7.1kviews

With more than 25,000 outlets operating in 75 countries, Starbucks is rightly said to be the premier retailer of specialty coffee globally. With the mission to “establish Starbucks as the premier purveyor of the finest coffee in the world”, the brand continues to rapidly expand its retail operations by opening stores in new markets, particularly with focus on Asian countries. Starbucks has already captured a solid customer base in China and Japan, and it is aiming to expand in other parts of the region, especially in India. While partnerships with local players have been beneficial to the company’s expansion strategy, Starbucks uses an interesting mix of product localization ideas to suit consumer preferences and local tastes to make a mark in the land dominated by tea drinkers.

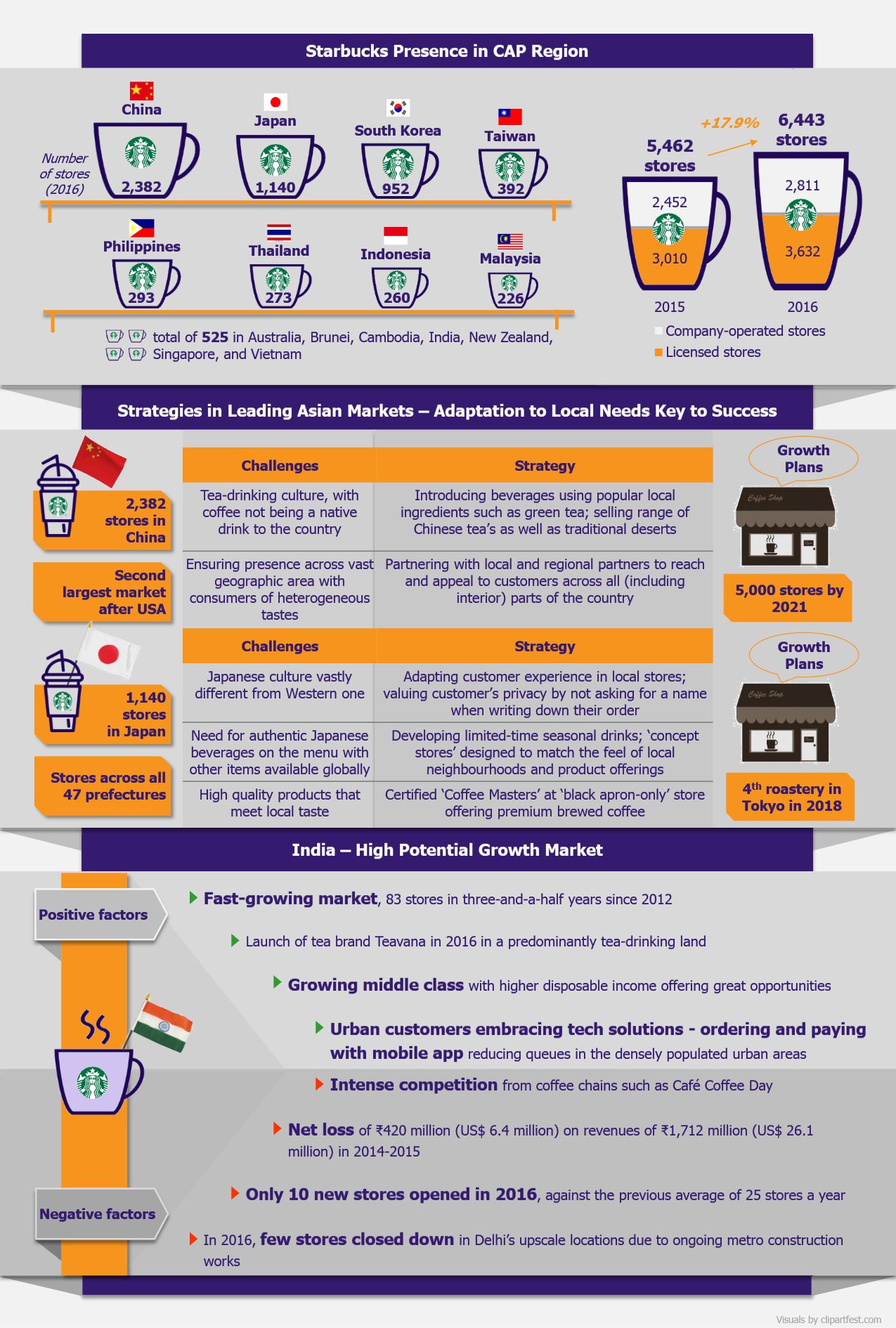

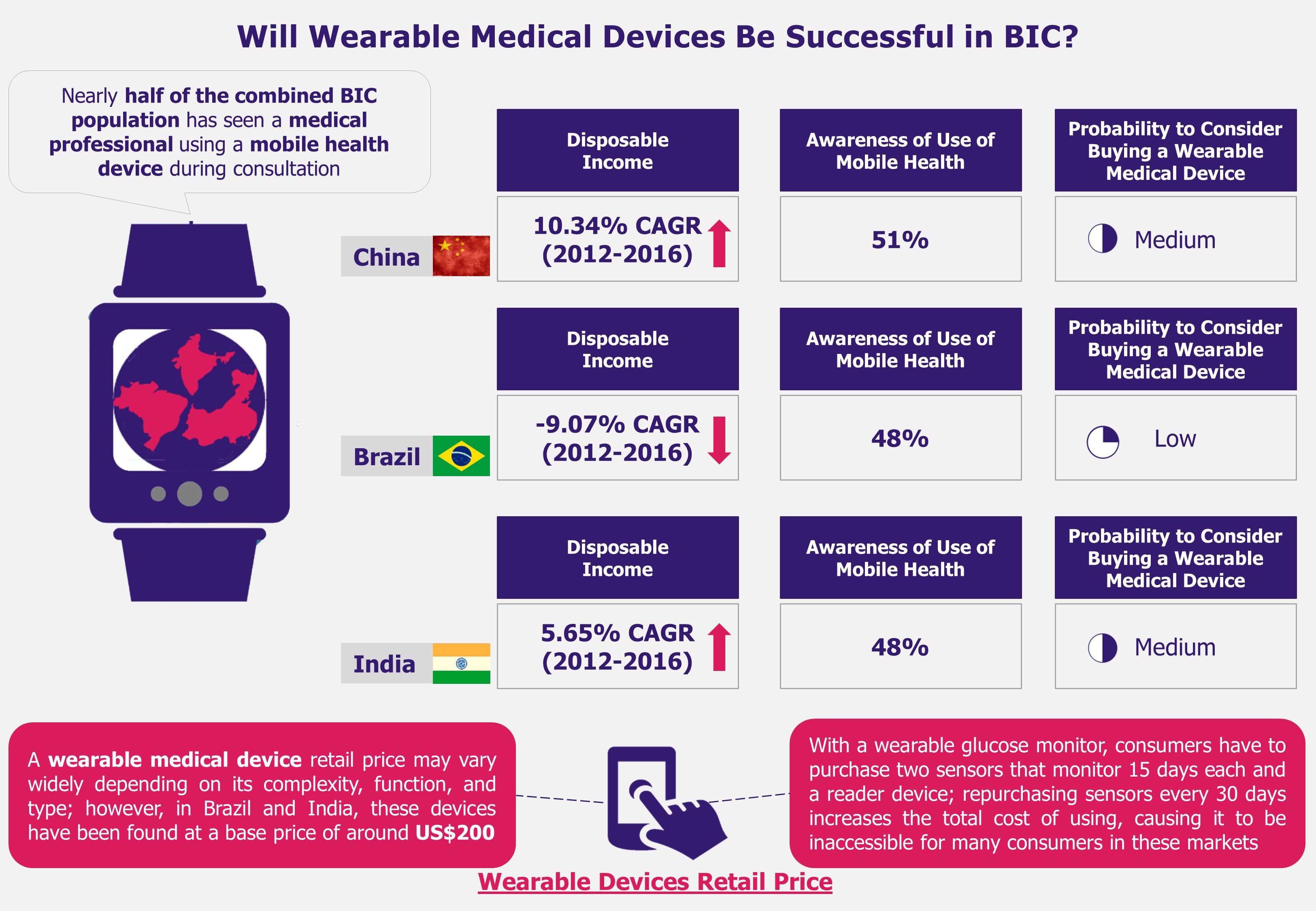

With plans to open 12,000 new outlets globally over a span of five years, out of which nearly half are to be opened in the USA and China, Starbucks is planning to take its chain to a total of about 37,000 outlets globally. Asia is increasingly important to Starbucks’ growth strategy. As of 2016, the company operated 6,443 stores in 15 countries in the China/Asia Pacific (CAP) region that includes Australia, Brunei, Cambodia, China, India, Indonesia, Japan, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Potential for growth in this region is great, not only measured in the number of stores, but also in per store revenue – the CAP region currently accounts for 25.7% of Starbucks stores count, but generates around 14% of the company’s revenue.

Starbucks – Expanding in Asia by EOS Intelligence

Starbucks follows a two-pronged approach to grow its business in the Asian markets (and other emerging regions). The first tactic of approaching these markets is to partner with regional players to have an easy access. For instance, the coffee maker entered the Japanese market in 1995 with a 50-50 joint venture with Sazaby League, a major Japanese retailer and restaurateur, and in 2014, Starbucks took over the full ownership of its Japanese operations. Similarly, the first Starbucks coffee store that opened in India in October 2012 was in alliance with Tata Global Beverages, Indian non-alcoholic beverages company and a subsidiary of Tata Group. These partnerships allowed to company to get a strong entrance to the local markets, navigate through diverse market environments, and to fulfill regulatory requirements imposed on foreign investors by local governments (which otherwise would leave Starbucks unable to tap these high-potential markets).

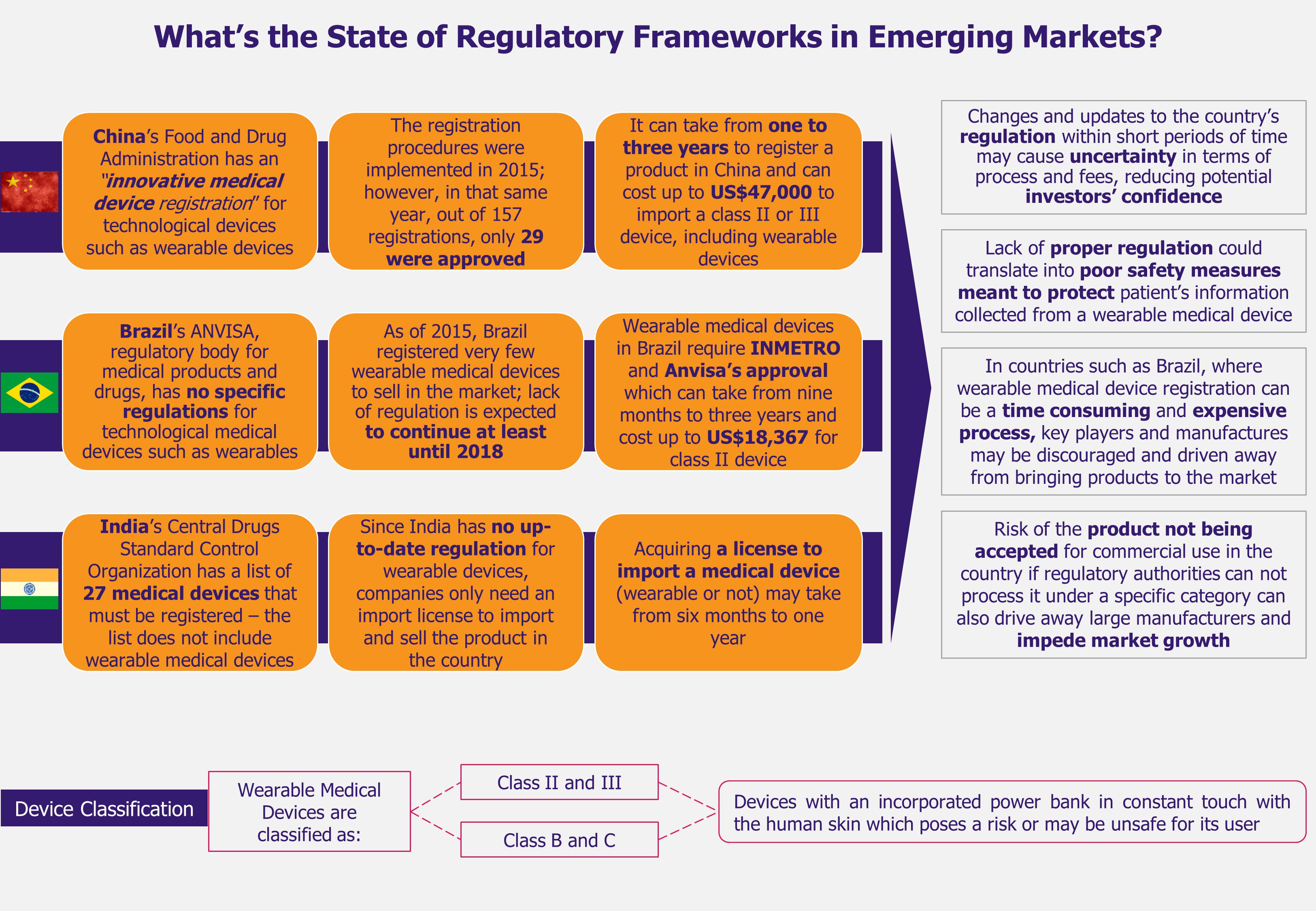

The second tactic that Starbucks has successfully implemented in most Asian markets was to tweak its menu to suit the tastes of the local population. Considering that since its inception, Starbucks has been synonym for coffee, adjusting the menus to suit tea-drinking consumer tastes without diluting the brand has surely been challenging. Although the Asian tastes evolve and more consumers start to drink coffee, basing the menu on coffee beverages alone would be a risky move. One of the moves Starbucks did to accommodate the local preferences was the 2016 launch of ‘Teavana’ line of tea beverages for Asian countries that includes matcha and espresso fusion, black tea with ruby grapefruit and honey, and iced shaken green tea with aloe and prickly pear, flavors not typically found in the company’s western stores.

Starbucks’ strategy in the region seems to be paying off. As of December 2016, in China, Starbucks store was said to be opened every 15 hours, making it the company’s fastest growing market, the highest revenue generator in the region, as well as the second largest market globally in terms of stores count. Overcoming challenges of reaching out to consumers with heterogeneous tastes in this vast country, partnering with local players, and creating a menu that suits the taste buds of local consumers have been a game changer for the coffee brewer in mainland China.

Japan is another key market for Starbucks in Asia. The company was able to successfully tackle the Japanese market, as it chose to focus on providing excellent customer experience to better resonate with Japanese culture that emphasizes traditional etiquettes and personal respect. Starbucks outlets in Japan do not ask for the customer name while placing order as privacy is highly valued in Japanese culture. To fit in the local culture, Starbucks in Japan has come up with the ‘concept stores’ that offer products based on local needs. Starbucks has the one of a kind ‘black apron-only’ store boosting of certified coffee experts in Japan.

India, a relatively new addition to the company’s Asian portfolio of markets, might turn to be a problem child for Starbucks. Since entering the Indian market, the company has been trying to take full advantage of the opportunities lying in the increasing income of the middle class population in India. Having opened more than 80 outlets in less than four years since inception, Starbucks in India (known as Tata Starbucks Private Limited) seems to be on an extension route in the Indian subcontinent. But with retail figures saying the opposite, with only 10 new stores in 2016 up against average of 25 stores in last three years and a few closed over infrastructure mishandling, the picture does not look very positive. India’s devotion to tea is a hard nut to crack for Starbucks, and while the company followed its standard move to include tea beverages in local stores, they do not always suit local tastes, as they differ greatly from chai that majority of Indians are used to and love. The scenario in south India might seem more favorable, as the locals have been accustomed to drinking coffee since long before Starbucks came to the country. But the local preference if for traditional filtered coffee, very different from anything on Starbucks’ menu, and bulk of it is consumed at home. With not much being said about the opening of new stores in the near future in any regions of the country, Starbucks in India needs to realign its strategic move to be able to see persistent growth.

EOS Perspective

While many enterprises fail to understand the impact of consumer behavior and preferences over the success or failure of a business, Starbucks offers a finely tailored customer experience to its consumers. For the most part, the company has managed to combine its exciting American flair with the underlying values of the Asian cultures to create a localized, unique experience.

With continuous and consistent expansion of its store base by adding stores to higher growth markets, Starbucks aims at standing as one of the most recognized coffee brands in China and Japan, and increasingly in other CAP countries. In those regional markets, where Starbucks has achieved the greatest success, China and Japan, the company’s efforts to offer consumers new coffee (and non-coffee) flavors in a variety of forms, across new categories have led to Starbucks’ continuous strong performance, and over time translated to acceptability of the American coffee-brewer in the lands of tea drinkers.

However, the coffee brand’s take off in India has been bumpy. The company has less than 100 stores in India, incomparably fewer than its competitor, Café Coffee Day, which has more than 1,500 outlets across the country. In terms of geographic spread in India, Starbucks has till now only concentrated on opening its stores in the largest metro cities, where to some extend it could justify its products’ high pricing (for local market standards). But in order to be successful, the chain needs to reach consumers in tier 2 and tier 3 cities, and appeal to them with more affordable products by marginally compromising on product prices (yet still remaining elitist, as it stands no chance to appeal to the clientele of traditional tea-corner stands which offer a cup of hot tea or coffee for virtually a fraction of Starbucks products price). If the company ensures expansion beyond tier 1 cities, continues to launch new stores offering localized products, it should be able to reap benefits of the rising income of the fast-expanding middle class largely interested in the foreign-feel-like experience and social statement that visiting Starbucks offers them along with their tall Frappuccino.