China is widely criticized as the world’s largest emitter of carbon dioxide and other greenhouse gases. Less noticed, however, has been the fact that the country is also building the world’s largest renewable energy system. China plays a significant role in the development of green energy technologies and has over the years become the world’s biggest generator and investor of renewable energy. As China heads towards becoming the global leader in renewable energy systems, we pause to take a look at the major drivers behind this development and its implications on China as well as on the rest of the world.

Reducing CO2 emissions has become one of the top priorities and the Chinese government has set its eyes on developing sustainable energy solutions for its growing energy needs. To support this objective, China has set forth aggressive policies and targets by rolling out pilot projects to support the country’s pollution reduction initiatives and those which reflect the strategic importance of renewable energy in country’s future growth.

Why has China suddenly become so environmental conscious and investing billions on renewable energy?

-

Air and water pollution levels have become critical, causing tangible human and environmental damage, which lead Chinese authorities to rethink on the excessive use of fossil fuels. Considering current and potential future environmental hazards of burning fossil fuels, China decided to decrease the use of coal and is actively seeking for greener energy solutions. While serious concerns about climate change and global warming are key drivers towards expanding the use of renewable energy for any country, for China, the motives are well beyond abating climate change; they are creating energy self-sufficiency and fostering industrial development.

-

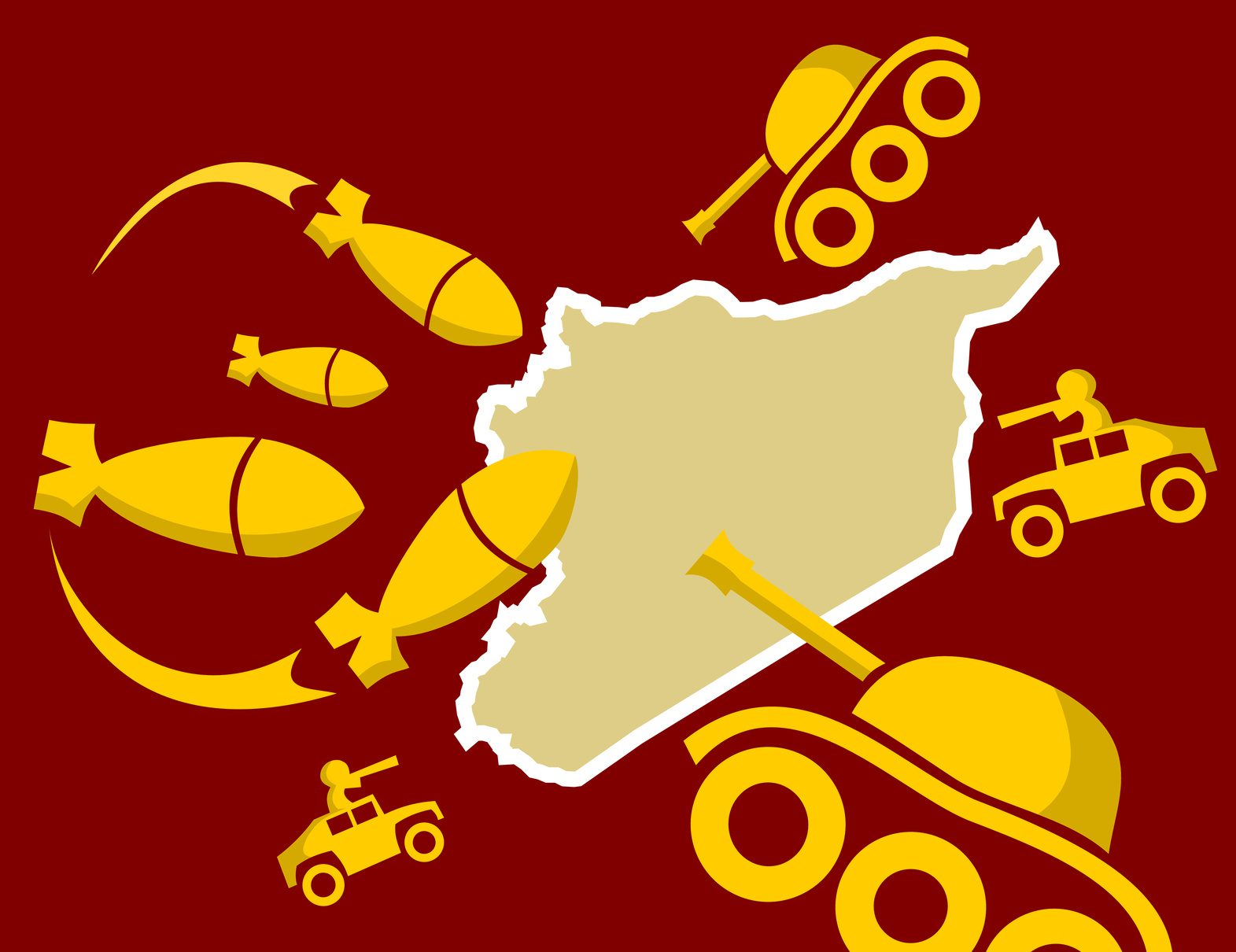

China is witnessing a dramatic depletion of its natural gas and coal resources and has become a net importer of these resources. China’s increased dependency on imported natural gas, coal and oil to meet its growing energy demands bring along some major energy security concerns. The current political volatility in Russia, the Middle-East and Africa pose serious challenges not only for China, but, for other countries as well to secure their energy supplies for the future. Not to mention the risks associated with energy transport routes.

Taking into account these geo-political risks and in order to achieve a secure, efficient and greener energy system, China started its journey towards developing an alternative energy system. A new system that reduces pollution, limits its dependency on foreign coal, natural gas and oil was envisioned.

China’s Ambitious Renewable Energy Plans

According to RENI21’s 2014 Global report, in 2013, China had 378 gigawatts (GW) of electric power generation capacity based on renewable sources, far ahead of USA (172 GW). The nation generated over 1,000 terawatt hours of electricity from water, wind and solar sources in 2013, which is nearly the combined power generation of France and Germany.

The country has now set its eyes on leading the global renewable energy revolution with very ambitious 2020 renewable energy development targets.

In May 2015, we published an article on the solar power boom in China, in which we presented the revised, higher solar power generation targets.

To achieve the 2020 renewable energy targets, China has adopted a two-fold strategy.

-

Rapidly expand renewable energy capabilities to generate greener and sustainable energy.

It has significantly expanded its manufacturing capabilities in wind turbines and solar panels to produce renewable electricity. As per data from The Asia-Pacific Journal, China spent a total of US$56.3 billion on water, wind, solar and other renewable projects in 2013. Further, China added 94 GW of new capacity, of which 55.3 GW came from renewable sources (59%), and just 36.5 GW (or 39%) from thermal sources. This highlights a major shift in energy generation mix as well as China’s commitment towards cleaner energy technologies.

-

Reduce carbon footprint.

The government has banned sale and import of coal with more than 40% ash and 3% sulphur. Government’s Five year plans have stringent targets on reducing coal consumption as well as CO2 emissions. It is expected that environmental and import reforms will become more stringent along with greater restrictions, which would help accelerate China’s migration to a green economy.

The government has also announced a range of financial support services, subsidies, incentives and procurement programs for green energy production and consumption. Solar PV and automotive industries are good examples.

-

By supporting domestic production and providing export incentives, China has become the global leader in solar panels. Over the last few years, the government has also financed small-scale decentralized energy projects, deployed and used by households and small businesses, in order to make them self-sufficient in their energy needs

-

China has also positioned itself as the leading manufacturer of electric vehicles globally. According to Bloomberg, China is mandating that electric cars make up at least 30% of government vehicle purchases by 2016. To achieve this target, the government has started investing on essential infrastructure and providing tax incentives for purchasing of electric vehicles.

China has laid the foundations for a future where renewable energy will play a vital role. The advancements in technology and changes in policies will further enhance the country’s renewable energy landscape and will drive affordable, secure and greener energy. How the Asian giant achieves to balance between its economic, industrial, regulatory and environmental goals with sustainable renewable energy investments will, however, only become clear in the next few years.