Dubbed as ‘Modicare’ (named after the Indian prime minister), India’s National Health Protection Scheme (NHPS) is being considered as the world’s largest government funded healthcare scheme. The scheme is expected to benefit 500 million people by providing them with cover for secondary and tertiary care hospitalization. While the recent press around the scheme focuses largely on the implementation and funding challenges, we are looking at Modicare from the perspective of opportunities it will bring to the table for healthcare industry players.

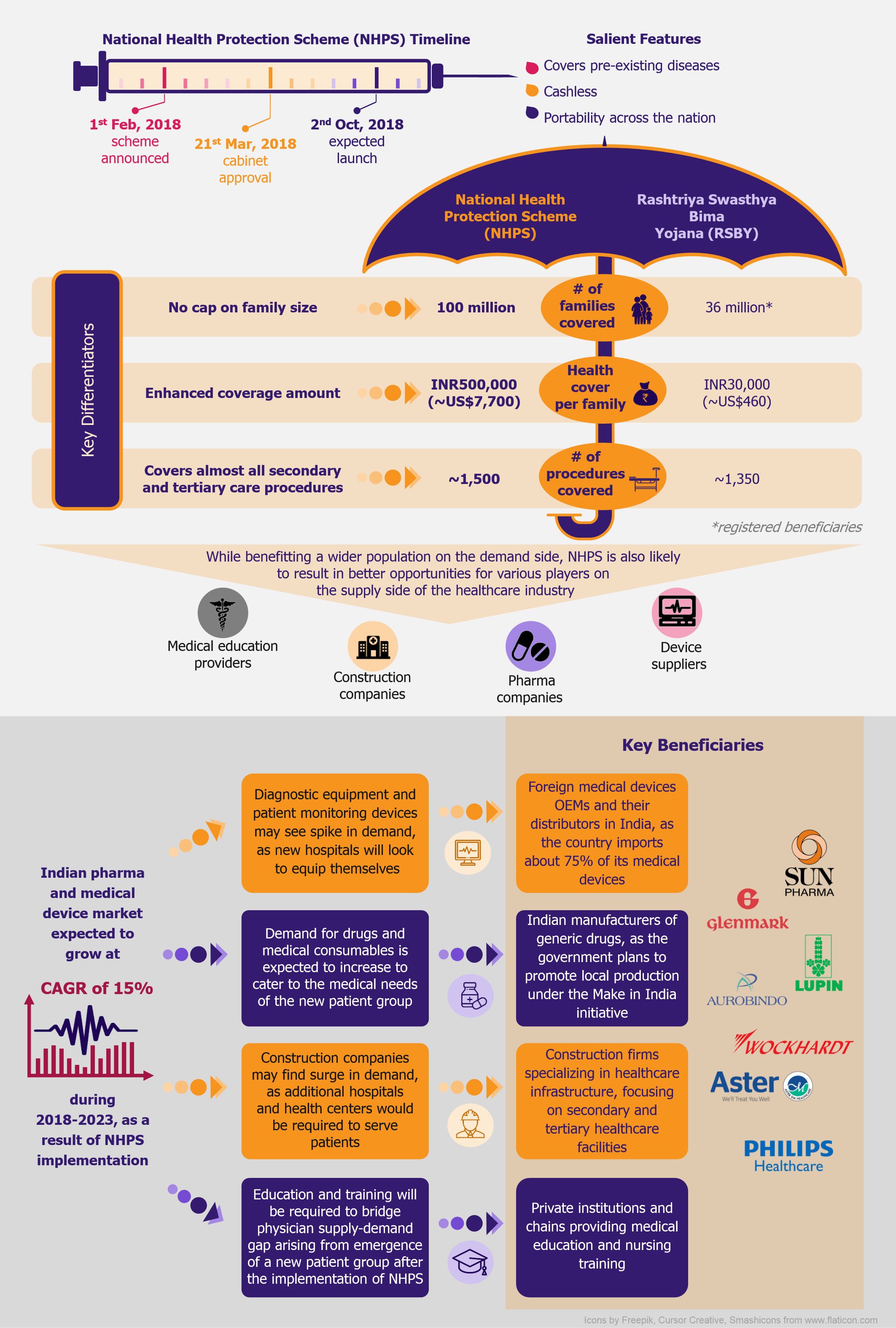

Announced during the 2018 union budget, NHPS is a government-funded secondary and tertiary healthcare plan aimed at 100 million financially vulnerable families, referred to as Below Poverty Line (BPL) families, in India. Expected to be launched on 2nd October 2018, NHPS will replace the existing central-government-operated Rashtriya Swasthya Bima Yojana (RSBY), which provides an annual insurance cover of INR30,000 (~US$460) for a family of maximum five members, and is operational in only 15 (out of total 29) Indian states. The new scheme will offer insurance cover of INR500,000 (~US$7,700) per family.

NHPS is expected to provide secondary and tertiary healthcare access to more than 40% of the Indian population, which was earlier deprived of it due to financial constraints. This will create a new healthcare market, giving boost to the entire healthcare ecosystem in India. Companies across the entire healthcare value chain, including medical education providers, healthcare service providers, construction firms, pharmaceutical and medical devices companies, etc., are expected to witness ample growth opportunities. One can expect increased investments in the Indian healthcare sector by private companies as well as foreign investors.

NHPS is expected to provide secondary and tertiary healthcare access to more than 40% of the Indian population, which was earlier deprived of it due to financial constraints. This will create a new healthcare market, giving boost to the entire healthcare ecosystem in India. Companies across the entire healthcare value chain, including medical education providers, healthcare service providers, construction firms, pharmaceutical and medical devices companies, etc., are expected to witness ample growth opportunities. One can expect increased investments in the Indian healthcare sector by private companies as well as foreign investors.

Since the scheme is aimed primarily at making healthcare affordable and accessible for BPL population, opportunities will be up for grabs for companies to tap and expand their reach in areas where the BPL population resides in India. Based on the currently available scheme details, we have tried to identify top five states in India that are ripe for opportunities with the expected launch of the new scheme.

EOS Perspective

EOS Perspective

Taking into account various factors, including red tape, electricity supply, political stability, etc., as well as the current state of healthcare infrastructure and BPL population, we project the states of Uttar Pradesh (UP), Bihar, Telangana, Madhya Pradesh (MP), and West Bengal (WB) will be most attractive for healthcare industry players.

Uttar Pradesh offers greatest opportunities on the basis of a large BPL population residing in it. The state boasts of a robust road infrastructure and a stable political climate. UP has legacy issues related to administrative challenges, however, the state has taken major steps in cutting the red tape.

Madhya Pradesh is the leading state in India in terms of ease of doing business. The state has electricity surplus, with good road infrastructure, and reasonably priced real estate (as compared with the remaining four states), making it an ideal destination to invest.

One of the largest BPL populations resides in Bihar, a fact that makes it one of the most attractive markets expected to be created after the introduction of NHPS. However, the administrative bottlenecks and lack of infrastructure (as compared with the other four states) may act as constraints for the market players in realizing the full potential.

Telangana, a newly formed state, offers excellent opportunities due to a reasonably large BPL population. The state has performed well on administrative reforms front, and it is expected to improve infrastructure (including electricity availability) in the future, to make it more attractive.

West Bengal has shown remarkable improvement in the field of administrative reforms (in cutting of the red tape), to make it one of the most attractive destinations for any industry. It has to focus more on further improvement in the infrastructure to make it a natural choice for the industry players to invest in the state.

In the end, the realization of the opportunities will depend on smooth as well as quick implementation of the scheme across India. At the outset, NHPS offers promising future for healthcare industry across the nation in general, and the five highlighted states in particular.

Ranking Methodology

-

EOS assessed attractiveness (in terms of opportunities for healthcare industry players) of all Indian states on the basis of a scorecard

-

States were ranked on selected parameters, i.e. size of the market and other factors (termed as ‘market enablers’) that are likely to influence decision-makers to prefer one state over another while planning to invest to tap the opportunities created post the launch of NHPS

-

Maximum score (awarded for first rank) for each parameter was fixed based on its relative importance (weightage); scores awarded for subsequent ranks (on each parameter) were a percentage (decreasing in accordance with the rank) of maximum score

-

The final score (and hence the overall rank) was the summation of individual scores on all parameters