1.7kviews

While Botswana has been an important player in the global precious stones industry for years, it has once again received global attention in November 2015, when the second-largest diamond ever unearthed was found in Botswana’s Karowe mine. Diamonds-derived revenues have been the key pillar to the country’s development over years, on the back of Botswana’s considerable deposits and well-performing global precious stones market. However, the outlook for Botswana might not be so bright anymore, as industry experts expect the global diamond production to decline after 2025 when majority of the mines are likely to be exhausted. Botswana, still one of the largest producers and exporters of diamonds, is already facing challenges in this industry. Being a diamond-dependent economy, will Botswana be able to maintain a sustained growth in the future as its shining precious gems industry weakens?

Diamond-fueled economic growth

Botswana, a small African country with a population of around two million people, has witnessed huge success since its independence in 1966. From being one of the poorest countries in the continent, Botswana has grown to be now considered one of the fastest developing countries in the world (with average annual GDP growth rate of 4.45% from 1995 until 2015). The success of the nation is largely attributed to the diamond deposits and the associated extraction industry. The discovery of the gems in 1967 led the way to the country becoming the poster child of the continent’s success. As of 2015, the diamond industry contributed 80% to the country’s export revenues and 30% to public revenues. In 2013, it accounted for around 25% of the country’s GDP. The success of the industry paved the way for the development of several roads, schools, and clinics in the country. Gaborone, the capital of Botswana, has transformed from a village to a city of malls and office buildings, all largely thanks to the diamond industry. Further, the sector has created job opportunities in the country and greatly contributed to raising standard of living of the country’s citizens.

“For our people, every diamond purchase represents food on the table, better living conditions, better healthcare, potable and safe drinking water, more roads to connect our remote communities, and much.” – Festus Mogae, Botswana’s President, 2006

As of 2014, Botswana was the largest producer of diamonds in terms of value and the second largest, after Russia, in terms of volume. The country’s production increased from 17.73 million carats in 2009 to 24.67 million carats in 2014. This represented a hike of almost 40% in the span of only five years.

Diamond mining operations in Botswana are controlled by Debswana Diamond Company, a joint venture between De Beers, world’s leading diamond company engaged in exploration, mining, and marketing of rough diamonds, and the Botswana government.

In the past years, the government has undertaken various initiatives to make the country a global diamond hub. In 2013, Dee Beers and the Botswana government formed the Diamond Trading Company Botswana (DTCB) to encourage the practice of sorting and marketing rough diamonds in the country itself, rather than sending them to De Beer’s Diamond Company based in London. This move facilitated job creation and upliftment of the local businesses in Botswana. Further, a state-owned company called Okavango Diamond Company was set up in order to sell 15% of the diamond production of Debswana independent of De Beers.

Grim future for Botswana

Despite being amongst the leaders in the global diamond industry, a grim future lies ahead for Botswana, driven by a range of reasons.

-

A weakened global demand: The global jewellery industry has been observing a sluggish demand, which has led to the global prices of diamonds witnessing a 12% decline from 2010 until 2015. To compensate for the stagnant sales, Botswana had been relying on opulent Chinese and Indian customers. However, the strengthening of the dollar and the decreasing price attractiveness of Chinese exports have weakened the Chinese economy. This was followed by a 2% devaluation of the Chinese currency, Yuan, which in turn has adversely affected the spending and demand for Botswana diamond by Chinese consumers.

-

Difficulty in diamond extraction: Botswana mines have reached a plateau as most of the diamond volume has already been extracted from the surface. Deeper extraction has now become a costly and time-consuming affair, showing an early sign that diamonds are likely to gradually become inaccessible in the country.

-

Competition from India: It is becoming increasingly difficult for Botswana to compete with a low-cost country such as India where majority of diamond cutting takes place. Although the wages in both countries are almost the same, India has levelled up its game by increasing its productivity by two to three times higher than that of Botswana’s. The cutting and polishing costs in 2013 ranged between US$ 60 and US$ 120 per carat in Botswana, whereas, in India it was between US$ 10 and US$ 50 per carat.

The above challenges have had an adverse impact on the country’s economy, particularly the employment sector. Teemane Manufacturing Company, a 20 year old diamond cutting and polishing firm in Botswana, shut down in January, 2015, leaving around 350 workers jobless. In the same period, MotiGanz and Leo Schachter, diamond cutting companies, also released almost 150 employees, and Debswana shut down two of its mines. These companies are offering retrenchment packages to their employees and ending their contracts with third parties which is likely to be affecting over 10 thousand jobs in the country. Shutting down of companies has also led to a decline in the various CSR programmes. The villages near the mines will no longer benefit from initiatives such as electrification of schools and development of roads.

The weakening demand also meant that early this year, De Beers failed to dispose off 30% of its diamonds stock. The company had to reduce its 2015 production target from 23 million carats to 20 million carats. And the impact of the sluggish demand goes beyond the industry as well. In the first half of 2015, the country witnessed a year-on-year decline of 16.8% in the export of rough diamonds. Further, since the production of diamonds is a critical element in Botswana’s GDP composition, a fall in the diamond output has reduced the country’s GDP growth forecast for 2015 from 4.9% to a mere 2.6%. Botswana’s government has decided to use its foreign reserves amounting to around US$ 8.3 billion to fuel growth in the country.

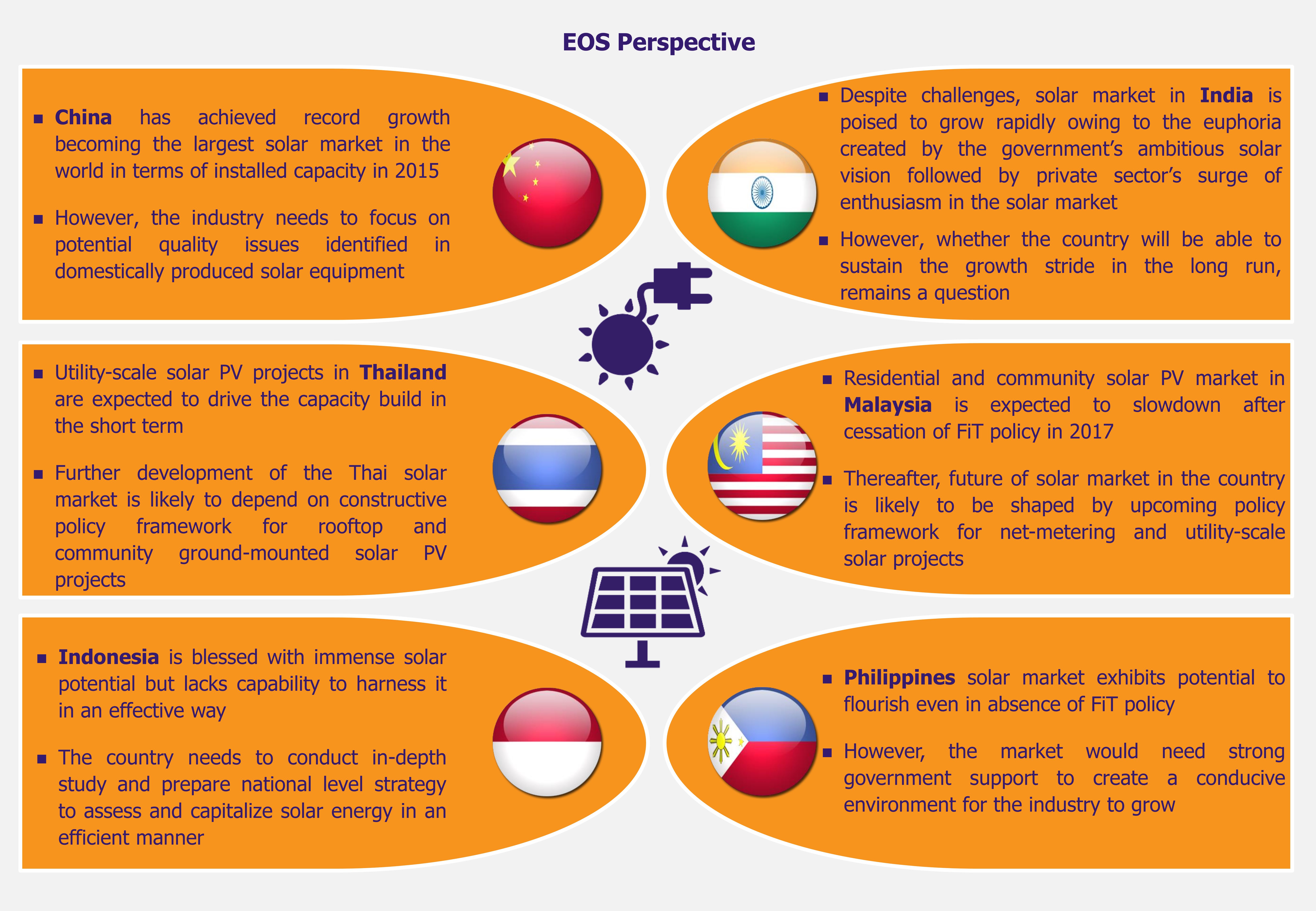

EOS Perspective

The Botswana economy has relied heavily on its diamond industry for survival for a long time. Since the revenues from diamonds are now becoming uncertain, the country is in a dilemma of how to keep its economy moving. Encouraging economic diversification could be one of the ways to help the country reduce its dependency on diamonds. Apart from diamonds, Botswana also produces other minerals such as coal, copper, iron ore, and nickel. The country should focus on developing a suitable industrial policy to promote the production and export of these minerals. However, whatever the alternative growth-fuelling path is chosen by Botswana, the country has a long way to go in order to shift away from over-dependence on diamonds, its largest structural weakness, to make its economy sparkle even when diamonds run out.