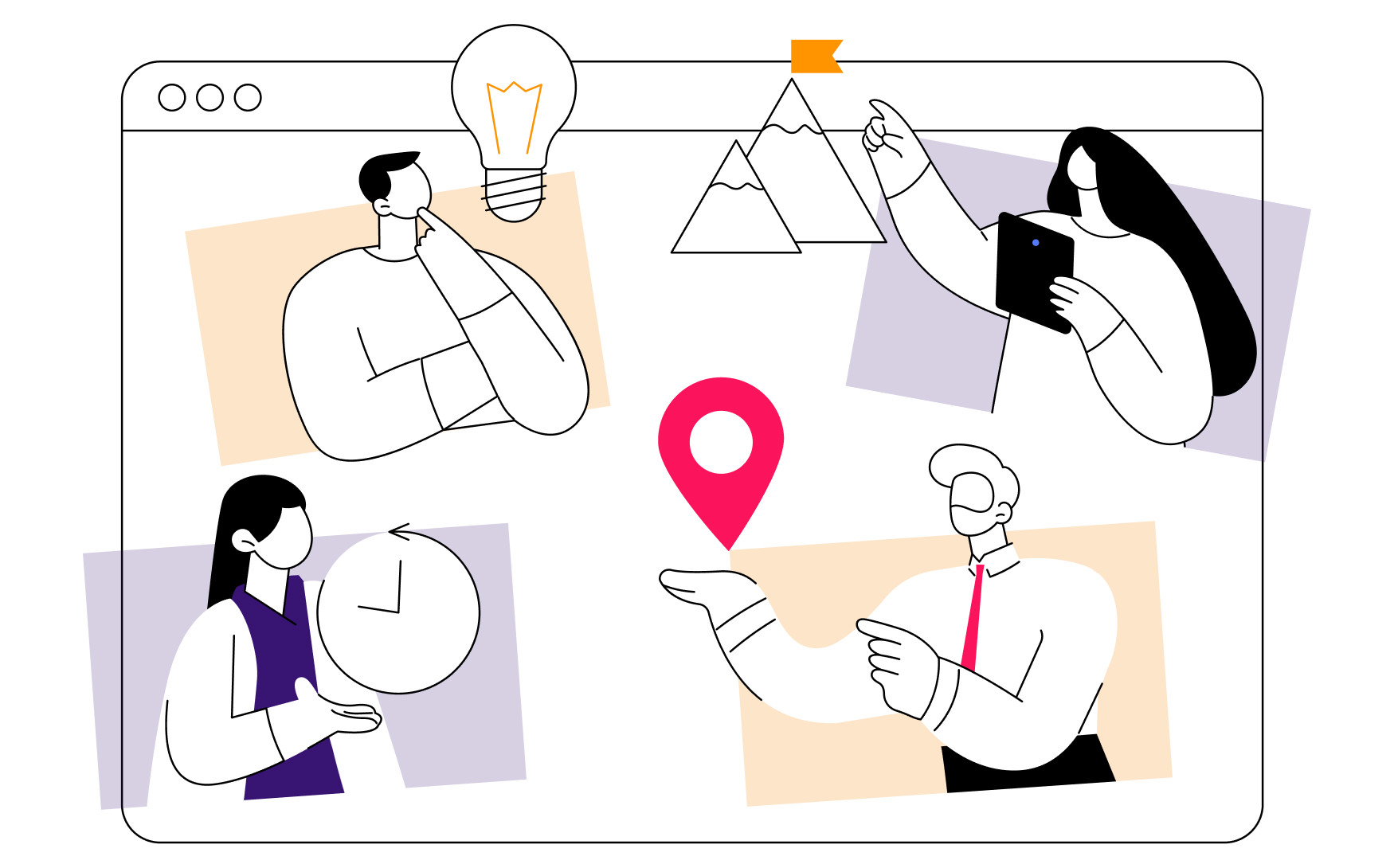

The transition to Electric Vehicles (EVs) is picking pace with concentrated efforts to achieve the net-zero carbon scenario by 2050. The International Energy Agency (IEA) estimated that global EV sales reached 6.6 million units in 2021, nearly doubling from the previous year. IEA projects that the number of EVs in use (across all road transport modes excluding two/three-wheelers) is expected to increase from 18 million vehicles in 2021 to 200 million vehicles by 2030, recording an average annual growth of over 30%. This scenario will result in a sixfold increase in the demand for lithium, a key material used in the manufacturing of EV batteries, by 2030. With increasing EV demand, the industry looks to navigate through the lithium supply disruptions.

Lithium supply shortages are not going away soon

The global EV market is already struggling with lithium supply constraints. Both lithium carbonate (Li2CO3) and lithium hydroxide (LiOH) are used for the production of EV batteries, but traditionally, lithium hydroxide is obtained from the processing of lithium carbonate, so the industry is more watchful of lithium carbonate production. BloombergNEF, a commodity market research provider, indicated that the production of lithium carbonate equivalent (LCE) was estimated to reach around 673,000 tons in 2022, while the demand was projected to exceed 676,000 tons LCE. In January 2023, a leading lithium producer, Albemarle, indicated that the global demand for LCE would expand to 1.8 million metric tons (MMt) (~1.98 million tons) by 2025 and 3.7 MMt (~4 million tons) by 2030. Meanwhile, the supply of LCE is expected to reach 2.9 MMt (~3.2 million tons) by 2030, creating a huge deficit.

There is a need to scale up lithium mining and processing. IEA indicates that about 50 new average-sized mines need to be built to fulfill the rising lithium demand. Lithium as a resource is not scarce; as per the US Geological Survey estimates, the global lithium reserves stand at about 22 million tons, enough to sustain the demand for EVs far in the future.

However, mining and refining the metal is time-consuming and does not keep up with the surging demand. According to IEA analysis, between 2010 and 2019, the lithium mines that started production took an average of 16.5 years to develop. Thus, lithium production is not likely to shoot up drastically in a short period of time.

Considering the challenges of increasing lithium production output, industry stakeholders across the EV value chain are racing to prepare for anticipated supply chain disruptions.

Automakers resort to vertical integration to tackle supply chain disruptions

At the COP26 climate meeting in November 2021, governments of 30 countries pledged to phase out the sales of petrol and diesel vehicles by 2040. Six automakers – Ford, General Motors, Mercedes-Benz, Jaguar Land Rover, Quantum Motors (a Bolivia-based automaker), and Volvo – joined the governments in this pledge. While Volkswagen and Honda did not officially sign the agreement, both companies announced that they are aiming to become 100% EV companies by 2040. Other leading automakers have also indicated EVs to be a significant part of their future product portfolio. Such commitment shows that EVs are indeed going to be the future of the automotive industry.

Automakers have resorted to vertical integration to gain better control over the EV supply chain – from batteries to raw materials supply, including lithium, to keep up with the market demand.

Building own battery manufacturing capabilities

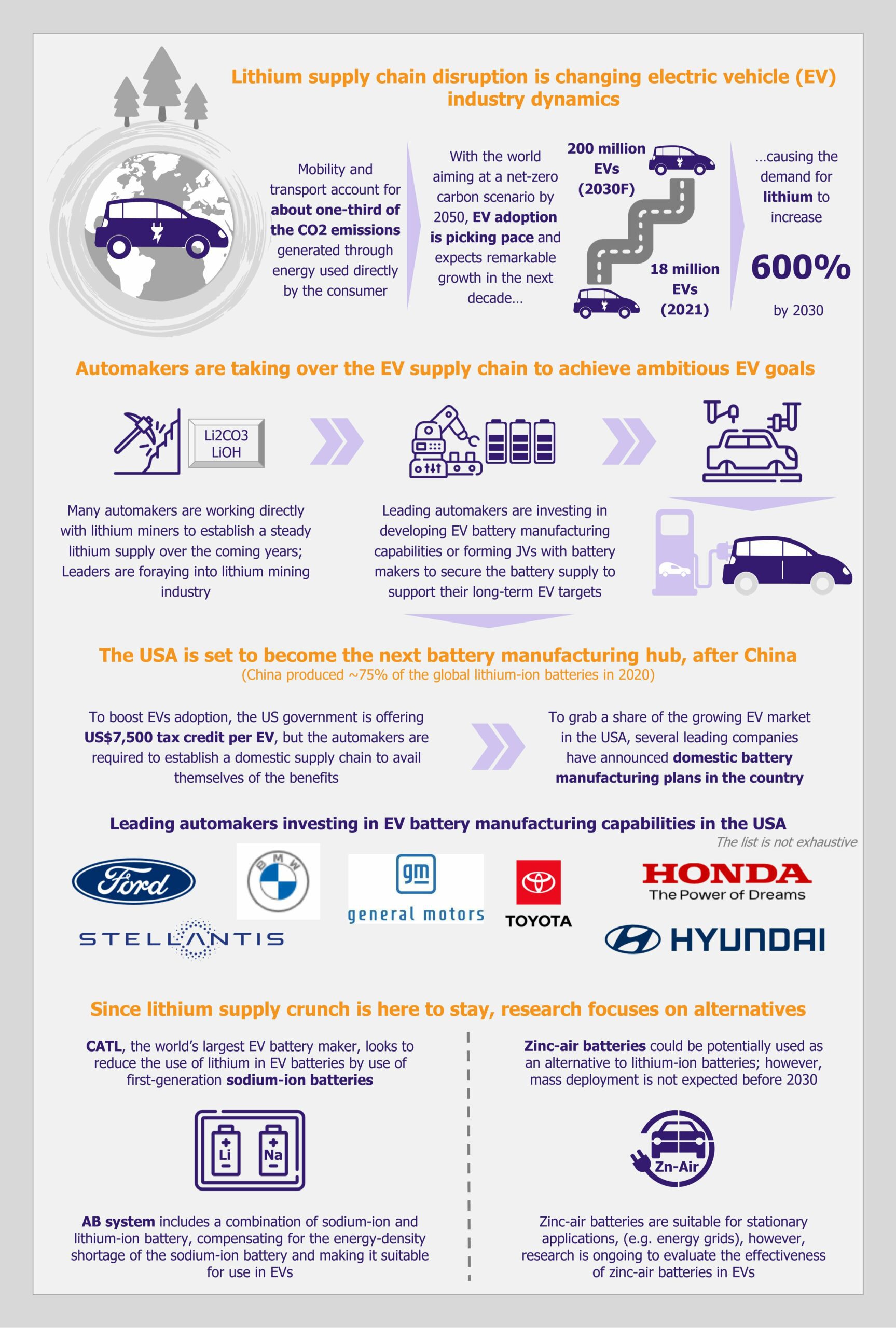

Till now, China has dominated the global battery market. The country produced three-fourths of the global lithium-ion batteries in 2020. At the forefront, automakers are looking to reduce their reliance on China for the supply of EV batteries. Moreover, many automakers have invested in building their own EV battery manufacturing capabilities.

While the USA contributed merely 8% to global EV battery production in 2020, it has now become the next hot destination for battery manufacturing. This is mainly because of the government’s vision to develop an indigenous EV battery supply chain to support their target of 50% of vehicle sales being electric by 2030. As per the Inflation Reduction Act passed in August 2022, the government would offer up to US$7,500 in tax credit for a new EV purchase.

However, half of this tax credit amount is linked to the condition that at least 50% of EV batteries must be manufactured or assembled in the USA, Canada, or Mexico. Taking effect at the beginning of 2023, the threshold will increase to 100% by 2029. To be eligible for the other half of the tax credit, at least 40% of the battery minerals must be sourced from the USA or the countries that have free trade agreements with the USA. The threshold will increase to 80% by 2027. In October 2022, the Biden Administration committed more than US$3 billion in investment to strengthen domestic battery production capabilities. While some automakers had already been planning EV battery production in the USA, after the recent announcements, the USA has the potential to become the next EV battery manufacturing hub.

BloombergNEF indicated that between 2009 and 2022, 882 battery manufacturing projects (with a total investment of US$108 billion) were started or announced in the USA, of which about 25% were rolled out in 2022.

In September 2021, Ford signed a joint venture deal with Korean battery manufacturer SK Innovation (BlueOvalSK) to build three battery manufacturing plants in the USA, investing a total of US$11.4 billion. Once operational, the combined output of the three factories will be 129 GWh, enough to power 1 million EVs.

In August 2022, Honda announced an investment of US$4.4 billion to build an EV battery plant in Ohio in partnership with Korean battery manufacturer LG Energy Solutions.

As of January 2023, GM, in partnership with LG Energy Solutions, announced the build of four new battery factories in the USA that are expected to have a total annual capacity of 140GWh.

Toyota, Hyundai, Stellantis, and BMW are a few other automakers who also announced plans to establish EV battery production facilities in the USA during 2022.

Automakers are also expanding battery manufacturing capabilities in the regions closer to their EV production base. For instance, Volkswagen is aiming to have six battery cell production plants operating in Europe by 2030 for a total of 240GWh a year.

In August 2022, Toyota announced plans to invest a total of US$5.6 billion to build EV battery plants in the USA as well as Japan, which will add 40 GWh to its global annual EV battery capacity.

Focusing on securing long-term lithium supply

While vertically integrating the battery manufacturing process, automakers are also directly contacting lithium miners to lock in the lithium supply to meet their EV production agenda.

Being foresightful, Toyota realized early on the need to invest in lithium supply and thus acquired a 15% share in an Australian lithium mining company Orocobre (rebranded as Allkem after its merger with Galaxy Resources in 2021) through its trading arm Toyota Tsusho in 2018. As a part of this agreement, Toyota invested a total of about US$187 million for the expansion of the Olaroz Lithium Facility in Argentina and became an exclusive sales agent for the lithium produced at this facility. In August 2022, a Toyota-Panasonic JV manufacturing EV batteries struck a deal with Ioneer (operating lithium mine in Nevada, USA), securing a supply of 4,000 tons of LCE annually for five years starting in 2025.

Since the beginning of 2022, Ford secured lithium supply from various parts of the world through deals with multiple mining companies. This included deals with Australia-based mining company Ioneer, working on the Rhyolite Ridge project in Nevada, USA, US-based Compass Minerals, working on extraction of LCE from Great Salt Lake in Utah, USA, Australia-based Lake Resources, operating a mining facility in Argentina, and Australia-based Liontown Resources operating Kathleen Valley project in Western Australia.

GM is also among the leading automakers that jumped on the bandwagon. In July 2021, the company announced a strategic investment to support a lithium mining company, Controlled Thermal Resources, to develop a lithium production site in California, USA (Hell’s Kitchen project). The first phase of production is planned to begin in 2024 with an estimated lithium hydroxide production of 20,000 tons per annum, and under the agreement, GM would have the first rights on this. In July 2022, GM announced a strategic partnership with Livent, a lithium mining and processing company. As part of this agreement, Livent would supply battery-grade lithium hydroxide to GM over a period of six years beginning in 2025. The automaker continues to invest in this direction; in January 2023, GM announced a US$650 million investment in the lithium producer Lithium Americas, developing one of the largest lithium mines in the USA, which is expected to begin operations in 2026. As a part of the deal, GM will get exclusive access to the first phase of lithium output, and the right to first offer on the production in the second phase.

Other automakers also invested heavily in partnerships with mining companies to secure a long-term supply of lithium in 2022. The partnership between Dutch automaker Stellantis and Australia-based Controlled Thermal Resources, Mercedes-Benz and Canada-based Rock Tech Lithium, and Chinese automaker Nio and Australia-based Greenwing Resources are a few other examples.

There are also frontrunners who are directly taking charge of the lithium mining and refining process. In June 2022, the Chinese EV giant BYD announced plans to purchase six lithium mines in Africa. If all deals fall in place as planned, BYD will have enough lithium to manufacture more than 27 million EVs. American Tesla recently indicated that it might consider buying a mining company. In August 2022, while applying for a tax break, Tesla confirmed its plan to build a lithium refinery plant in the USA.

This vertical integration is nothing new in this sector. In the early days of the auto industry, automakers owned much of the supply chain. For instance, Ford had its own mines and steel mill at one point. Do we see automakers going back to their roots?

Battery makers are also looking for alternatives

Some of the battery makers, especially the Chinese EV battery giants, are going upstream and expanding into lithium mining. For instance, in September 2021, Chinese battery maker Contemporary Amperex Technology (CATL) agreed to buy Canada’s Millennial Lithium for approximately US$297.3 million. Another Chinese battery maker, Sunwoda, announced in July 2022 that the company plans to buy the Laguna Caro lithium mining project in Argentina through one of its subsidiaries.

However, being aware that the lithium shortage is not going to be resolved overnight, battery makers are ramping up R&D to develop alternatives. In 2021, CATL introduced first-generation sodium-ion batteries having a high energy density of 160 watt-hours per kilogram (Wh/kg). This still does not match up to lithium-ion batteries that have an energy density of about 250 Wh/kg and thus allow longer driving range. Since sodium-ion batteries and lithium-ion batteries have similar working principles, CATL introduced an AB battery system that integrates both types of batteries. The company plans to set up the supply chain for sodium-ion batteries in 2023.

Zinc-air batteries, which are composed of a porous air cathode and a zinc metal anode, have been identified as another potential alternative to lithium-ion batteries. Zinc-air batteries have been proven to be suitable for use in stationary energy storage, mainly energy grids, but it is yet to be seen if they could be as effective in EVs. The application of zinc-air batteries in EVs – either standalone or in combination with lithium-ion batteries – is under development and far from market commercialization. A World Bank report released in 2020 indicated that mass deployment of zinc-air batteries is unlikely to happen before 2030.

EOS Perspective

Despite all the measures, the anticipated lithium shortages will be a setback for the transition to EV. One of the major factors will be the escalating costs of lithium, which will, in turn, impact the affordability of EVs.

Lithium prices have skyrocketed in the past two years on account of exploding EV demand and lithium supply constraints. The price per ton of LCE increased from US$5,000 in July 2020 to US$70,000 in July 2022.

One key reason driving the adoption of EVs has been the cost of EVs becoming comparable to the cost of conventional internal combustion engine vehicles because of the continually decreasing lithium battery prices. By the end of 2021, the average price of a lithium-ion EV battery had plunged to US$132 per kilowatt-hour (kWh), compared to US$1,200/kWh in 2010.

Experts project that EVs will become a mass market product when the cost of the lithium-ion battery reaches the milestone of US$100/kWh. Being so near to the milestone, the price of lithium-ion batteries is likely to take a reverse trend due to the lithium supply deficit and increase for the first time in more than a decade. As per BloombergNEF estimates, the average price of the lithium-ion battery rose to US$135/kWh in 2022. Another research firm, Benchmark Mineral Intelligence, estimated that the cost of lithium-ion batteries increased by 10% in 2022. This would have a direct impact on the cost of EVs, as batteries account for more than one-third of the cost of EV production.

Read our related Perspective: Chip Shortage Puts a Brake on Automotive Production

Automakers are still healing from the chip shortage. They are now faced with lithium supply constraints that are not expected to ease down for a few years. There is also a looming threat of a shortage of other minerals such as graphite, nickel, cobalt, etc., which are also critical for the production of EV components. While the world is determined and excited about the EV revolution, the transition is going to be challenging.