India, still a developing country, has achieved tremendous success as the world’s largest vaccine producer. This accomplishment leads to many lessons that India can offer to other low- to middle-income economies across the globe, such as Africa, looking to ramp up their vaccine industry. The African continent should capitalize on this opportunity and seek guidance from India, considering that India’s pharma and vaccine sectors are four to five decades ahead of the African continent.

How did it all begin for the Indian pharma and vaccine sectors?

The Indian pharma industry is more than a century old, with the first pharmaceutical company founded in 1901 and started operations in Calcutta. Till 1970, the Indian pharmaceutical industry comprised foreign players with very few local companies. However, driven by the purpose of the Swadeshi (meaning ‘of one’s own nation’) movement during the pre-independence era, some pharmaceutical manufacturing firms were founded in India. Established in 1935 in Bombay, Cipla was one such company, which is now a multinational pharmaceutical firm.

Apart from pharma companies, the presence of the Bombay-based Haffkine Institute (founded in 1899) and Coonoor-based Pasteur Institute of India (founded in 1907) solidified the country’s vaccine industry foundation. These institutes manufactured anti-plague, anti-rabies, smallpox, influenza, and cholera vaccines, among others. Nevertheless, the British colonial government in India withdrew the funds during World War II, which led to the subsidence of a few of these institutes.

The Indian pharma industry’s dynamics began to change, with recognition given to process patents instead of product patents. This created an opportunity for local pharma companies to reverse-engineer branded drugs’ formulations. It also allowed the creation of low-cost medicines since the producers did not have to pay royalties to original patent holders. It fueled the generics market growth in India, along with improving the capabilities of the manufacturers to produce high volume at low cost, thereby increasing the cost-effectiveness of the products. This was followed by the exit of foreign pharma players from the country with the removal of the Indian Patents and Design Act of 1911 and the implementation of the Government’s Patents Act of 1970.

This article is part of EOS' Perspectives series on vaccines landscape in Africa. Read our other Perspectives in the series: Vaccines in Africa: Pursuit of Reducing Over-Dependence on Imports Why Can India’s Vaccine Success Story Be a Sure Shot Template for Africa?

The structural change in the Indian pharma industry was evident from the drastic increase in the number of domestic companies from 2,000 in 1970 to 24,000 in 1995, leapfrogging 12-fold in a span of 25 years.

Additionally, driven by public sector investment and the central government’s prioritization of localized vaccine and drug production, India had over 19 public sector institutes and enterprises by 1971 that produced vaccines and generic drugs. These public sector institutes included Gurgaon-based Indian Drugs and Pharmaceuticals Limited and Pune-based Hindustan Antibiotics Limited.

Some pharma companies entered the export market owing to the 1991 liberalization of the Indian economy, the experience gained from producing cost-effective generic drugs, and global expansion. With this step, the Indian vaccine industry forayed into the international market between 1995 and 2005.

The reintroduction of the product patent system encouraged foreign pharma firms to return to India as the 2005 Patents (Amendment) Act prevented domestic pharma companies from reverse engineering formulations of branded medicines protected by patents to produce generic drugs.

In the pursuit of staying competitive with their foreign peers, Indian pharmaceutical companies focused on improving R&D thereby increasing investments in this space from 2005 to 2018.

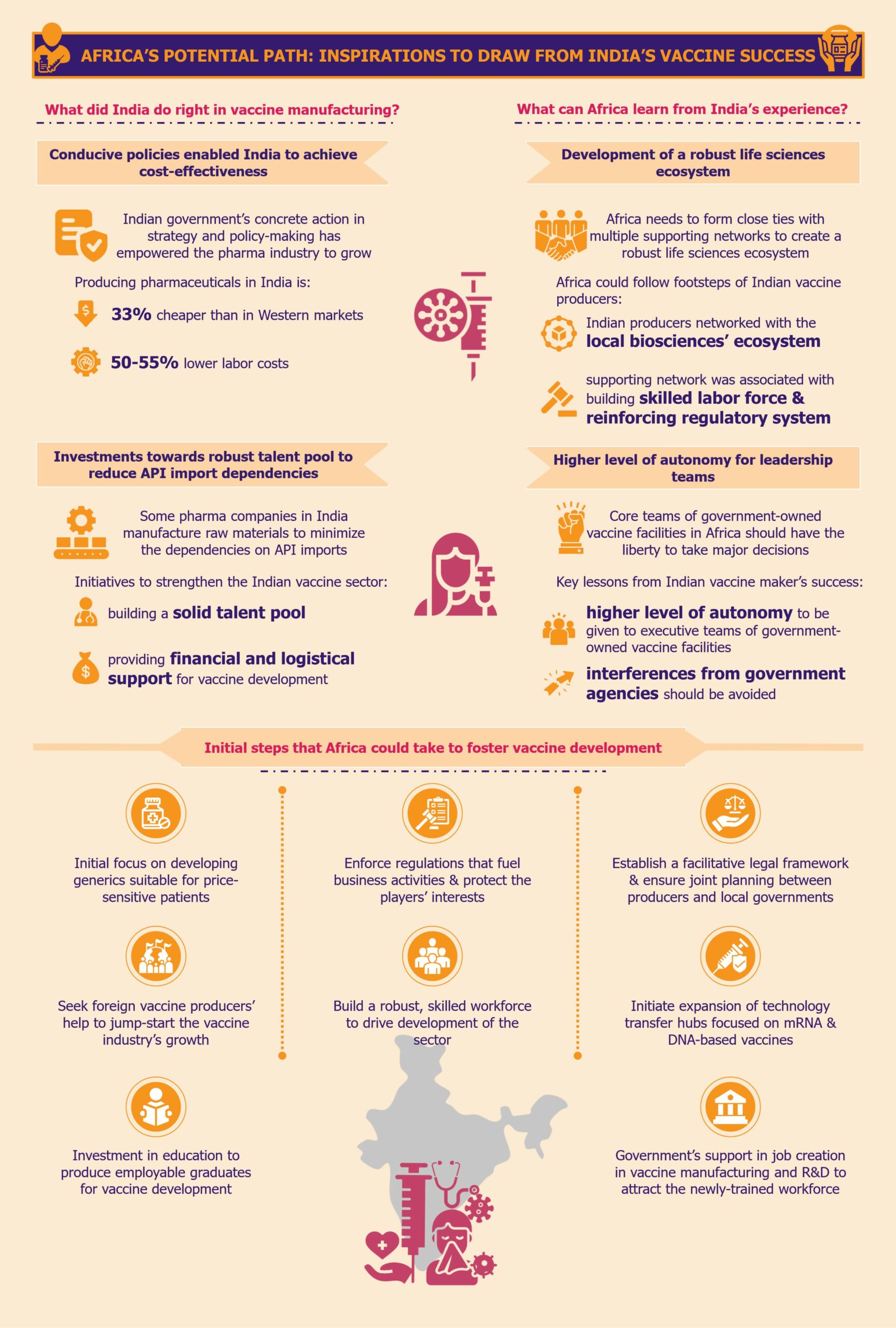

What did India do right in vaccine manufacturing?

From investing in education and R&D to making necessary policy changes conducive to the growth of a sustainable and resilient vaccine sector, the Indian government has always been at the forefront of reducing overall pharmaceutical costs and nurturing the pharma industry.

Experience, expertise, and conducive policies enabled India to achieve cost-effectiveness

Indian government’s concrete action in strategy and policy-making has empowered the pharma industry to grow in a conducive environment. These conditions enabled the sector to become cost-effective by producing low-cost generic medicines and vaccines at high volumes.

This is evident from the fact that Invest India, the country’s investment promotion agency, states that producing pharmaceuticals in India is 33% cheaper than in Western markets due to labor costs being 50-55% lower. The cost of conducting clinical trials in India is also much lower, approximately 40%-80% cheaper when compared to Western markets, according to a 2010 article by the International Journal of Pharmacy and Pharmaceutical Sciences.

Indian pharma firms sometimes reverse-engineer medicines produced by companies making branded drugs and sell the formulation at a much-reduced price. The unique selling proposition of the Indian pharma industry has always been high volume coupled with low costs to make its products more affordable and accessible to patients across low- to middle-income strata of society.

Investments towards a robust scientific workforce helped reduce API import dependencies

Backed by the central government’s prioritization of domestic vaccine and drug production, some pharma companies in India started manufacturing raw materials or key starting materials to minimize the dependencies on API imports.

Other initiatives to strengthen the foothold of the Indian vaccine sector were directed towards building a solid talent pool of professionals who could develop drugs and vaccines independently rather than copy the processes from branded medicines. A result of this approach was the Lucknow-based Central Drug Research Institute (CDRI), which was founded in 1951 and continues to be one of the leading scientific institutes in India.

With the creation of the Department of Biotechnology (DBT) in 1986, India took another massive step towards progressing its pharma industry. Since then, DBT has been at the forefront of providing financial and logistical support for vaccine development and production using new and advanced technologies. The organization is also involved in creating biotech training programs for universities and institutes across India.

What can Africa learn from India’s experience?

It would be too ambitious to anticipate Africa replicating the Indian vaccine sector’s strategies and mechanisms in every way and detail. Although the two regions share enough similarities regarding disease profiles, geographies, climates, economies, etc., differences in competition, technology, and market dynamics cannot be ignored.

These differences could benefit and challenge the vaccine sector in Africa. The region must prioritize the creation of a resilient, sustainable, and robust life sciences ecosystem that will support the pharma, medical technologies, and vaccine sectors in the long run.

Development of a strong life sciences ecosystem that nurtures the overall vaccine sector

Africa needs to form close ties with multiple supporting networks, similar to how the Indian vaccine producers networked with the local biosciences ecosystem. These supporting networks must be associated with the production of multiple pharmaceutical products for a region, building a strong scientific labor force alongside reinforcing its regulatory system.

Higher level of autonomy for the leadership teams of government-led vaccine facilities

One of the key learnings from the pitfalls of India’s vaccine sector is that the executive/leadership teams of government-owned vaccine facilities should receive a higher level of autonomy. Interferences from government agencies should be avoided to the maximum extent possible. A classic example from the Indian market is the 2020-2021 downfall of HLL Biotech Limited which could not produce any COVID-19 vaccine owing to government interferences in the technology upgrade and production-related decisions.

EOS Perspective

For the African vaccine development and production industry to embark on a path of growth, it is imperative to learn from the valuable lessons available. However, with limited financial resources and insufficient infrastructure, it is crucial to prioritize the actions taken to ensure maximum progress.

To start building a favorable environment, it might be beneficial for the African markets to develop policies emphasizing process patents more than product patents, at least in the initial few years. This could be akin to regulations in the Indian pharma sector of 1970-1995, which proved quite effective and could fuel the growth of the generics market in Africa. Creating such an environment would waive off patent protection of branded drug manufacturers initially so that the local pharma companies can produce medicines at a low cost without paying royalties for copying the drug formulations of the branded drugs. Therefore, Africa can focus on building their generics market first and utilize the profits from there to reinforce the vaccine industry.

Secondly, African governments should initiate expanding the number of technology transfer hubs across the continent that focus not only on mRNA-based vaccines but also on newer DNA-based vaccines that are more suited for the African climate. Partnerships and collaborations with research institutes that are already working towards this goal can be a good first step.

One crucial step, which should not be delayed, is building a robust, skilled workforce to drive the sector development. Unfortunately, most African countries’ current education curricula are not in sync with the continent’s needs for vaccine manufacturing. Therefore, Africa urgently needs investment in education from various sources to develop the backbone of the vaccine industry so that the new education system can produce employable graduates in this field. It is important to note that the African governments should take a significant portion of this responsibility.

To begin with, new graduates can be something other than tertiary-educated, highly specialized professionals, such as PhDs. Rather than that, some form of vocational training in vaccine manufacturing or bachelor’s programs in relevant subjects, such as pharmacy, chemistry, etc., would help produce sufficiently skilled labor. This manpower can work and train further on the job under the guidance and supervision of foreign high-level talent and local high-level scientists who are present in the continent relatively sparsely.

These vocational programs should be designed in a collaborative effort between educational institutions and the existing and new vaccine manufacturing facilities in Africa. This would increase the chances of the African manufacturing facilities absorbing the graduating trainees.

India’s education evolution demonstrates the significance of having domestically bred relevant talent to augment and strengthen its own pharma and vaccine sector. This can empower Africa to curb the costs associated with foreign talent hunting and be more resilient to situations such as staff shortages, foreign staff availability fluctuations, etc.

Moreover, it is the responsibility of African governments to support the creation of jobs in vaccine manufacturing and R&D to attract the newly-trained workforce. A proven approach to this is to offer incentives for employing local talent to foreign and domestic investors who intend to set up vaccine facilities in the region. The incentives could range from tax rebates, exemptions, or credits, to offering employee training grants, subsidies for insurance coverage, etc. If this can encourage the creation of jobs in the sectors, young Africans will likely be keen on enrolling in related vocational programs.

Looking at the long-term objectives for the continent’s vaccine industry path, Africa’s primary aim should be to meet its own domestic vaccine needs in terms of both volume and disease spectrum.

Africa can learn critical lessons from India’s strengths and weaknesses in the vaccine sector. The weight of kick-starting the industry development inevitably lies on the African governments’ shoulders, and the sector will not develop on its own. It is high time for stakeholders, such as state governments, regulatory bodies, institutes, pan-African organizations, and local pharma companies, to speed up the process of absorbing and implementing these lessons. It is the only way to achieve the goal of 60% domestic vaccine production by 2040.