legislation

Recently, Mexico’s Senate approved these changes, and passed legislation aiming at improving competitiveness in the telecom sector. While few key changes brought about by these reforms still need to be ratified by two-thirds of Mexico’s 31 states in order to become a law, this seems like a mere formality considering PRI’s dominance in provincial legislatures, as well as complete support from the opposition through the ‘Pact for Mexico’. The legislation is thus expected to go into effect by early 2014.

These reforms aim primarily at improving market dynamics in this $30billion annually industry, by facilitating competition, encouraging foreign investments, pushing down prices, and increasing mobile penetration, which (currently at 85.7%) stands much lower than 100%+ penetration in its neighboring Argentina and Brazil. However, the new legislation spells trouble for the current monopolies in this sector – America Movil Telcel (that accounts for 70% of the mobile market) and America Movil Telmex (that accounts for 80% of landline market). Both these companies operate as subsidiaries of America Movil, which is owned by world’s richest man, Carlos Slim.

The reforms seem to be particularly beneficial for international telecom companies operating in neighboring lands, who have been shy of entering the Mexican arena owing to the 49% limit on foreign investments. These players can look to buy companies such as Axtel and Maxcom Telecommunications, to get their hands on the fiber-optic cables placed across Mexico, thus hinting towards a wave of consolidation activities in the medium term.

However, despite ongoing efforts by the government, the success in this industry is not guaranteed. Firstly, the fixed line market is expected to remain devoid of foreign investment, owing to the overall decline of the industry globally, and the local Telmex’s 80% share in the market. Moreover, the impact of the reform would only be assessed on how it is brought to force (i.e. if it is implemented in its current form by the legislatures of the 31-states) and also upon how well is it enforced by the independent bodies (Federal Telecommunications Institute and Federal Competition Commission), as previously the industry suffered mostly due to law loopholes and poor implementation of these laws by authorities.

Moreover, reforms similar to those in the telecom industry have been implemented in the television industry, where Televista holds 70% market share. While these reforms (in both the telecom and the television industry) are expected to weaken the hold of the monopolies in their respective markets, it provides them with an opportunity to strengthen their existing presence in each other’s market. (Carlos Slim’s America Movil is a leading player in the pay-TV sector in Latin America, having a subscriber-base of 15million viewers and Televista, along with Azteca, owns Lusacell, the third largest mobile network in Mexico.) Thus, it is feared that instead of stirring foreign investments and competition, these reforms might just result in these incumbent monopolies swapping market share among themselves.

While the majority of the nation rejoices at these reforms and eagerly awaits an influx of investment and increase of competition that could push down the prices, it is premature to predict the long-term outcome of the new legislation. The country is on a correct path to build competitiveness in the telecom sector, but considering the level of corruption and red-tapism in the nation, it seems clear that what matters even more than the reforms themselves, is the way they are implemented.