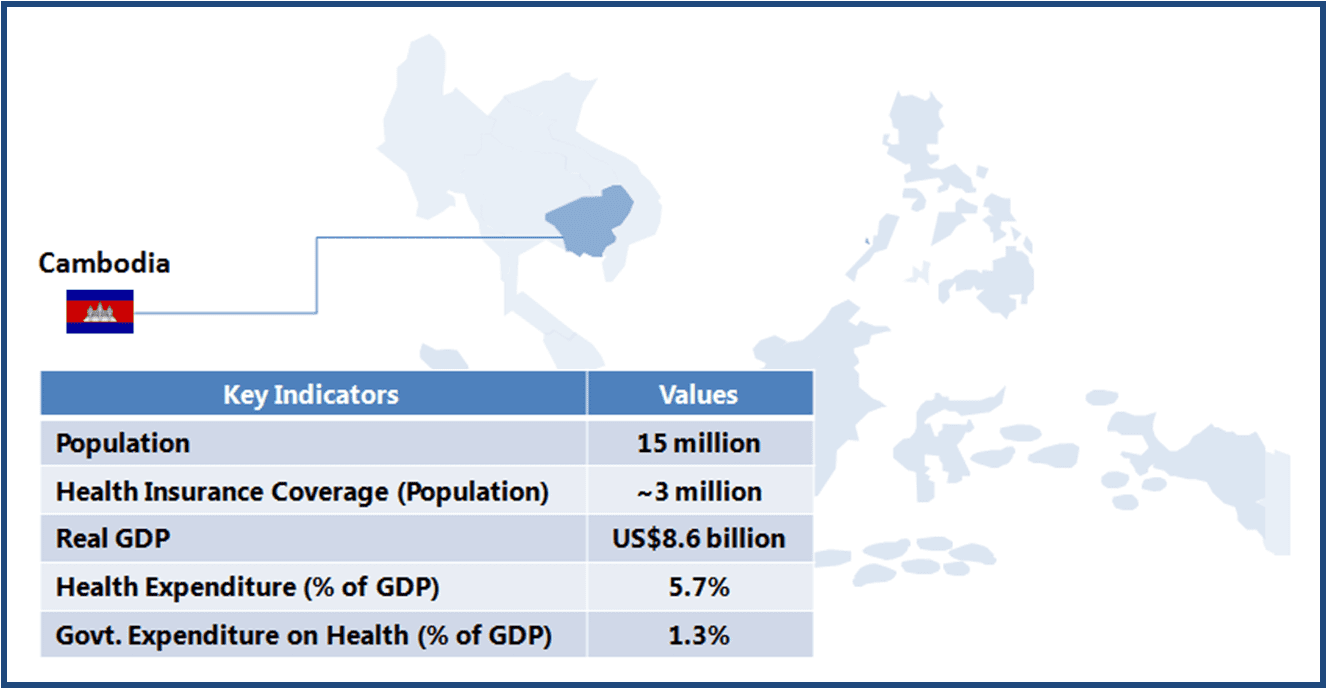

Cambodia is a low income country (GNI per capita US$880 as of 2012) with a population of about 15 million (67th most populous country as of 2012). Though the country has witnessed concentrated efforts towards better healthcare infrastructure and services since gaining independence in 1953, the major push came only in 1993 after the establishment of a dedicated Ministry of Health (MOH). The MOH has been consistently working to overcome major healthcare-related challenges, such as widespread malnutrition, high mortalities from communicable diseases, and low access to healthcare. MOH’s Health Sector Plan (HSP) (2008-2015) focuses on developing healthcare infrastructure and ensuring that healthcare services reach the entire population.

This article is part of a series focusing on universal healthcare plans across selected Southeast Asian countries. The series also includes a look into the plans in The Philippines, Cambodia, Vietnam, Indonesia, and Thailand.

Social Health Insurance (SHI) is still in early stages of implementation, and will take some years before it is firmly established. The SHI Master Plan was launched in 2003 with an aim to develop a stable financing system, and to promote equity in healthcare access. Currently, people from poorer sections of the society and informal sector are covered through Health Equity Funds (HEF) and Community-based Health Insurance (CBHI) Plans. The government plans to introduce a single health financing system by 2015.

About 2.5 million poor and more than 500,000 individuals from the informal sector are covered by HEF and CBHI plans, respectively.

When implemented fully, SHI is expected to provide healthcare protection to urban and rural poor (among others). The success of SHI would depend on the government’s ability in establishing healthcare infrastructure in places where it is currently unavailable, devising a suitable taxation/financing mechanism to support it, and in ensuring an optimum coverage of health conditions. The current design and support infrastructure would determine the long term success of SHI.

| INFRASTRUCTURE |

| Key Stakeholders |

|

| Healthcare Service Delivery |

|

| KEY CHALLENGES |

Lower Adoption of Public Healthcare Services

Less Efficient Procurement System

|

| DESIGN |

| Beneficiary Classification |

|

| Healthcare Insurance Financing |

|

| Payment System |

|

| Benefits |

|

| Co-payment (Reimbursement) System |

|

| Reimbursement System for Drugs |

|

| KEY CHALLENGES |

Lack of Funding Mechanism to Ensure Long-term Viability of SHI

|

Opportunities for Healthcare Companies

Healthcare Service Providers

-

Outsourcing healthcare services has proven to be an effective way to improve the performance of the healthcare system in Cambodia. Therefore, the outsourcing of services may continue in the future as well, providing opportunities to healthcare service providers

-

Experienced service contractors help in fulfilling the goals set-out in HSP (2008-2015, especially the Millennium Development Goals) where the country appears to be lagging

Medical Device Manufacturers

-

There is severe lack of medical devices, such as MRI, tomography scanners, mammography, etc. in public hospitals. SHI aims at providing such facilities, even if outsourced to private players

-

Increased in-patient coverage is likely to result in demand for devices such as patient monitoring equipment

Pharmaceuticals Companies

-

SHI implementation may not bring any additional benefits to pharmaceutical companies, as OPD drugs are not included as part of the benefits

-

Demand for in-patient drugs is likely to increase; the focus of pharmaceutical companies would remain on the inclusion of their drugs in the reimbursement list

A Final Word

The SHI system is still in early stages of development in Cambodia and the government needs to work on both infrastructure and design to ensure success of the scheme. SHI will be effective only if the people under coverage avail healthcare services through it, for which government healthcare services need to be at par with the private system. Provision of OPD services under SHI coverage will also help in greater adoption of the scheme.

Participation of the informal sector population is key to the success of the scheme from a financial perspective (ensuring adequate funds and lower reliance on foreign aid), and for meeting the key objective of ‘healthcare to all’.

From the perspective of healthcare industry participants, Cambodian healthcare service providers are likely to gain the most if the government expands services to a larger set of population (based on positive outcome from previous experiments). On one hand, lack of adequate equipment provides a strong opportunity for medical devices companies, while on the other hand, the expansion of in-patient services (as more people are covered by SHI) should provide an impetus to pharmaceuticals companies. For pharmaceuticals companies, the growth potential may not be fully realized unless OPD services are also covered under SHI.

———-

Notes:

- Health Equity Fund (HEF) are schemes to support vulnerable groups, supported by the Health Sector Support Program and funds from various development partners and the national budget

- Community-based Health Insurance is a voluntary, community-based and not-for-profit health insurance

- About 35% of the total population lives below the poverty line, earning US$0.45-0.60 per day