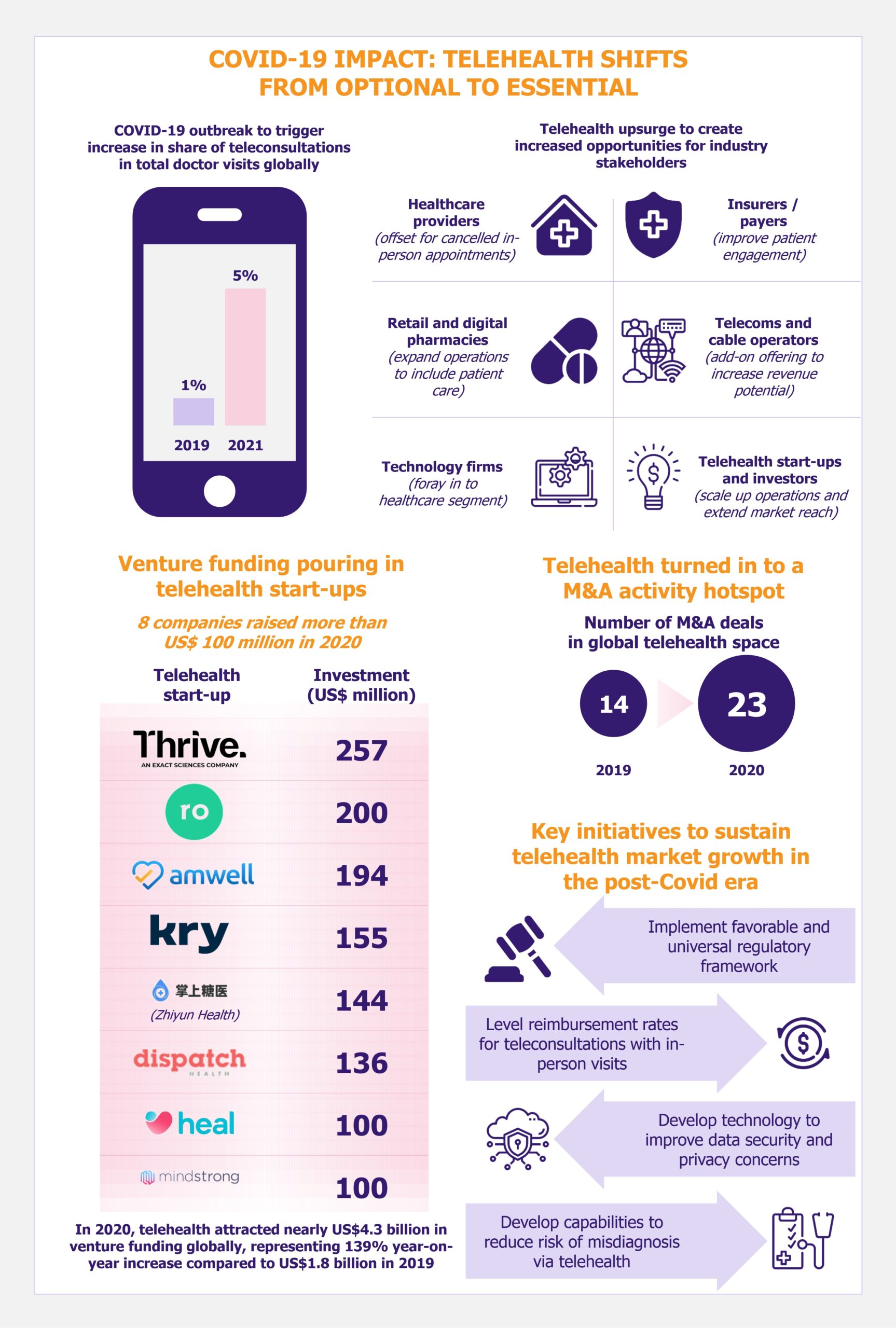

Telehealth is one of the few sectors that have benefited from the coronavirus outbreak. Telehealth services have been around since 1950s, however, they were perceived as a nice-to-have alternative to conventional delivery of healthcare services and thus largely underutilized. COVID-19 pandemic has proved to be a game changer for the industry. Since social distancing became a necessary measure to curb the risk of COVID-19 transmission, telehealth emerged as a viable option to offer uninterrupted healthcare without physical contact. Towards the end of 2020, Deloitte predicted that virtual consultations would account for 5% of total visits to doctor in the world in 2021, up from 1% in 2019. To put this into perspective, in 2019, doctor’s visits in OECD-36 countries totaled 8.5 billion, worth approximately US$500 billion. 5% of this would result in about 400 million teleconsultations and over US$25 billion in value (if doctors earn the same for teleconsultations as for in-person visits).

Telehealth services uptake during the pandemic varied by region

While the adoption of telehealth services has increased across the globe, the growth rate varied by region depending upon factors such as technology and infrastructure, consumer awareness and willingness, government regulations, insurance policies, etc.

In the USA, world’s largest telehealth market which accounted for 40% of the global share in 2019, the growth over the years was steady but incremental mainly because of regulatory constraints and stringent insurance policies.

In response to the pandemic, the US government health insurance plans (Medicare, Medicaid, etc.) as well as private insurers expanded their coverage for telehealth services. As a result, telehealth accounted for 43.5% of all US Medicare primary care visits in April 2020, compared with just 0.1% before the pandemic. US Centers for Disease Control and Prevention indicated that the number of telehealth visits increased by 154% during the last week of March 2020, compared with the same period in 2019, primarily due to policy changes and public health guidance on telehealth during the pandemic. Considering unprecedented rise in demand for telehealth services during the times of pandemic, in April 2020, Forrester (a research and consulting firm) revised their estimation for virtual general medical care visits in the USA from 36 million to 200 million for the year 2020.

UK and France have been the dominating countries in the European telehealth market. Telehealth services’ growth momentum due to COVID-19 pandemic in these countries is likely to continue because of conducive environmental factors such as established ecosystem, favorable regulatory framework, reimbursement policies, and consumer readiness. UK’s National Health Service revealed that 48% of GP consultations in May 2020 were carried out remotely over the telephone, compared with 14% in February of the same year. Teleconsultations in France increased from 40,000 in February 2020 to 611,000 in March 2020.

Growth of telehealth market in Switzerland, Germany, and Austria has been comparatively slow as these countries have more decentralized healthcare systems in contrast to UK or France. For instance, McKinsey’s survey of over 1,000 consumers from Germany, conducted in November 2020, showed that only 2% respondents started or increased usage of telehealth services since COVID-19 outbreak.

In countries such as Greece and Czech Republic, telehealth platforms were launched for the first time during the pandemic. Ireland had telehealth platforms before COVID-19, but the adoption of the telehealth services even after pandemic remains moderate because of lack of favorable regulatory framework.

China and India are among the fastest growing telehealth markets in Asia. The number of telehealth providers in China increased from less than 150 to nearly 600 between late 2019 and early 2020. Telehealth platforms in India are witnessing increased interest from both patients as well as doctors. India’s leading health-tech firm, Practo, reported that 50 million people opted for teleconsultations through its platform between March 2020 and May 2020, representing 500% growth in teleconsultations during this time. 1mg Technologies, another telehealth service provider in India, indicated that between March 2020 and July 2020 nearly 10,000 doctors showed interest in signing up with the platform to offer teleconsultations. The company had only 150 doctors onboard until March 2020.

Japan, which is one of the largest healthcare markets, lagged in remote healthcare services because of stringent legislative policies. Remote consultations were allowed only for recurring patients and for limited number of ailments. Following the spike in COVID-19 cases, Japan temporarily eased restrictions on telehealth by allowing doctors to conduct first-time consultation online. Japan health ministry indicated that about 15% or 16,100 Japanese medical institutions (excluding dentists), offered telehealth services by July 2020. This shows phenomenal growth as in July 2018 only 970 of such Japanese healthcare institutions offered telehealth services.

In South Korea, telehealth was banned before COVID-19. This ban was lifted temporarily during the pandemic, but the long-term growth of telehealth in South Korea will depend on how the regulatory framework is shaped in the post-COVID era.

Vietnam also joined the telehealth upsurge as the country’s first telehealth app (developed by the Vietnamese multinational telecommunications company, Viettel) was launched amidst corona virus outbreak in April 2020.

Industry stakeholders seek to capitalize on telehealth boom

Healthcare providers have turned to telehealth to compensate for cancelled in-person consultations due to COVID-19 outbreak. This has encouraged providers to scale up their telehealth capabilities. For instance, over 56,000 doctors in France started teleconsultations by July 2020, as compared with only a few thousands at the beginning of the year.

Healthcare providers are not the only players looking to capitalize on the increase in demand for telehealth services. Other industry participants such as insurers and pharmacies are also exploring this segment.

In the USA, leading insurers such as Cigna, United Health, Aetna, Anthem, and Humana are partnering with telehealth providers to capitalize on the spurt in virtual healthcare demand. For instance, in February 2021, Cigna announced plans to acquire MDLive, Florida-based telehealth firm serving 60 million people across the USA, with a view to bring telehealth services in-house and reduce the patient-provider accessibility gap. Pharmacy giants Walgreens and CVS also extended access to telehealth services during COVID-19 crisis. In March 2021, a US-based digital retail pharmacy NowRx expanded into telehealth to provide care for HIV patients in California.

Since telehealth primarily encompasses delivery of healthcare services through digital and telecommunications platforms, telecoms and cable operators are uniquely positioned to organically expand in to telehealth space. Telecoms have the opportunity to expand in healthcare space by delivering telehealth as a value-added service. In October 2020, CommScope, an infrastructure solutions provider for communications networks, estimated that telehealth has the potential to create US$50 billion per year revenue opportunity for internet and telecom service providers in the USA.

Moreover, leading technology firms including Amazon, Microsoft, Salesforce, Tencent, Alibaba, and Alphabet are also investing in or considering to invest in telehealth. For instance, in January 2020, Alibaba launched an online coronavirus clinic, to offer remote assistance to patients across China.

Telehealth startups are mushrooming across the world and raking in millions in investment. Mercom Capital Group indicated that, in 2020, telehealth attracted nearly US$4.3 billion in venture funding. This represents 139% year-on-year increase compared to US$1.8 billion in 2019 implying that COVID-19 outbreak was the key driver behind the increased investment in telehealth.

Since everyone is trying to grab a piece of the growing telehealth market cake, this has led to flurry of M&A deals. Mercom Capital Group recorded 23 M&A transactions in telehealth space in 2020, up from 14 transactions in 2019.

EOS Perspective

COVID-19 outbreak worked as a catalyst resulting in dramatic increase in telehealth services utilization; whether this growth will continue in the long term, remains a question. This growth of telehealth market is primarily demand-driven. Thus, to sustain the growth momentum it would be imperative to overcome the challenges faced by the industry before the pandemic.

Ambiguous and often changing regulatory framework remains one of the biggest hindrances to telehealth. In order to tackle the spread of coronavirus, many countries temporarily relaxed their regulations for telehealth. However, it remains unknown whether countries will pull back the relaxations once the pandemic is over. Moreover, telehealth opens up doors for cross-border provision of healthcare services. This calls for development for a universal law for telehealth which is acceptable worldwide.

Further, the market will also largely depend on how the reimbursement policies evolve in the future. Historically, in many countries, reimbursement for teleconsultations has been lower than for in-person consultations. During the pandemic, the reimbursement amount was leveled in order to encourage adoption of telehealth. This proved to be a strong incentive driving the surge in telehealth. Post the pandemic, if the policies are changed again offering lower reimbursement for teleconsultations as compared with in-person visits, this could impact the growth momentum.

Data security and privacy concerns have long been debated as some of the biggest barriers for telehealth worldwide. Development of more secure platforms using technologies such as blockchain, AI, and Secure Access Service Edge (SASE) networks could potentially address these issues in future. Further applications of blockchain are being explored to improve operational transparency, increase protection of health records, and detect fraud related to patients’ insurance claims as well as physician credentials.

It is believed that the risk of misdiagnosis increases with telehealth as compared to in-person visits. This risk can be significantly reduced by integration of remote patient monitoring technologies with teleconsultations. IoT-enabled remote care monitoring technologies have been evolving by leaps and bounds. Teleconsultations carried out in conjunction with data collated from smart wearable devices can potentially help to cut down misdiagnoses.

Telehealth has become the new normal amidst coronavirus outbreak. While the telehealth market growth in the next 2-3 years could be attributed to pandemic crisis, the future will depend on how the regulatory framework will shape up and whether the industry will be able to tackle the challenges related to the technology implementation.