Many biopharmaceutical companies, such as AriBio, Annovis Bio, Athira Pharma, Cassava Sciences, and Alzheon, specializing in treating neurodegenerative diseases, are developing drugs for Alzheimer’s disease (AD) that are currently in phase 3 of clinical trials. If approved, these drugs can ameliorate the AD treatment approaches to a considerable extent. A major prerequisite to this is for concerned authorities to take concrete steps to fast-track clinical trials and increase AD research investment.

With only a 1% success rate of clinical trials in drug development until 2019, the AD treatment gap is alarming. A 99% failure rate means there is a very limited influx of new, more effective, and more advanced AD drugs into the market, and the gap between available treatment options and the rising number of AD cases is increasing.

The disease burden of Alzheimer’s will rise from US$1.3 trillion in 2020 to US$2.8 trillion by 2030 globally. With the rise in the aging population across the globe, the estimated number of AD patients will increase from 55 million in 2020 to 78 million in 2030.

However, recent drug approvals, such as Elli Lilly’s Kisunla (Donanemab) in July 2024 and Biogen/Eisai’s Leqembi (Lecanemab) in January 2023, bring a ray of hope for a new approach to AD treatment.

Initial hopes for new drugs can be premature

New drugs do enter the market from time to time. However, their impact on AD treatment in the long term is not always significant. An example of this is Biogen’s Aduhelm. Based on its ability to reduce amyloid protein in the brain, the FDA approved Aduhelm (Aducanumab) in 2021 in an accelerated approval route for AD treatment.

However, in 2024, Biogen discontinued the drug in the alleged desire to reprioritize its resources in AD treatment. Experts cite weak clinical evidence for efficacy, serious side effect risks, a high price point, and poor sales among the many reasons for Aduhelm’s withdrawal from the market.

AD drug candidates succumb to clinical failures

Eisai and Biogen have been working together since 2014 to develop and commercialize AD drugs. However, they have faced clinical drug failures, similarly to many other pharmaceutical companies during that time. For instance, they had to terminate Elenbecestat, one of their AD drugs, in phase 2 clinical trial in 2019 following an unfavorable risk-benefit ratio finding by the Data Safety Monitoring Board (DSMB).

Eisai launched its first AD drug, Aricept, an acetylcholinesterase inhibitor, in the USA in 1997 in collaboration with Pfizer. The annual peak sales of Aricept were US$2.74 billion before its patent expiry in 2010. However, Pfizer exited neuroscience drug research and development in 2018 after the failure of its AD drug candidates, such as Dimebon and Bapineuzumab.

Clinical challenges in Alzheimer’s research and reallocation of resources were among the other reasons for Pfizer’s exit from neuroscience R&D and drug development. Nevertheless, Pfizer did not desert the neuroscience space completely, rather forged a spin-off company called Cerevel Therapeutics in partnership with Bain Capital.

Phase 3 Drug Candidates – A Ray of Hope in Alzheimer’s Disease Bleak Treatment Landscape by EOS Intelligence

Recent drug launches focus on amyloid beta targeting mechanism

In January 2023, the FDA approved Leqembi (Lecanemab), a drug by Biogen and Eisai, for AD treatment. It is a monoclonal antibody that clears away the amyloid beta plaques known to cause cognitive impairment in AD patients. With MHRA’s (Medicines and Healthcare Products Regulatory Agency) approval of Leqembi, Great Britain becomes the first European country to authorize the drug for the treatment of early-stage AD as of August 2024.

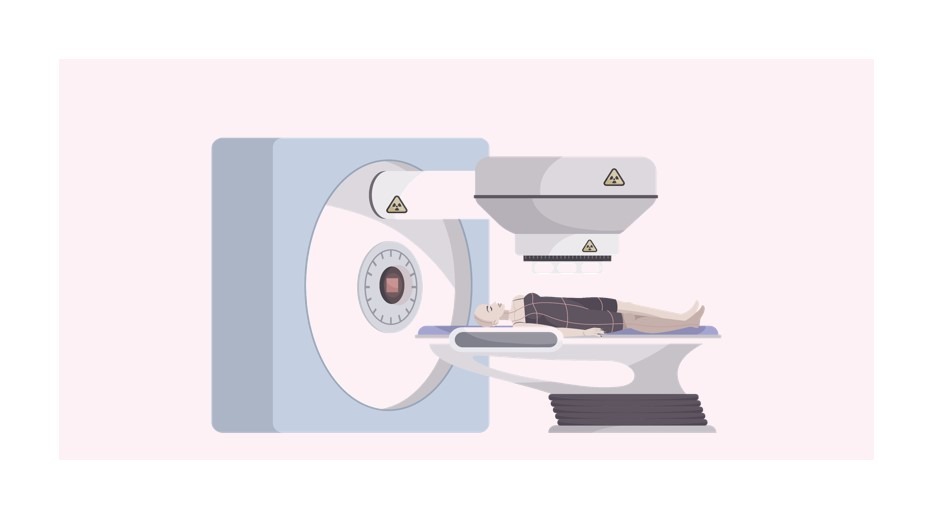

In July 2024, the FDA approved Kisunla (Donanemab) by Eli Lilly to treat early-stage AD. The drug’s mechanism of action is the same principle as that of Leqembi, an amyloid beta protein plaque targeting mechanism. Kisunla becomes the third anti-amyloid drug approved for AD treatment, following Aduhelm (now discontinued) and Leqembi. Both Kisunla and Leqembi drugs carry the risks of the formation of temporary lumps in the brain that can be fatal. Therefore, physicians advise regular brain MRIs to alleviate this risk. Neurologists and researchers are in disagreement over whether the benefits offered by these drugs are clinically meaningful.

Researchers are still studying the side effects of these two drugs. Prescribing them requires confirmation of the presence of amyloid protein in the brain. Therefore, PET scans and CSF tests are required before such a prescription.

The FDA has approved both drugs in the USA for intravenous infusions (IV) in the early stages of AD. Kisunla is administered every four weeks instead of every two for Leqembi. Therefore, Kisunla offers greater convenience compared to Leqembi.

Experts from Bloomberg Intelligence suggest that Eli Lilly will likely surpass Biogen and Eisai’s reign at the top of the AD drug market by capturing around 50% of the US$13 billion market globally by 2030. This is partly because of Kisunla’s convenient dosing and the fact that AD patients can stop taking the drug after the amyloid levels touch the clearance threshold.

Newer therapeutic approach-based drugs are in phase 3 clinical trials

Apart from the amyloid beta therapeutic approach, AD researchers are exploring the role of other mechanisms in AD treatment, such as anti-tau antibodies, neurotransmitter receptors, and synaptic plasticity or neuroprotection. Drugs based on these mechanisms are currently in phase 3 of clinical trials.

The Washington University School of Medicine’s DIAN-TU (Dominantly Inherited Alzheimer Network Trials Unit) trial is testing Lecanemab plus Eisai’s investigational anti-tau antibody E2814 in patients with early-onset AD caused by a genetic mutation. E2814 prevents the spreading of tau seeds in the brains of AD patients. This drug is in phase 3 clinical trial. The clinical study commenced in June 2024 and will complete by November 2029.

ACP-204 by Acadia Pharmaceuticals is also in phase 3 clinical trial for AD. The agent acts as an inverse agonist at the 5-HT2A serotonin receptor. FDA has approved Acadia’s previous 5-HT2A inverse agonist, Nuplazid, for Parkinson’s disease psychosis. ACP-204 will be the first drug for AD treatment in Acadia’s product portfolio if approved.

Another drug in phase 3 trial is AriBio’s AR1001, a phosphodiesterase-5 (PDE5) inhibitor. Apart from AR1001, two more AD drugs are in AriBio’s pipeline, AR1002 and AR1003 that are currently under the investigational new drug-enabling stage of clinical trials.

For better patient outcomes, researchers are attempting to develop AD drugs with non-invasive modes of administration that are likely to be less expensive and equally effective compared to AD drugs administered intravenously.

The safety and effectiveness of oral therapy candidate Buntanetap, developed by Annovis Bio, are comparable in people with early onset AD regardless of whether they do or do not carry a genetic risk factor APOE4. That is according to new data from a phase 2/3 clinical trial that tested three doses of Buntanetap against a placebo in more than 300 patients with the neurodegenerative disease. Buntanetap modulates protein production to reduce clumping. The competitive advantage of Annovis Bio over its peers is the fact that Buntanetap targets multiple proteins in the brain, such as amyloid beta, tau, alpha-synuclein, and TDP43, making it more effective than AD drugs that target a single protein.

Apart from Buntanetap, Annovis Bio has another oral drug to treat advanced AD and dementia in its pipeline, ANVS301, which is in phase 1 of clinical trial. In July 2024, Annovis Bio received FDA approval to transition to a new solid form of Buntanetap in future clinical trials allowing the company to refine its drug formulation, potentially improving its efficacy and safety profiles.

Another promising AD drug candidate, Fosgonimeton by Athira Pharma, is a small-molecule positive modulator of the hepatocyte growth factor (HGF) system, previously showing neuroprotective, neurotrophic, and anti-inflammatory effects in preclinical models of dementia. This drug is in phase 3 clinical trial. Athira Pharma ended 2023 with a strong balance sheet, signaling its better financial position to augment its ongoing pipeline development.

Eli Lilly’s new drug Remternetug works as pyroglutamyl (3)-amyloid beta-protein (3-42) inhibitors, positioning it as a promising AD drug. Remternetug will join Eli Lilly’s portfolio as a second AD drug if approved.

Simufilam by Cassava Sciences is a proprietary, small-molecule oral drug that restores the normal shape and function of altered filamin A (FLNA), a scaffolding protein, in the brain. It is now in phase 3 clinical study to test this new and promising scientific approach to treating and diagnosing AD. The mechanism of action of this drug involves stabilizing a critical protein in the brain instead of removing it. This novel approach distinguishes Cassava Sciences’ drug from other treatments that predominantly focus on amyloid-beta or tau proteins. In May 2024, Cassava Sciences raised US$125 million by selling its stock to shareholders. The funds will be utilized for the continued development of Simufilam.

Valiltramiprosate by Alzheon is potentially the first oral disease-modifying treatment for AD. Valiltramiprosate is well differentiated from plaque-clearing antibodies in development for AD due to its novel mechanism of action, oral mode of administration, and potential efficacy in a genetically targeted population. In October 2017, Valiltramiprosate/ALZ-801 received FDA Fast Track designation for AD investigation. Due to Alzheon’s significant progress in AD drug development, the company has attracted a lot of investors since 2022. Alzheon received US$100 million in June 2024 in Series E venture capital funding which will be utilized to further develop and commercialize Valiltramiprosate. This is in addition to US$50 million received in series D round of funding in 2022.

Big names dominate the competition, with clinical trials in progress by smaller biopharma players

On the competitive landscape front, the AD drug market is highly competitive, with many pharmaceutical companies financing R&D to engineer new drugs that could potentially delay the progression of AD and/or restore neuronal health. The global AD therapeutics market size was US$4.8 billion in 2023 and will surpass US$7.5 billion by 2031, as per Towards Healthcare, a healthcare consulting firm.

A couple of large players still dominate the global AD therapeutics market. Interestingly, they are not the only ones active in the AD treatment development, as several smaller biopharmaceutical companies that specialize in neurodegenerative disease treatment are working on AD drugs (many currently in phase 3 of clinical trials).

High R&D costs are a considerable factor in slowing the progress down

Between 1995 and 2021, the cumulative private spend (total R&D expenditure by pharmaceutical companies, does not include federal funding) on clinical stage R&D for AD was US$42.5 billion, with the largest share of 57% (US$24.1 billion) incurred during phase 3. During the same period, the FDA approved 878 drugs across all therapeutic areas; only six of these drugs were for AD treatment (four cholinesterase inhibitors [ChEIs], memantine, and aducanumab). These statistics speak volumes of the complex, expensive, time-consuming, and predominantly unsuccessful nature of AD clinical trials. This ultimately leads to exorbitant prices of AD drugs.

A range of factors drive the R&D costs and, in turn, the price of AD drugs. A significant component here is patient screening, which contributes to 50-70% of the cost. Patient recruitment and retention are also challenging, given the considerable length of such trials.

Moreover, patient recruitment challenges stunt the progress of AD clinical trials. The recruitment rate for AD clinical trials is as low as one patient per site per month. In terms of eligibility, 99% of AD patients who are eligible for participation in a clinical trial never consider taking part. This further increases the time taken to conduct AD clinical trials.

EOS Perspective

After decades of failure in clinical trials, two anti-amyloid AD drugs, Kisunla and Leqembi, are available in the market, forming a duopoly in the USA. There are several promising drugs in phase 3 clinical trials with a new mechanism of action apart from amyloid beta protein inhibitors. However, the disease management landscape is prone to unforeseen changes, such as the withdrawal of drugs owing to safety, efficacy, and pricing issues.

The AD treatment landscape faces challenges such as drug inefficacy, complex pathophysiology of AD, expensive and time-consuming clinical trials, delays in diagnosis by physicians, behavioral changes and deteriorating mental health of AD patients, and severe side effects of medications. These challenges will continue to impede the development of new disease management approaches.

An issue that is very likely to continue to challenge progress in developing better treatment options for AD is the severe lack of funding. Dementia research is extremely underfunded compared to HIV/AIDS, cancer, and COVID-19 in the USA. Irrespective of the fact that the deaths attributed to AD are on par with cancer, the difference between the annual US federal government funding for AD vis-à-vis cancer is strikingly huge.

AD drug development is a tough market to operate in. The ongoing issue with AD research funding persists, and there do not seem to be changes in federal funding soon. On top of that, the slow progress in successful R&D and many failed clinical research trials will likely make private-sector investors hesitate or withdraw.

In addition to this, AD drug manufacturers will also continue to face the challenge of low to modest drug sales due to poor adoption rates stemming from issues like restricted coverage.

As of June 2023, Medicare was covering AD drugs that slow down the progress of the disease provided a physician agrees to the collection of real-world evidence of these AD drugs, as per the Centers for Medicare & Medicaid Services (CMS). However, there is a significant underlying problem with drugs for AD treatment. When the drug finally enters the market, patients cannot afford the treatment, and the coverage is restricted and sometimes withdrawn. There is no foreseeable change to this impasse, and hence, the AD treatment development is likely to be slow.

If reimbursement of AD drugs is removed, patients are likely to stop administering AD drugs altogether and adopt alternative healthcare resources such as antidepressants, as found in a 2021 study by researchers from Paris-Saclay University and Memory Center of Sainte Périne Hospital in France.

The reluctance of payers to cover the treatment cost for AD is influenced by several factors beyond just the high cost of the drug. Factors include cost-effectiveness of treatments, uncertain long-term safety and efficacy benefits of treatments, clinical guidelines and recommendations, availability of alternative treatments including generics (from drug makers such as Cadila, Cipla, Dr. Reddy’s, among others), and regulatory and reimbursement policies.

The future of AD treatment approaches will continue to remain bleak, and patients will be left with only a few available drug options unless the right authorities set out a plan for fast-track clinical trial processes, increase AD research investment, and support broader insurance coverage.