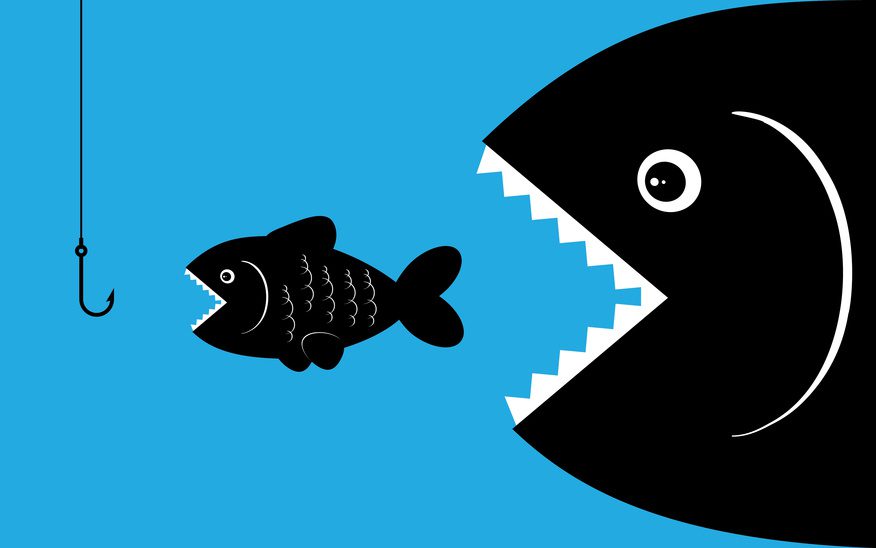

Since its announcement last year, a US$160 billion Pfizer-Allergan merger has been under an ongoing discussion, with great synergies and tax savings expected if the deal was to be finalized, (we wrote about it in our ‘Pfizer-Allergan Deal – What’s in Store for Allergan’ article in February 2016).

However, discussions came to an abrupt end, when the merger was called off on April 6th, 2016 in the wake of changes in tax rules by the US government to check inversions. New rules disregard last three years’ (at the time of deal) acquisitions by a foreign company in the USA in determining its market value. It is a general feeling that the three-year rule was introduced primarily to stop Pfizer-Allergan deal. Since its announcement, the deal was a talking point in political debates with some presidential hopefuls taking an open stance against it.

To secure maximum tax benefits of inversion deal, Pfizer shareholders were required to own 50-60% of the merged entity. Allergan’s market capitalization stood at US$120 billion (against Pfizer’s US$200), owing to three deals, i.e. Allergan-Actavis merger (US$66 billion), Forest Laboratories acquisition (US$25 billion) and Warner Chilcott purchase (US$5 billion), struck in last three years, thereby giving Pfizer shareholders more than 50% of the combined entity. However, this will not be the case now due to drastic reduction in Allergan’s market value as a result of three-year window provision. This also means that both the companies will have to go back to the drawing board.

For Pfizer, this means the need for an increased focus on management of its vast portfolio of drugs (a mix of patent and off-patent products) with an intent to further improve profitability. While Pfizer’s patented drugs command higher prices, the off-patent ones are subject to price decline thereby impacting the company’s profitability. After the announcement of Pfizer-Allergan deal, there were speculations about sale/spin-off of Pfizer’s off-patented portfolio. However, with revenue loss due to the broken deal, the plan (if still any) to sell off-patented business is likely to be put in freezer for some time to come. This could also mean more efforts on research and development front, and being inherently a research driven company, Pfizer has some potentially lucrative drugs in pipeline (including cholesterol lowering and cancer drugs).

For Allergan, the broken deal means looking for alternative ways to strengthen its position outside the USA. The company can take inorganic route to achieve this. No headway was made towards operations restructuring of the merged entity. Therefore, in all likelihood, the research and development assets of Allergan will remain intact, one positive outcome for the company out of the broken deal, as it has some good candidates in the field of ophthalmology, urology, and women’s health. With sale of its generic business to Israeli rival Teva Pharmaceuticals in July 2015, Allergan showed the intent to focus on patented products, therefore the company will have to look for means to raise its R&D budget.

The broken Pfizer-Allergan deal will remain in discussion in coming days from the point of view of missed opportunities for both Pfizer and Allergan, as well as for the political angle involved. Even if the decision was politically motivated, it may have put moratorium on inversion as a strategy for the time being, and it would be interesting to track moves not only in the pharmaceutical space but in other industries as well, following the new regulatory regime.