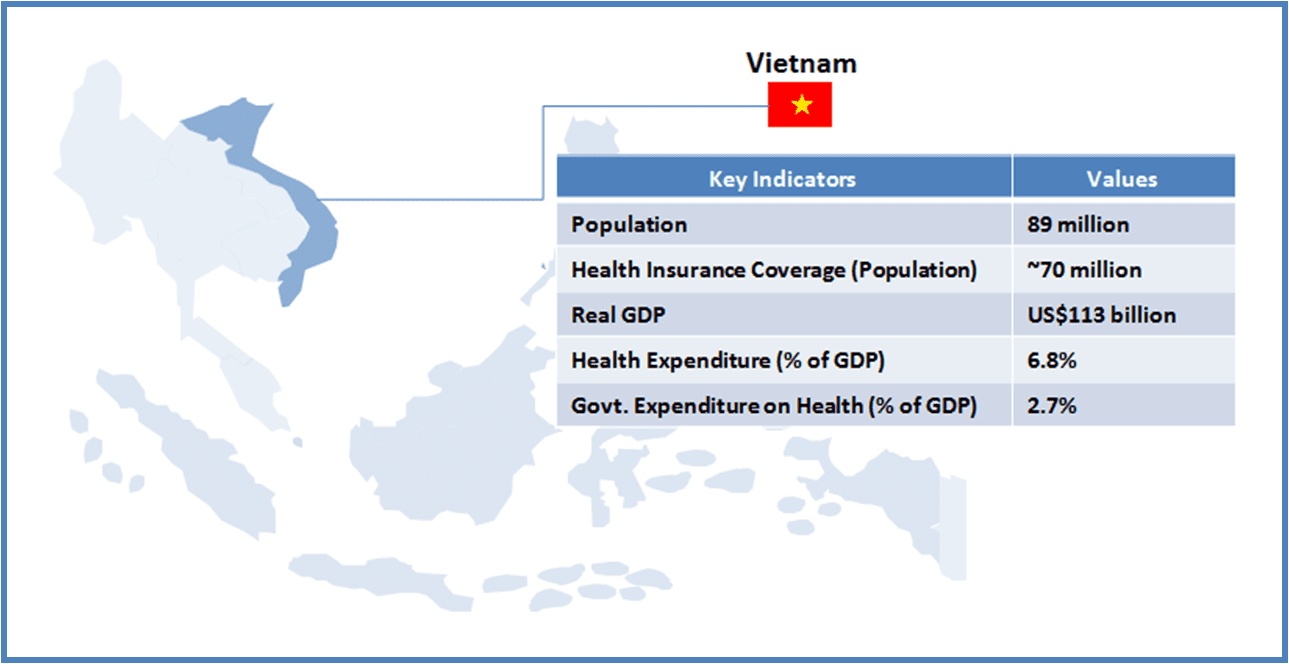

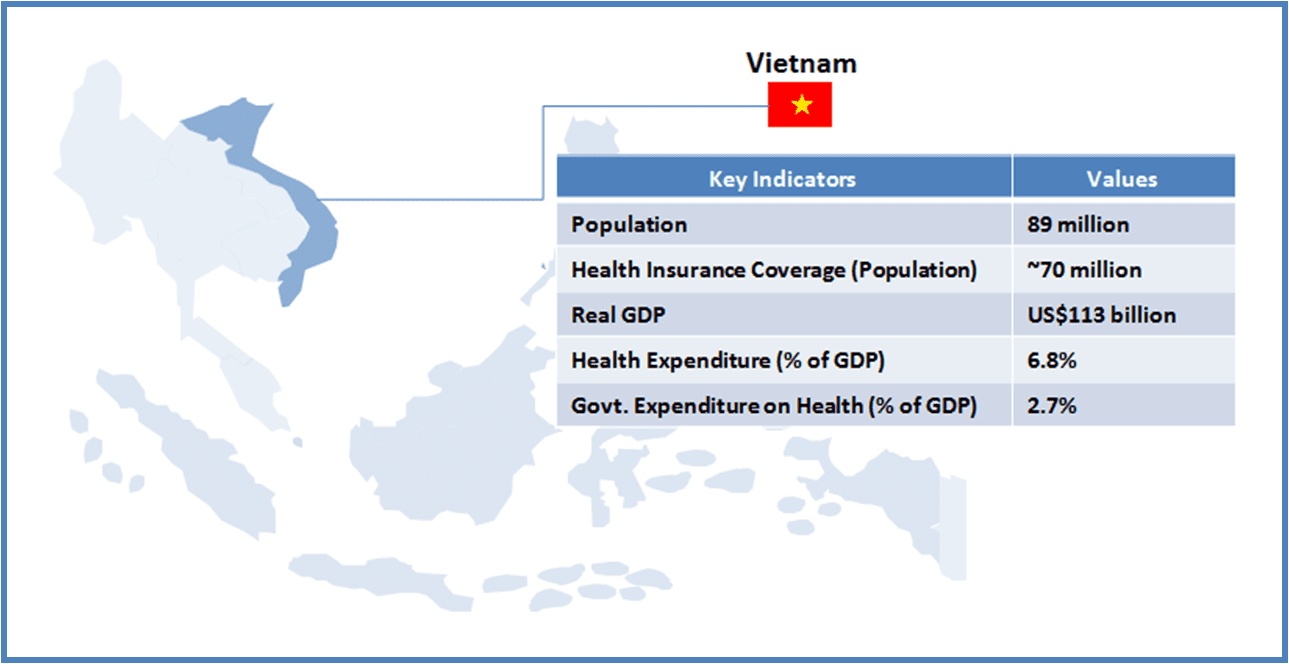

Vietnam is a lower-middle income country (GNI per capita US$1,550 as of 2012) with a population of about 89 million (14th most populous country as of 2012). Entitlement of healthcare to every citizen is imbibed in Vietnam’s constitution, and the country has taken steps to achieve it. National Strategy on Protection and Care of the People’s Health (2001) increased the state’s role in ensuring basic healthcare services to all Vietnamese. The Law on Health Insurance (2008) was formulated with the objective of achieving universal health insurance coverage.

This article is part of a series focusing on universal healthcare plans across selected Southeast Asian countries. The series also includes a look into the plans in The Philippines, Cambodia, Vietnam, Indonesia, and Thailand.

As of 2011, more than 60% population were covered under the Social Health Insurance (SHI) scheme. The government is aiming to cover rest of the population (primarily the people from the informal sector) by 2014.

If achieved, Vietnam would be among few Asian countries with 100% Universal Health Care (UHC) coverage for its citizen. For a private sector player (pharmaceutical company, medical device manufacturer, or a healthcare service provider), this should materialize in to increased sales, as the number of customers (which otherwise are faced with financial constraints to avail healthcare services/products) grow.

However, from a long term perspective, sales prospect are likely to depend on the government’s ability to maintain service levels, to tackle emerging healthcare challenges within UHC mandate, and to ensure availability of finances for SHI. The current design and the support infrastructure would determine the long term success of SHI (and hence the prospects of the companies from healthcare industry).

| INFRASTRUCTURE |

| Key Stakeholders |

-

The Ministry of Health (MOH) is responsible for developing programs and policies, budgeting, personnel allocation, direction and supervision of national institutions

-

The Provincial Health Bureau administers the provincial healthcare care system. Each province consists of District Health Bureau responsible for district level administration of the healthcare services

-

The Commune Health Station (CHS) in each district provide healthcare services at Commune Level. District People’s Committee is responsible for the funding of the healthcare services in each district

|

| Healthcare Service Delivery |

-

CHS providing primary healthcare services is the entry point in the public healthcare system in Vietnam

-

District hospitals offer basic inpatient treatment, emergency services, and pre-natal and delivery services. Provincial hospitals (including specialty clinics) provide outpatient and inpatient services

-

National hospitals are the most advanced with specialties such as oncology, endocrinology etc.

-

Current hospital infrastructure:

- HC: ~11,000

- District Hospitals: ~1,300

- Provincial Hospitals: ~ 500

- National Hospitals: ~ 45

- Private Hospitals: ~ 1,00

|

|

| KEY CHALLENGES |

Regulatory Framework for Private Healthcare

-

Private healthcare infrastructure has flourished in Vietnam as the government intended to reduce burden from the public healthcare system. However, due to lack of regulations, the private system has failed to complement the public one as expected

Burdened Public Healthcare

-

People mostly rely on private system for outpatient care, though they may prefer to visit the public system for inpatient services. Therefore, healthcare at primary level has not developed as expected, putting more pressure on secondary and tertiary healthcare infrastructure

Uneven Concentration of Healthcare Personnel

-

Distribution of human resources is not even, as most of the doctors and support staff is concentrated in the urban centers. Due to it, rural population may not be able to avail the benefits of social health protection, despite being under coverage

|

| DESIGN |

| Beneficiary Classification |

|

SHI members are classified in to the following six groups:

- Civil servants and formal sector workers

- Pensioners, meritorious people, beneficiaries of social security/protection allowances, and veterans

- The poor and near-poor

- Children under six years of age

- School children and students

- All remaining population

|

| Healthcare Insurance Financing |

-

SHI is funded through government budget, employer and employee contribution, and Vietnam Social Security (VSS). The ‘Healthcare Fund’ for SHI is managed by the VSS.

-

SHI premium is fixed at 4.5% of the salary/pension/protection allowance/unemployment benefit wherever applicable. The government pays for the premium of poor, children under six years, and meritorious people. For unemployed and pensioners, VSS pays the premium. Group 5 (from above) is eligible for 30% subsidy in the premium, fully paid by the government

|

| Payment System |

-

SHI member are enrolled either at CHS or district hospitals. Capitation system covers all the costs incurred by CHS and district hospitals for providing healthcare services to SHI members.

-

There is a provision for the refund of capitation payment in case the funds are not fully utilized by CHS/District Hospital in a particular year.

-

In case of deficit of funds (i.e. more SHI members than planned avail services in a particular year), the provincial social security office reimburses CHS/District Hospitals

-

Secondary and tertiary hospitals are covered by fee-for-service payment system.

|

| Benefits |

-

Inpatient Service – Birth Delivery, Emergency Services, Other inpatient Services (nursing, tests, catering, pharmaceutical)

-

Outpatient – Public health services, primary care services, specialist services, pharmaceuticals, tests, and scans

-

Other Services – Dental care, mental care, dialysis, and transplants

|

| Co-payment (Reimbursement) System |

-

For Inpatient Services – Pensioners, poor, and members receiving social protection allowance (5%), others (20%)

-

For Outpatient Services – No co-payment for services at CHS; for others, same as applicable for inpatient services

-

Other Services – Same as applicable for inpatient services

|

| Reimbursement System for Drugs |

-

Drugs specified under the reimbursement list (consisting of more than 800 pharmaceutical products as of now) qualify for co-payment system (mentioned above).

-

SHI members can avail co-payment benefit only if the required drug is available at the CH/Hospital they are registered at. There is no reimbursement if the drug is purchased from a private drug store

|

|

| KEY CHALLENGES |

Enrollment of People still Outside the SHI Coverage

-

While there is clarity in the Vietnamese social health insurance beneficiary classification system, a large population still remains outside its ambit. The government needs to introduce a better mechanism to ensure enrollment of the section of the population (e.g. informal sector) who have less incentives to join the scheme (at present), as compared with other groups

Corruption

-

Due to rampant corruption in the public hospitals, the patients have to pay extra despite a well defined payment mechanism, or else the services are alleged to be unavailable despite being under social health insurance coverage.

Adequate Funding Mechanism to Ensure Long-term Viability of SHI

-

As the population under coverage increases, the government may need a better taxation policy to fund the services or else the Health Fund is expected to fall short to meet expenses. In 2013, VSS proposed the government to increase health insurance premiums from 4% to 6%, which the government declined in view of the weak economic condition.

|

Opportunities for Healthcare Companies

Healthcare Service Providers

-

Contractual healthcare services are not a popular trend in Vietnam; however, subjected to a robust regulatory framework with respect to its linkage with the social healthcare insurance system, private players have considerable opportunities to complement the overburdened public healthcare system in the country

Medical Device Manufacturers

-

There is a critical shortage of medical devices, such as MRI, Tomography scanners, mammography, etc. in public hospitals. With the SHI, public hospitals would need to purchase such equipment, to cater to the increasing demand, this providing a platform for medical device manufacturers in the country

-

There is a provision for private investment in public hospitals for the purchase of medical equipment. Greater opportunity lies in provincial hospitals, which lack medical equipment despite witnessing a large number of patient visits every year

Pharmaceuticals Companies

-

Vietnam is among few countries, which cover outpatient cases under the social health insurance system

-

Pharmaceutical companies have significant potential to increase sales as a result of wider coverage (once SHI is implemented), and by focusing marketing and sales efforts on the inclusion of their drugs in the reimbursement list

A Final Word

One of the key priorities for the Vietnamese government is to meet the target of 100% population coverage. For a populous country, such as Vietnam, the public healthcare system is hamstrung by the lack of infrastructure (a crucial factor in determining the success of UHC in the long term), which is aggravated by the concentration of healthcare in specific regions (e.g. urban centers). Design of Vietnamese UHC appears to be robust in terms of clarity in beneficiary classification and wider coverage of healthcare services (e.g. outpatient services). However, to ensure success, the government would be required to bring the informal sector population within the UHC ambit.

For healthcare industry participants, there are opportunities for pharmaceutical as well medical device manufacturers, with the expected expansion of public healthcare services in Vietnam. There may be a case for healthcare service providers as well in case the government decides to experiment with contractual healthcare services (to compensate for the lack of public healthcare infrastructure).

A comparative with other countries in the region should provide a better perspective on the actual potential of Vietnam as a prospective destination for devices and drugs companies alike.