With the proposal of the deeply revamped new EU pharma legislation in April 2023, the EU initiated an attempt to tackle the medicine shortfall that the union has been experiencing for over two decades now. Europe has witnessed a 20-fold rise in reported drug shortfalls from 2000 to 2018, as per research conducted by the Mediterranean Institute of Investigative Reporting (MIIR).

According to the European Data Journalism Network (EDJNet), the problem of drug inadequacies is not novel, although it got under the spotlight during the 2020-2022 COVID-19 pandemic, the energy crisis that started in early 2022, and the beginning of the Russian invasion of Ukraine in early 2022. Ironically, the fundamental reasons responsible for the medicine shortages in the EU are not solely these three events but a mixture of structural, economic, and regulatory factors that the governments often refuse to agree on.

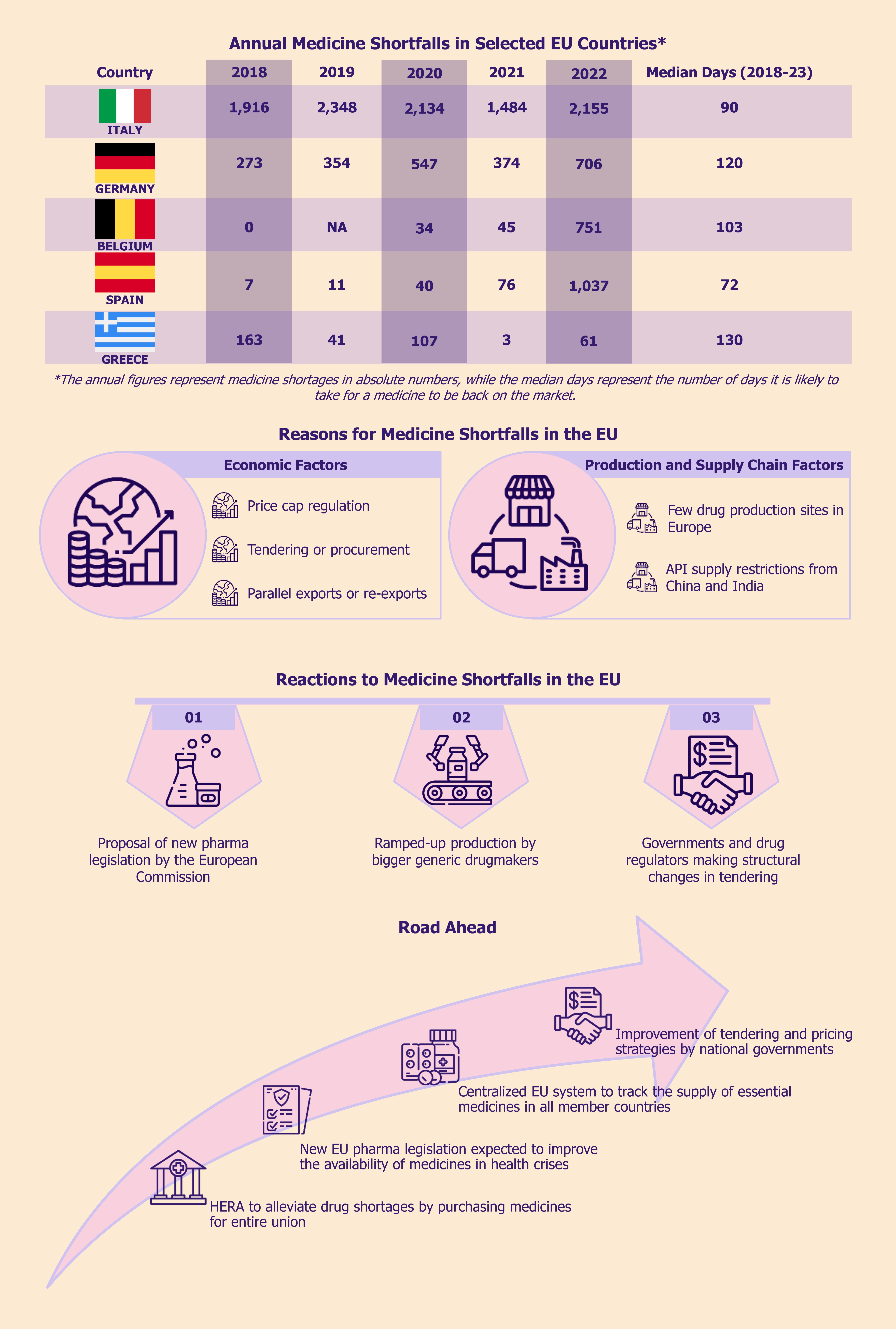

In terms of the magnitude of the shortage during the five-year period from January 2018 to March 2023, Italy experienced the highest inadequacy in absolute terms to the tune of 10,843 medicines, followed by Czechia with 2,699 medicines and Germany with 2,355 medicines. Although Greece witnessed the lowest shortage, with 389 medicines between 2018 and 2023, the median duration for which the shortfall existed was the longest for this country, with 130 days, followed by Germany with 120 days, and Belgium with 103 days. This means that, for instance, in Greece, it is likely to take about four months and eight days for a medicine to be back on the market.

According to a survey regarding medicine shortages in the EU members organized by the Pharmaceutical Group of European Union (PGEU) between mid-November and end-December 2022, all 29 EU countries surveyed recorded drug shortfalls during the past 12 months among community pharmacists (pharmacists in retail pharmacies where the general populations have access to medications). Moreover, around 76% of the respondents agreed that the situation had worsened compared to 2021, and the remaining 24% said the situation remained the same compared to 2021. Not a single country registered any improvement in the situation compared to 2021. Furthermore, the survey also revealed that 83% of the respondents concurred that cardiovascular drugs were in short supply during the last 12 months in community pharmacies, followed by medicines treating nervous system diseases and anti-infectives for systemic use, such as antibiotics (79% each). Owing to the sample size of this survey of 1 response per country covering 29 EU countries, the findings might not be accurate but are likely to illustrate the overall trends correctly.

The problem of medicine shortages is not just limited to EU countries, as the UK is also experiencing acute drug inadequacies, including HRT (hormone replacement therapy) medicines and antibiotics, among other medicines.

In December 2022, the European Medicines Agency (EMA) announced that most EU countries are confronted with drug shortages. The question that arises is what led to the medicine shortfall in the EU and how the EU members can attempt to combat the issue at hand.

Factors responsible for medicine shortages in the EU

The attributing factors to drug shortages in the EU are mainly a combination of economic, regulatory, and production or supply chain-related causes.

Economic factors

Price cap regulation on generics amidst rising costs hindering production

One of the key reasons for the drug shortfall of medicines, including antibiotics (such as Amoxicillin) in the EU is the fact that generic drug makers are not paid sufficiently for increased production of the medicine to cover the associated costs such as production, logistics, and regulatory compliance costs that are rising steeply.

To add to the woes of most European generic drug makers, the prices of the generics that the respective countries had set have remained unchanged for the past two decades, making the situation much worse.

Additionally, due to regulated prices of generic drugs, numerous European drug producers have shown a lack of interest in boosting their production capacity. This has become particularly relevant during the Russian invasion of Ukraine, which has caused a rise in energy costs. This cost increase affects the smooth functioning of factories that produce everything from aluminum for medicine bottle caps to cardboard for packaging medicines, indicating a rise in drug insufficiencies in the foreseeable future.

According to a Reuters report, six European generic drug industry groups and trade associations, as well as 13 European producers, revealed that many smaller drug makers are battling to be profitable and, therefore, are contemplating if producing antibiotics would be feasible, let alone expanding production capacity.

Government tenders indirectly force generic producers to cut production

Before inviting quotations or tenders, many European governments tend to weigh the generic drug prices with prices in other regional markets or prices of similar drugs in the home market to establish a reference price point that can be used in negotiating with producers. These governments give contracts to those producers who quote the lowest price, resulting in “further downward pressure on prices in subsequent tenders,” as per generic drug producers.

According to many European generic drug producers, the price cap regulation and the tender system of generics have spurred a ‘race to the bottom’. The European generic drug makers bear the brunt of Asian generic drug producers charging less for the same products. Consequently, some European firms were compelled to either decrease production or choose offshore production (of generics and APIs required to produce them) to low-cost locations such as India and China.

Parallel exports aggravate the shortages in low-price markets

Although some European countries have started prohibiting parallel exports (cross-border sale of medicines within the EU by sellers outside of the producer’s distribution system and without the producer’s permission) to other countries, this practice of buying drugs from low-price markets and selling them in high-price markets has resulted in the exhaustion of medicine supplies in low-price markets. This has been noticed in some EU countries such as Greece, Portugal, and Central and Eastern European member states where legislations have been put into effect that make the re-export of pharmaceuticals harder. For instance, drug shortages in Greece have been attributed to the re-export of imported medicines to regions where these medicines are sold at a higher price point than in Greece, as per a news report by the Turkish news agency, Anadolu Agency.

According to a report published by the Centers for European Policy Network in May 2021, the magnitude of parallel imports of medicines occurring in the European Economic Area (EEA) was to the tune of €5.7 billion in 2019. Furthermore, the share of parallel-imported pharmaceuticals varied considerably across European countries. To cite a few examples, Denmark’s share of parallel-imported pharmaceuticals was around 26.2% in 2018, while the corresponding figure for Austria was 1.9% in the same year. Similarly, in 2018, the share of parallel-imported medicines was around 12% in Sweden and 2% in Poland.

Production and supply chain factors

The current lack of a sufficient number of production facilities in European countries can increase the chances of drug shortfalls in the region at the time of any production problem. To illustrate this, the European Medicines Agency (EMA) cited that drug shortages in the EU are caused by production factors, raw material shortages, distribution issues, and high demand due to respiratory diseases and inadequate manufacturing capacities.

Furthermore, many pharma producers utilize the just-in-time concept of inventory management, which improves efficiency, reduces storage costs, and minimizes waste, thanks to producing goods as needed. Due to this, producers often face challenges such as the inability to adapt to changing demand volumes.

Moreover, owing to the innate reliance of drug producers on APIs, variations in the “supply, quality, and regulation” of APIs have affected medicine supplies, according to a report by the Economist Intelligence Unit. To cite an example, pharmacies in Italy have attributed the decline in the making of APIs in China to the shortfall of medicines in Italy, according to a report by Anatolia Agency, the leading Turkish news agency.

Reactions from various stakeholders in the EU pharma market

Starting from proposing a revision of the EU pharma legislation to banning parallel exports of medicines in some European countries, there are many reactions to drug shortages in the EU from various pharma market stakeholders.

New Pharma legislation in the EU by the European Commission

The proposal of the new pharma legislation in the EU by the European Commission in April 2023 came as a reaction to the acute medicine shortage in the region. It proposes measures for producers to provide early warnings of drug shortfalls and necessitates producers to keep reserve supplies in sufficient quantities for times of crisis, such as acute shortages.

Read our related Perspective: New EU Pharma Legislation: Is It a Win-win for All Stakeholders?

Price capping cannot facilitate sustainability

European lobby groups supporting generic medicine makers argue that price limits won’t be effective due to growing production and regulatory expenses. There was no system to review medicine prices and adjust them for inflation or when APIs became scarce in most European countries. Moreover, it is exceedingly complex to continue to keep medicines competitive after 10 years of their launch.

Ramped up production by bigger generic drug producers

The pricing framework in Europe is the primary concern of generic drug makers in the long term, not production costs. According to the global supply chain head of Sandoz, Novartis’s generic division, the current inflexible pricing framework prevents generic drug producers from adjusting prices for essential drugs according to changes in input costs.

To illustrate this, the price of 60ml of pediatric amoxicillin in 2003 in Spain was around €0.98 (US$1.05). In the following ten years, the only change that was made was to reduce the quantity of the medicine to 40ml of pediatric amoxicillin, still pricing it at €0.98 (US$1.05). However, no change has been made since 2013.

Some larger generic drug companies are ramping up the production of certain medicines, such as amoxicillin, that are in short supply. To cite a few examples, Sandoz is planning to add extra shifts in its factory in Austria to meet their increased production target of amoxicillin by a double-digit percentage in 2023 vis-à-vis 2022. Additionally, the company plans to start the operation of another expanded factory by 2024. Similarly, GSK also recruited a new workforce and increased shifts in its amoxicillin factories in the UK and France. However, for companies with smaller market shares, such as Teva, things are different as increasing production capacity is not a viable option for them as they are struggling to be profitable, and thus, there is no way they can ramp up production to bridge the market gap.

National governments and drug regulators making big changes

Some European governments are considering making legal changes to ease the current procurement system of medicines in their respective regions. Additionally, some European governments are also striving to ban the re-export of imported medicines. Germany’s government is set to contemplate making legal changes to its tender system for generic medicines in 2023, whereas the Spanish government is planning to review its pricing scheme for certain medicines, which might cause patients to pay a higher price for medicines, including amoxicillin, on a temporary basis. The Netherlands and Sweden have put in place a law that requires vendors to stock six weeks of reserve supplies to mitigate shortfalls.

Several European countries are taking initiatives to prohibit parallel exports or re-exports of imported medicines to preserve domestic medicine supplies. To cite an example, in November 2022, the medicines regulatory body in Greece expanded the list of drugs whose re-export to other countries is prohibited. Another example is Romania, which halted exports of certain antibiotics and pediatric analgesics for three months in January 2023. Also, in January 2023, Belgium issued an official order allowing the respective authorities to stop the export of medicines to other countries during crises such as shortages.

EOS Perspective

Tender or procurement and pricing strategies of medicines in the EU and the UK must be improved after in-depth analysis. This is the only way to improve production in the European region so that future shortages of drugs can be avoided, in addition to curbing heavy dependence on Asia for essential drugs.

Secondly, there needs to be a centralized EU system in place that is designed to track the supply of essential medicines in all member countries, allowing for the identification of early signs of upcoming risks or shortfalls.

The new pharma legislation in the EU is expected to help improve the availability of drugs in situations of health crises, including drug shortages. The EU could reduce medicine shortages across the region over time as it has awarded the EMA more responsibilities and established a new body called HERA that can purchase medicines for the entire union.