As of 2023, 5,279 electric heavy-duty trucks (HDTs) were on the roads in Europe, representing merely 1.5% of total HDTs in the region. Despite being in its early stages, the adoption of electric HDTs is expected to accelerate due to a combination of factors, including increasing regulatory support and advancements in charging infrastructure. As these factors converge, the electrification of HDTs is set to gain momentum, contributing to the decarbonization of the transportation sector and the achievement of EU climate goals.

Ambitious EU regulations toward a zero-emission future promote electric HDTs adoption

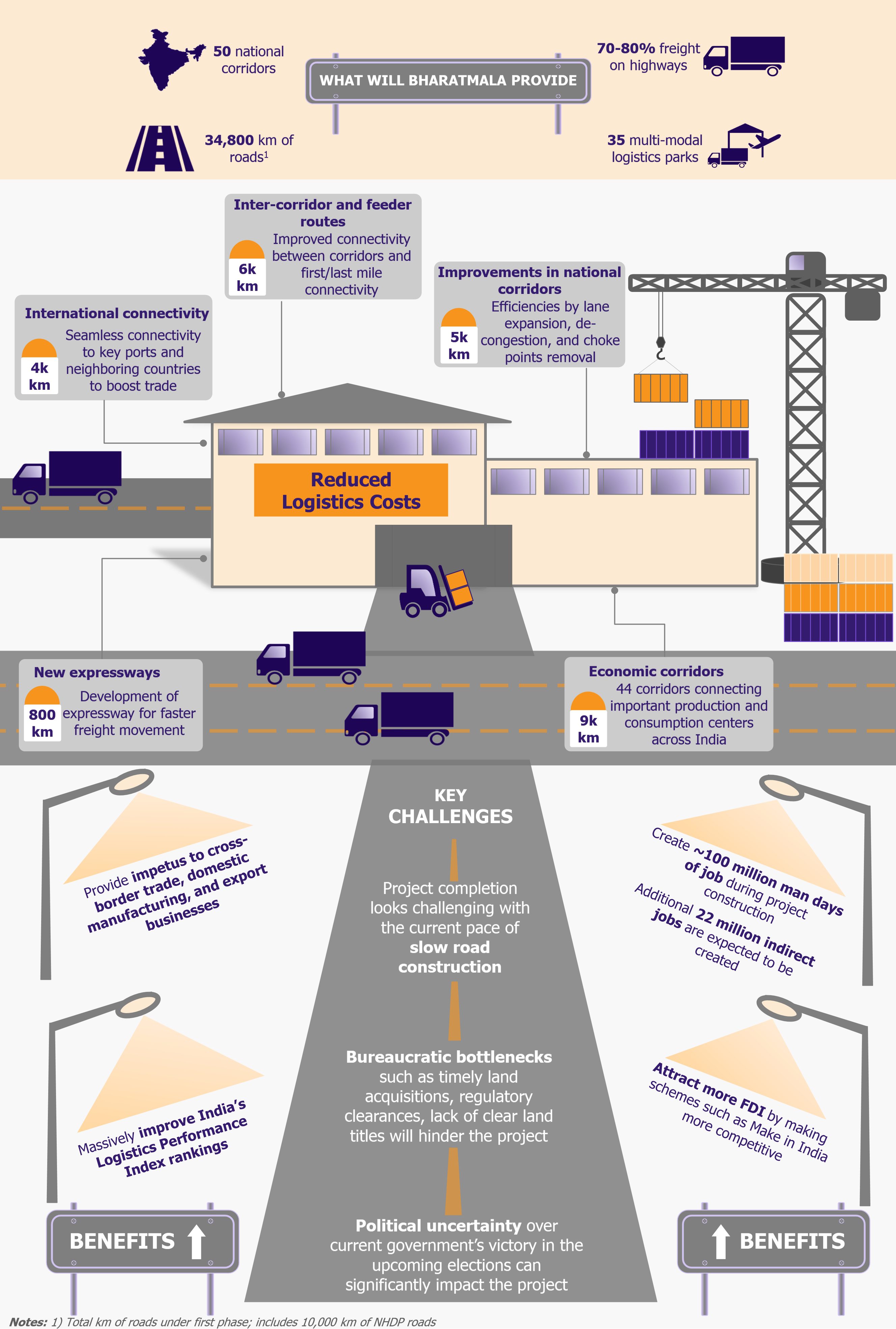

The EU aims to reduce CO2 emissions from heavy-duty vehicles by 45% in 2030, 65% in 2035, and 90% by 2040 compared to 2019 levels. The European Automobile Manufacturers’ Association (ACEA) suggested that more than 400,000 zero-emission trucks will have to be on the roads by 2030 to achieve a 45% CO2 reduction. There is a considerable gap to fill, considering only a few thousand electric HDTs were on the roads in 2023.

Additionally, to combat high pollution levels, specifically in urban areas, several European cities have implemented low-emission zones (LEZs) that restrict the entry of high-emission vehicles such as diesel trucks. As of June 2022, there were over 320 LEZs, about 40% more than in 2019. The number is set to increase to 507 by 2025. Obligations towards these regulations compel the European trucking industry to switch to electric HDTs.

Decreasing the cost gap between diesel and electric HDTs is likely to boost the adoption

The commercial vehicle market is price-sensitive, and hence, economic viability is essential for a smooth transition of HDTs from diesel to electric.

According to a study published in November 2023 by the International Council on Clean Transportation (ICCT), an independent environmental research organization, long-haul HDTs with an average daily travel range of 500 km powered by diesel were found to be cheaper. They had about a 5% lower total cost of ownership (TCO) compared to electric HDTs in 2023. However, the TCO difference between electric and diesel HDTs with an average daily travel range of 1,000 km was 10%. The TCO encompasses direct and indirect expenses, including acquisition, fuel or energy, maintenance and repairs, insurance, depreciation, financing, taxation, and operating costs.

ICCT estimated that for long-haul HDTs (both 500 km and 1,000 km range), electric battery-powered HDTs will reach parity with diesel between 2025 and 2026. Comparable long-term economic performance with diesel HDTs makes a favorable case for switching to electric HDTs.

However, the high retail price of electric HDTs remains a challenge, especially for small and medium fleet operators. ICCT indicated that in 2023, the retail price of a diesel HDT (500 km range) was EUR 152,000, while the cost of an electric HDT was more than double, EUR 354,000. The difference was even higher for HDT (1,000 km range), where the electric model was available for EUR 457,000, about 260% more expensive than the diesel model.

Acknowledging high upfront costs as one of the key barriers to the uptake of electric HDTs, as of 2022, 16 European countries, including the UK, were offering purchase incentives to the buyer to purchase zero-emission trucks such as electric HDTs to cover the price differential. Austria, France, Germany, Spain, Ireland, the Netherlands, Malta, and Denmark offered financial aid bridging 60% to 80% of the retail price gap, making a lucrative proposition for fleet operators to switch to electric HDTs.

In the countries not offering adequate financial support to cover the upfront costs, the adoption is likely to be moderate till the retail price of electric HDTs comes down. According to Goldman Sachs, battery pack prices are expected to fall by an average of 11% per year from 2023 to 2030, and about half of this price decline will be driven by the reduction in lithium, nickel, and cobalt prices. In the wake of rising demand for electric vehicles, the supply of these raw materials has been increasing, pushing the costs down. According to CME Group, a US-based financial services company, cobalt prices have dropped by more than 50%, from US$40 in 2022 to US$16.5 per pound in 2023, while lithium hydroxide prices have dropped nearly 75%, from US$85 to US$23 per kg during the same period.

Declining raw material costs will significantly lower production costs for electric HDTs, as battery packs account for a significant portion of the total production cost. As per BCG analysis, battery costs accounted for 64% of the total electric HDT production cost in Europe in 2022. This reduction will enable manufacturers to offer electric HDTs at more competitive prices.

At the same time, experts predict there might be a lithium supply deficit by the 2030s. This is likely to lead to pressure for increased production, as Benchmark Mineral Intelligence estimates a 300,000 tLCE deficit by 2030. Such a deficit can be expected to drive the raw material price up, negatively impacting the lithium-ion battery prices.

Read our related Perspective:

Lithium Discovery in Iran: A Geopolitical Tool to Enhance Economic Prospects?

Robust charging infrastructure is necessary for the adoption of electric HDTs

The widespread adoption of electric HDTs hinges on the availability of adequate charging infrastructure, and the industry stakeholders have already been investing in this direction.

In July 2022, Daimler Truck, the TRATON Group, and the Volvo Group formed a joint venture company, Milence, with an initial funding of US$542 (EUR 500) million, aiming to set up 1,700 high-performance public charging points in Europe by 2027. At the end of 2023, Milence opened its first charging hub in the Netherlands. In January 2023, the British oil giant BP opened public charging stations for electric HDTs on the 600 km long Rhine-Alpine corridor in Germany, one of the busiest road freight routes in the region. The company installed 300 kW charging stations, enabling electric HDTs to add up to 200 km range in 45 minutes of charging time.

However, establishing a well-planned charging infrastructure and ensuring accessibility across the region requires more coordinated efforts. In 2023, the EU Council and the European Parliament passed a new regulation for deploying alternative fuels infrastructure (AFIR). This regulation mandates the installation of fast charging stations with 350 kW output for heavy-duty vehicles. The stations are required to be installed every 60 km along the Trans-European Transport Network (TEN-T) system of highways. The TEN-T system is the EU’s primary transport corridor, accommodating 88% of long-haul HDT operations, according to 2018 data. The target is to deploy charging infrastructure for heavy-duty vehicles at least 15% of the length of the TEN-T road network by 2025, 50% by 2027, and 100% by 2030.

Foreign players are in good position to enter Europe’s electric HDT market

Non-EU manufacturers offering cheaper trucks, e.g., from the USA and China, are in a good position to address the increasing demand for electric HDTs in the EU. A study published by BCG in September 2023 indicated that the US and Chinese manufacturers could take over 11% of the European electric HDT market by 2035.

EU imposes a 22% import duty on diesel HDTs, while electric HDTs are subject to only 10%. Manufacturers from outside of the EU who are capable of producing battery packs at a lower cost can leverage the cost advantage and find it profitable to export electric HDTs to the EU despite paying import duties.

According to Bloomberg New Energy Finance, China produced heavy-duty vehicle batteries at a 54% lower cost than the rest of the world in 2022. A crucial factor contributing to this cost advantage is China’s significant control over the supply of lithium, a critical component in electric vehicle batteries. Additionally, China has strategically directed investments into cobalt mining ventures, notably in nations such as the Democratic Republic of the Congo. China oversees the processing of approximately 60-70% of both lithium and cobalt globally, underscoring its significant role in the processing of these critical materials by 2023, according to International Energy Agency (IEA) analysis in 2023. By securing access to raw materials such as lithium and cobalt, Chinese battery manufacturers are able to effectively manage costs, mitigate supply chain risks, and ultimately reduce the production cost of their battery packs. Even after adding a 10% import duty, China can potentially offer electric HDTs to the EU market at a more attractive price than EU manufacturers.

Similarly, the USA offers generous tax credits for producing clean energy components through the Advanced Manufacturing Production Credit (AMPC), making battery costs more competitive in the USA than in the EU.

Foreign manufacturers that may not have the cost advantage might potentially look at partnerships and collaborations to grab a piece of Europe’s booming electric HDT market. For instance, in March 2024, Hyundai, a South Korean automotive manufacturer, and Iveco, an Italian transport vehicle manufacturer, signed a Letter of Intent reinforcing their commitment to collaborate on developing and introducing electric HDT solutions for European markets. By partnering with Iveco Group, Hyundai aims to leverage Iveco’s existing market presence, local expertise, and production capabilities to develop and introduce competitive solutions for the European commercial heavy-duty vehicle market.

EOS Perspective

While still at the starting line, the adoption of electric HDTs is expected to sprint off in the EU, given the continuous efforts to achieve climate goals. Regulations pushing for zero-emission transport, increasing investment in charging infrastructure, and the shrinking difference between the TCO of diesel vs. electric HDTs will contribute to the widescale adoption of electric HDTs in the EU.

Amidst all the hype around electric HDT, hydrogen-powered HDT is also gaining some attention as a zero-emission alternative. Hydrogen HDTs have higher load-carrying capacity and can be refueled within minutes adding over 1,000 km range, making them suitable for long-haul transport of heavy loads. Leading truck manufacturers, such as Daimler Truck, Volvo Group, and Iveco, have come together to support a research project called H2Accelerate Trucks, aiming to deploy 150 hydrogen HDTs with a 1,000 km range and carrying capacities of up to 44 tones across the EU. As a part of this project, the first hydrogen HDT is likely to hit the roads in 2029.

However, hydrogen-fuel technology is still developing, and the hydrogen fuel cell HDT is far away from achieving cost parity with its diesel and electric counterparts. ICCT report indicates that hydrogen fuel cell HDT will achieve TCO parity with diesel HDT in 2035, but it is not expected to achieve TCO parity with electric HDT even by 2040. Underdeveloped technology and higher upfront costs associated with hydrogen fuel cell HDTs play a significant role in hindering their journey toward achieving TCO parity with electric counterparts. According to ICCT, hydrogen-powered HDTs are projected to have an average TCO of US$1.23 (EUR 1.14) per kilometer in 2035, compared to just US$0.99 (EUR 0.92) per kilometer for battery-electric HDTs. This disparity persists into 2040, with hydrogen-powered HDTs still trailing behind at US$1.15 (EUR 1.06) per kilometer, while battery-electric HDTs maintain a lower TCO of US$0.98 (EUR 0.91) per kilometer. This discrepancy poses implications for adoption, potentially hindering the widespread uptake of hydrogen-powered vehicles until significant advancements and cost reductions are achieved in the hydrogen sector.

In 2023, the CEO of MAN, Europe’s second-largest truck manufacturer, suggested that hydrogen HDTs will play a small role in the EU’s zero-emission commercial transport future. Considering the economic performance of hydrogen HDT, this opinion is likely to turn out to be correct. This suggests that electric HDT is the way forward.